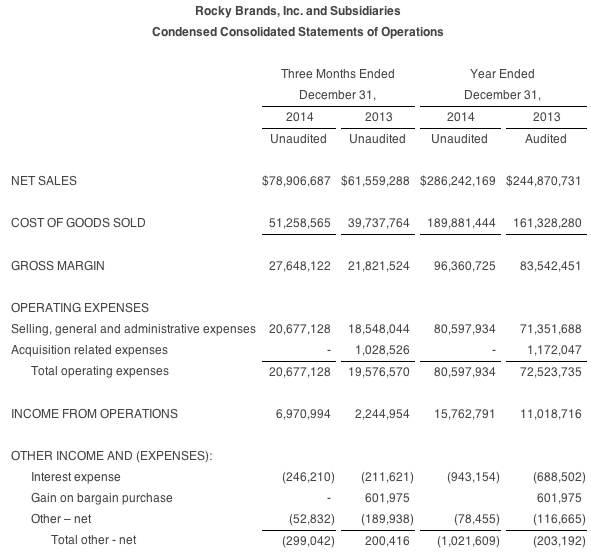

Rocky Brands, Inc. reported fourth quarter net sales increased 28.2 percent to a record $78.9 million

versus net sales of $61.6 million in the fourth quarter of 2013.

The

company reported record fourth quarter net income of $4.5 million, or 59 cents per diluted share as compared to net income of $1.8 million, or

$0.24 per diluted share in the fourth quarter of 2013. Excluding all

expenses and income related to Creative Recreation, fourth quarter 2013

net income was $2.2 million, or $0.29 per diluted share.

Fiscal Year 2014 Sales and Income

For fiscal year 2014, net sales increased 16.9 percent to $286.2 million versus net sales of $244.9 million in fiscal year 2013. The company reported net income of $9.8 million, or $1.30 per diluted share, for fiscal year 2014, compared with net income of $7.4 million, or $0.98 per diluted share, for fiscal 2013. Excluding the aforementioned expenses and income related to Creative Recreation, fiscal year 2013 net income was $7.9 million, or $1.04 per diluted share.

“Our record fourth quarter performance represents a great finish to a strong year for our company,” said

David Sharp, President and Chief Executive Officer. “Sales growth accelerated to its highest level of 2014 in the fourth quarter fueled by consumer demand for our compelling collections of Work, Western, Hunting and Commercial Military footwear. At the same time, Creative Recreation has started to become a more meaningful contributor to our profitability following the work we’ve done to improve the brand’s supply chain.”

“Our fourth quarter and full year results demonstrate the earnings power of our business model. We were able to increase profitability at a faster rate than sales by leveraging the leaner, more efficient operating expense structure we’ve put in place,” continued Mr. Sharp. “We are confident that the combination of our product and marketing strategies, diverse portfolio of authentic brands, and our strong retail relationships, provides us with continued growth opportunities in 2015 and beyond.”

Fourth Quarter Review

Net sales for the fourth quarter increased 28.2 percent to $78.9 million compared to $61.6 million a year ago. Wholesale sales for the fourth quarter increased 30.0 percent to $62.0 million including $3.3 million in Creative Recreation branded sales as compared to $47.7 million for the same period in 2013. Retail sales for the fourth quarter increased 6.6 percent to $13.7 million compared to $12.9 million for the same period last year. Military segment sales for the fourth quarter increased to $3.2 million compared to $1.0 million in the fourth quarter of 2013.

Gross margin in the fourth quarter of 2014 was $27.6 million, or 35.0 percent of sales, compared to $21.8 million, or 35.4 percent of sales, for the same period last year. The 40 basis point decrease was driven by higher military sales which carry lower gross margins than wholesale and retail.

Selling, general and administrative (SG&A) expenses were $20.7 million compared to $18.5 million a year ago. The $2.2 million increase in SG&A expenses was due to higher compensation expense, higher variable expenses associated with the increase in sales and additional expenses associated with the Creative Recreation brand, which was acquired in December 2013. As a percent of sales, SG&A improved 330 basis points to 26.2 percent of net sales compared to 29.9 percent sales last year.

Income from operations was $7.0 million, or 8.8 percent of net sales, compared to $3.4 million, or 5.6 percent of net sales a year ago which excludes expenses associated with the acquisition of Creative Recreation.

Interest expense was $0.2 million for the fourth quarter of 2014 and 2013.

The company’s funded debt was $36.3 million at Dec. 31, 2014 versus $38.4 million at December 31, 2013.

Inventory increased 9.0 percent, or $7.1 million, to $85.2 million at Dec. 31, 2014 compared with $78.2 million on the same date a year ago.