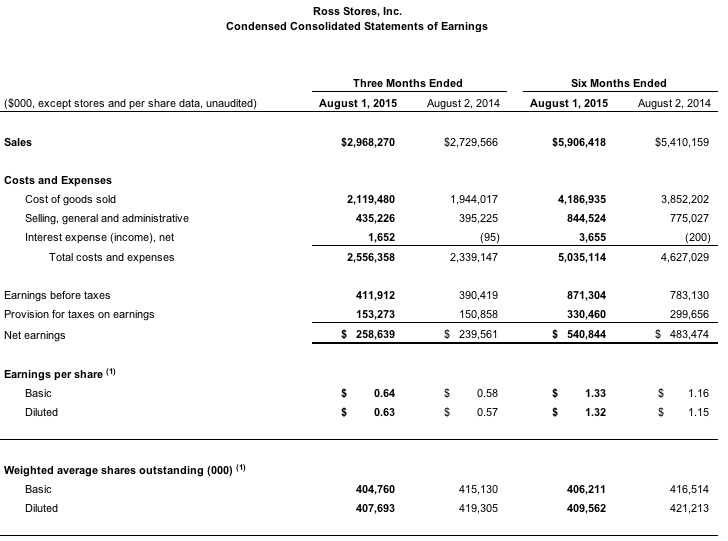

Ross Stores, Inc. reported that earnings per share for the second quarter ended August 1, 2015 increased 11 percent to $259 million, or 63 cents a share, up from $240 million, or 57 cents, in the prior year. Sales for the fiscal 2015 second quarter rose 9 percent to $2.968 billion, with comparable store sales up 4 percent over the prior year.

For the first six months of the fiscal year, earnings per share increased 15 percent to $1.32, up from $1.15 in the prior year. Net earnings were $541 million, up 12 percent from $483 million last year. Sales for the year-to-date period rose 9 percent to $5.906 billion, and comparable store sales increased 5 percent.

CEO Barbara Rentler commented, “We are pleased with our solid sales and earnings growth for both the second quarter and first six months. These results reflect that our assortments of compelling name brand bargains continue to resonate with today's value-focused customers.”

She continued, “While second quarter operating margin of 13.9 percent was down from last year, it was slightly better than expected. The quarter benefited from higher merchandise margin and tight expense control that partially offset a planned increase in distribution costs related to recent infrastructure investments.”

Rentler said, “During the second quarter of fiscal 2015, we repurchased 3.5 million shares of common stock for an aggregate price of $176 million. As planned, we expect to buy back a total of $700 million in common stock during fiscal 2015 under the two-year $1.4 billion authorization approved by our board of directors in February of this year.”

Looking ahead, Rentler said, “While we hope to do better, we are maintaining a cautious outlook for the second half when we face more challenging sales and earnings comparisons. In addition, the macro-economic and retail landscapes remain uncertain. For the third quarter ending October 31, 2015, we are forecasting same store sales to increase 1 percent to 2 percent on top of a 4 percent increase in the prior year and earnings per share of $.48 to $.50, up from $.46 in last year's third quarter. For the fourth quarter ending January 30, 2016, we are projecting same store sales to be flat to up 1 percent versus a 6 percent gain in the prior year, and earnings per share of $.60 to $.63 compared to $.60 in last year's fourth quarter. For fiscal 2015, earnings per share are now forecast to be in the range of $2.40 to $2.45, up 9 percent to 11 percent from $2.21 in fiscal 2014.”

As a reminder, all earnings per share results and forecasts for both the current and prior year reflect the Company's recent two-for-one stock split that became effective on June 11, 2015.