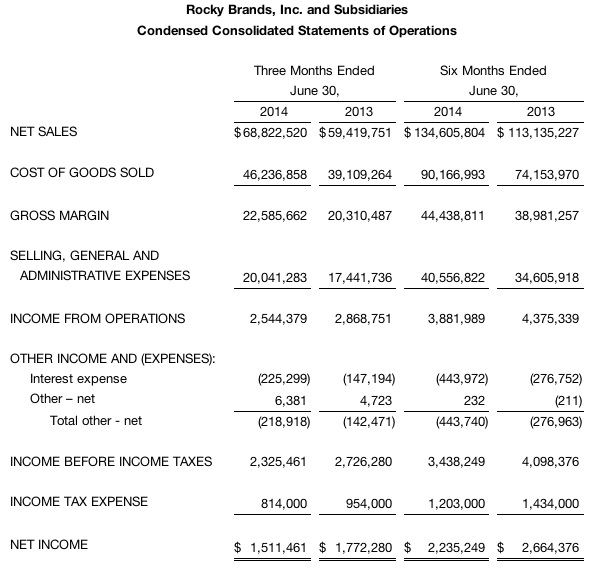

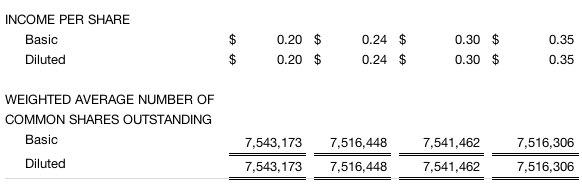

Rocky Brands, Inc. reported second quarter net sales increased 15.8 percent to $68.8 million versus net sales of $59.4 million in the second quarter of 2013. The company reported second quarter net income of $1.5 million, or 20 cents per diluted share compared with net income of $1.8 million, or cents 24 per diluted share in the second quarter of 2013.

The company's brands include Rocky, Georgia Boot, Durango, Lehigh, Creative Recreation, and the licensed brand Michelin.

David Sharp, president and chief executive officer, commented, “The investments we’ve made towards growing our brands and overall business continue to fuel record top-line results. For the second consecutive quarter each of our major wholesale categories, Work, Western, and Hunting, generated double digit sales increases on a percentage basis while the momentum in our commercial military and duty businesses accelerated following a solid start to the year. As we move into the back half of 2014, we believe we can continue to drive growth through compelling and innovative product introductions and begin delivering improved profitability through gross margin expansion and increased operating expense leverage. Our plans include capitalizing on the opportunities we believe exist for Creative Recreation within the broader casual footwear market. We are pleased with our recent accomplishments and look forward to building on our success in the quarters and years ahead.”

Second Quarter Review

Net sales for the second quarter increased 15.8 percent to $68.8 million compared to $59.4 million a year ago. Wholesale sales for the second quarter increased 23.7 percent to $56.7 million compared to $45.8 million for the same period in 2013. This included a 16.8 percent increase in wholesale sales of the company’s legacy brands. Retail sales for the second quarter increased to $10.1 million compared to $9.8 million for the same period last year. Military segment sales for the second quarter decreased to $2.0 million compared to $3.8 million in the second quarter of 2013.

Gross margin in the second quarter of 2014 was $22.6 million, or 32.8 percent of sales, compared to $20.3 million, or 34.2 percent of sales, for the same period last year. The 140 basis point decrease was driven by the combination of lower wholesale margins due primarily to costs associated with the seeding program with a key retail partner we announced in the first quarter of 2014 and lower retail gross margin than a year ago resulting from the completed transition to a web based retail platform which carries lower gross margin and lower operating expenses compared to the previous mobile store structure.

Selling, general and administrative (SG&A) expenses were $20.0 million, or 29.1 percent of net sales, for the second quarter of 2014 compared to $17.4 million, or 29.4 percent of net sales, a year ago. The $2.6 million increase in SG&A expenses was due largely to the additional expenses associated with the Creative Recreation brand, which was acquired in December 2013, and higher compensation expense related to a new mid-year bonus program that wasn’t in place a year ago. The 30 basis point improvement in SG&A as a percent of net sales was driven by leveraging expenses on higher sales.

Income from operations was $2.5 million, or 3.7 percent of net sales, compared to $2.9 million, or 4.8 percent of net sales, a year ago.

Interest expense was $0.2 million for the second quarter of 2014, versus $0.1 million for the same period last year.

The company’s funded debt was $43.4 million at June 30, 2014 versus $31.4 million at June 30, 2013. The majority of the increase was related to additional borrowings to fund the acquisition of Creative Recreation in the fourth quarter of 2013.

Inventory increased 6.5 percent, or $5.3 million, to $86.4 million at June 30, 2014 compared with $81.2 million on the same date a year ago. Inventory at June 30, 2014 included approximately $2.8 million associated with the acquisition of Creative Recreation. Based on current sales trends and the fall order book, the company remains comfortable with its current inventory position.