Rocky Brands reported flat sales in the first quarter but its profitability doubled.

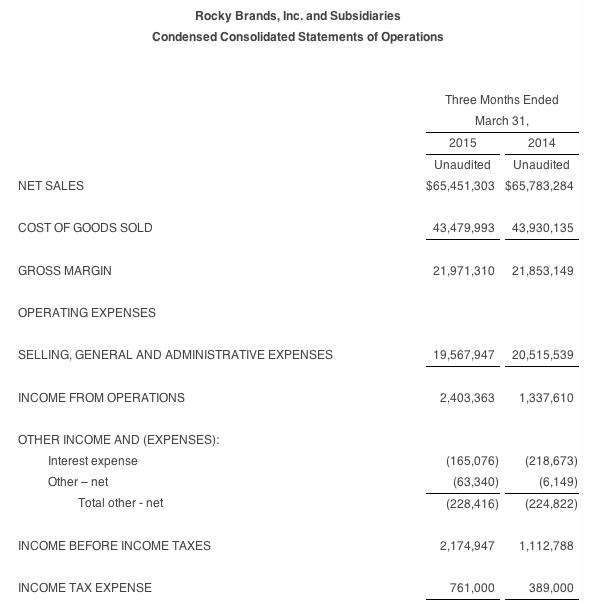

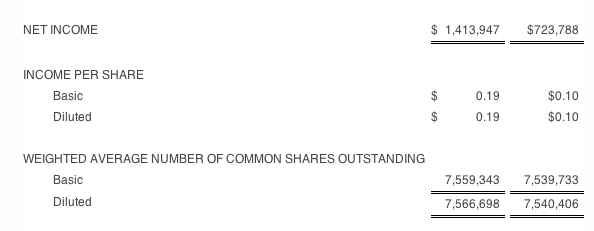

First quarter net sales were $65.5 million compared to $65.8 million in the first quarter of 2014. The company reported first quarter net income of $1.4 million, or $0.19 per diluted share compared to net income of $0.7 million, or $0.10 per diluted share in the first quarter of 2014.

David Sharp, president and chief executive officer, commented, “We are extremely pleased to deliver strong first quarter earnings and start 2015 on a positive note. Our bottom line performance was driven by improved gross margin in our wholesale channel and a reduction in operating expenses. At the same time, demand for our Durango collections continued to gain pace, fueling a 30 percent increase in Durango brand sales over the year ago period. We did experience some headwinds during the first quarter including delayed deliveries as a result of the West Coast port situation. We believe the current top-line challenges are temporary and based on recent sell-through trends and our fall order book, we are confident that growth will accelerate as the year progresses.”

First Quarter Review

Net sales for the first quarter were $65.5 million compared to $65.8 million a year ago. Wholesale sales for the first quarter decreased 4.0 percent to $51.0 million compared to $53.1 million for the same period in 2014. Retail sales for the first quarter increased 6.8 percent to $11.9 million compared to $11.1 million for the same period last year. Military segment sales for the first quarter increased to $2.6 million compared to $1.6 million in the first quarter of 2014.

Gross margin in the first quarter of 2015 was $22.0 million, or 33.6 percent of sales, compared to $21.9 million, or 33.2 percent of sales, for the same period last year. The 40 basis point increase was driven by higher wholesale gross margins, partially offset by an increase in military segment sales which carry lower gross margins than our wholesale and retail segments.

Selling, general and administrative (SG&A) expenses were $19.6 million, or 29.9 percent of net sales, for the first quarter of 2015 compared to $20.5 million, or 31.2 percent of net sales, a year ago. The $950,000 decrease in SG&A expenses was primarily related to a reduction in freight expenses and lower tradeshow & advertising spends compared with a year ago.

Income from operations was $2.4 million, or 3.7 percent of net sales, compared to $1.3 million, or 2.0 percent of net sales, a year ago.

Interest expense was $165,000 for the first quarter of 2015, versus $219,000 for the same period last year.

The company’s funded debt was $36.7 million at March 31, 2015 versus $36.6 million at March 31, 2014.

Inventory increased 6.2 percent, or $4.8 million, to $83.1 million at March 31, 2015 compared with $78.3 million on the same date a year ago. Based on current sales trends and the fall order book, the company is comfortable with its current inventory position.