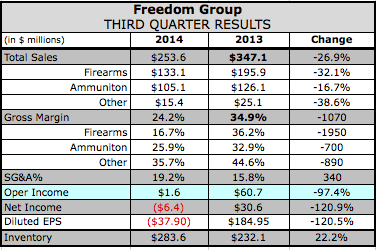

Freedom Group, the parent of Remington, reported a loss of $6.4 million in the third quarter ended Sept. 28, against earnings of $30.6 million a year earlier, according to a filing with the Securities & Exchange Commission. Sales slid 27.1 percent to $253.6 million.

Freedom Group, the parent of Remington, reported a loss of $6.4 million in the third quarter ended Sept. 28, against earnings of $30.6 million a year earlier, according to a filing with the Securities & Exchange Commission. Sales slid 27.1 percent to $253.6 million.

Firearms segment sales fell 32.1 percent to $133.1 million with declines seen across all major product categories. Gross profit in the Firearms segment fell 68.7 percent to $22.2 million.

Among firearms categories, MSR and centerfire sales decreased $66.5 million, handguns declined $9.2 million, shotguns decreased $4.5 million, and rimfire rifles slid $3.4 million. These decreases were partially offset by increases in its other firearms products, firearms parts and services of $19.9 million.

The firearms decline in the quarter as well as the nine months reflected the return of sales to more normalized levels, especially for MSR, handguns and centerfire rifles, Freedom Group said in the filing. Concerns over more restrictive government legislation contributed to strong demand for firearms in 2013, it noted.

The temporarily ceasing of production and sales of its Remington Model 700 during the second and third quarter of this year following a recall also impacted firearms sales. Due to the recall, many new product introductions were also delayed. Sales of its Remington Model 700 resumed at the beginning of the fourth quarter.

Ammunition sales in the quarter were down 16.7 percent to $105.1 million. Ammunition gross profit declined 34.5 percent to $27.2 million.

Sales of shotshell ammunition decreased $10 million and sales of centerfire ammunition decreased $5 million. Sales in its other ammunition product lines decreased $4.6 million while sales of rimfire ammunition decreased $1.4 million. Similarly, the decline in ammunition reflects a return to more normalized purchasing levels, but Freedom Group believes overall ammunition sales are “still above historical levels.”

All Other segment sales were down 38.6 percent to $15.4 million, primarily due to lower sales volume in its various accessories businesses. All Other gross profits dropped to $5.5 million from $11.2 million. Freedom noted that many of its accessories are aftermarket products for firearms and follow similar sales patterns

Freedom Groups brands include Remington, Bushmaster Firearms, DPMS/Panther Arms, Marlin, H&R, The Parker Gun, Mountain Khakis, Advanced Armament Corp., Dakota Arms, Para USA and Barnes Bullets.

Companywide gross margins were reduced to 24.2 percent from 34.9 percent a year ago. Firearm segment gross margins eroded to 16.7 percent from 36.2 percent reflecting the lower sales volumes increased manufacturing costs, and an unfavorable sales mix and pricing.

SG&A expenses were reduced 11.1 percent due to lower expenses for incentive compensation and legal expense, but increased as a percent of sales due to the lack of sales leverage.

Assessing current demand, Freedom Group said that although Remington Model 700 resumed production and sales in the third quarter, the company continues to see heavy channel inventories with partners, but we are working together to move inventory through the channels.

It also noted that while the ammunition market has returned to more normalized levels, the shotshell ammunition has been more affected than other classifications. Centerfire and rimfire ammunition sales continue to be relatively steady. Freedom Group also said the excluding the unusual comparisons, we believe our sales continue to remain above historical levels.