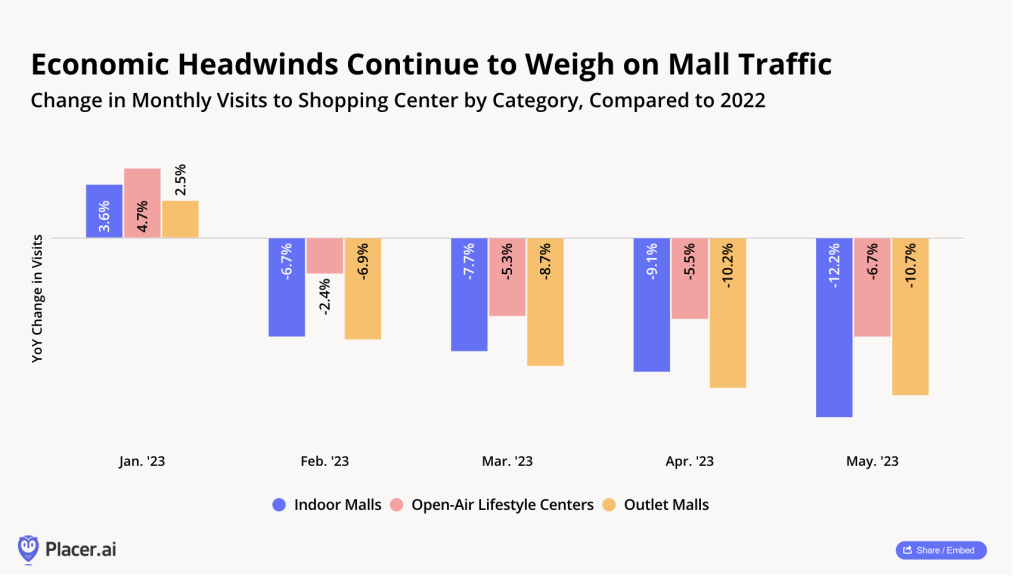

The latest update to Placer.ai’s Mall Index, Placer.ai Mall Index, May 2023 Recap, shows that shopping malls continue to bear the brunt of consumer concerns regarding the economy, as foot traffic fell year-over-year at indoor malls, open-air lifestyle centers and outlet malls. In May, visits were down 12.2 percent, 6.7 percent and 10.7 percent, respectively, at each mall type. There are signs, however, that malls may be gaining steam in foot traffic.

Although consumers appear slightly more optimistic about the economy, savings intentions remain strong, which may come at the expense of discretionary spending, with clothing, footwear and household goods, the bulk of categories sold in malls, being the most impacted. However, amid the challenges, foot traffic data may show signs of a mall recovery.

Placer.ai dove into the shopping center visitation patterns for Indoor Malls, Open-Air Lifestyle Centers, and Outlet Malls in its May 2023 report to better understand current consumer trends.

Signs of a Shopping Center Recovery

First, Month-over-month (MoM) visits remained mostly positive or flat over the past three months. And while some of the MoM increases could be due to changes in month length, the relative consistency in MoM visit numbers may also indicate that although YoY visit gaps persist, mall traffic trends are not necessarily worsening.

Second, the recent trend towards more mission-driven shopping seen in several retail categories, including malls, superstores and grocery, continued in May, with open-air lifestyle centers and outlet malls witnessing a boost in median visit length relative to May 2022. The increase in visit time could mean that consumers are making fewer trips to the mall and maximizing each visit and shopping their favorite stores, dining concepts and entertainment venues on each trip. In other words, the quality of visits may be increasing even as the number of visits slows.

Outlet Malls Get Biggest Sales Event Boost

Zooming into visitation patterns over recent sales events also highlights the continued value that consumers receive from malls and helps put the current traffic slowdown into perspective.

Over the past year, all sales events, including minor retail holidays like St. Patrick’s Day, have driven significant traffic surges to the three mall categories, indicating that consumers still want to visit the mall; however, they want to ensure that the trip will not diminish their monthly shopping budget.

Outlet Malls have consistently seen the most significant sales event boost, including over the recent Memorial Day weekend, which also suggested that consumers are willing to go out of their way to visit a mall to shop when it doesn’t break the pocketbook.

Visits to Outlet Malls during the week of May 22 through 28, 2023 were up 50.9 percent relative to a weekly January 30 through February 5 baseline, while Indoor Malls and Open-Air Lifestyle Centers saw their visits increase just 14.6 percent and 19.8 percent, respectively.

The relatively strong performance of Outlet Malls over retail sales events indicated that consumers are not permanently abandoning malls. Instead, in the current economy, many appear to have prioritized value, which could explain why Outlet Malls receive a floor traffic boost during holidays, as consumers look to take advantage of the discounts offered by the Outlet format during these times.

With the summer months offering more promotional opportunities, including critical back-to-school sales, the mall recovery may accelerate. And if recent visitation patterns forecast what’s to come, outlet malls could be the bit winners in the upcoming season.

To access the Placer.ai Mall Index, May 2023 Recap, go here.

Graphic courtesy Placer.ai