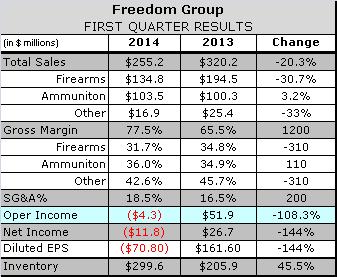

Remington Outdoor Company Inc. reported net sales declined $65 million, or 20.3 percent to $255.2 million in the first quarter, as an 18-month boom in firearms sales tapered off.

Remington Outdoor Company Inc. reported net sales declined $65 million, or 20.3 percent to $255.2 million in the first quarter, as an 18-month boom in firearms sales tapered off.

Firearms sales fell by $59.7 million, or 30.7 percent to $134.8 million in the first quarter ended March 30 reducing their share of the company’s total revenues to 52.8 percent, compared with 60.7 percent compared with the quarter ended March 31, 2013.

Centerfire sales decreased $45.9 million while sales of shotguns, handguns and other firearms and firearms products decreased $4.0 million, $7.2 million and $2.6 million, respectively. Rimfire rifle sales remained stable. Ammunition sales were up $3.2 million, an increase of 3.2 percent over 2013 with sales of $103.5 million. Sales at the company’s All Other segment, which includes accessories and apparel, declined 33 percent to $8.5 million.

Gross margin tumbled 1,200 basis points to 22.5 percent primarily due to $25.3 million in accruals for a product safety warning and recall related to reports that Remington Model 700 and Model Seven rifles using X-Mark Pro triggers were accidentally discharging.

On a category basis, gross margins fell 310 points to 31.7 percent on firearms and increased 110 bps to 36 percent on ammunition sales, where higher prices and lower manufacturing costs added $3.5 million and $1.5 million in gross profit respectively; more than offsetting a $2.7 million decline from lower sales and a less favorable sales mix.

Gross margins at the All Other segment, which includes everything from silencers, air guns and pet accessories to the 1816 and Mountain Khaki’s apparel brands, gross margin slipped 310 bps to 42.6 percent as lower sales of high-margin accessories and more than offset increased demand for apparel.

SG&A expense declined 10.6 percent from the 2013 level yet rose 200 bps to 18.5 percent as a percentage of sales. The company reported a net loss of $11.8 million compared with a net income of $26.7 million a year earlier and that Adjusted EBITDA declined 38.5 percent to $38.8 million due largely to the product recall.

The company ended the quarter with inventory valued at $299.6 million, up 45.9 percent compared with a year earlier.

Despite the tough quarter, Remington said its sales are still higher as compared to quarters prior to the first quarter of 2013 and that it is expanding capacity with additional capital investment, lean initiatives and added shifts, particularly at a new factory it acquired in Huntsville, AL, where it is consolidating manufacturing from seven other sites. The company said it sees growing interest in recreational and shooting sports, a growing number of female shooters, a greater focus on home and self defense, renewed interest in the outdoors and consumer concern over more restrictive government regulation of firearms continuing to drive sales.

Despite the tough quarter, Remington said its sales are still higher as compared to quarters prior to the first quarter of 2013 and that it is expanding capacity with additional capital investment, lean initiatives and added shifts, particularly at a new factory it acquired in Huntsville, AL, where it is consolidating manufacturing from seven other sites. The company said it sees growing interest in recreational and shooting sports, a growing number of female shooters, a greater focus on home and self defense, renewed interest in the outdoors and consumer concern over more restrictive government regulation of firearms continuing to drive sales.

Later this year, the company plans to introduce a new shotgun specifically designed for female and youth shooters. It will also launch new handgun platforms aimed at emerging or rapidly growing markets and lighter rifles for the shooting and hunting markets. Earlier this year, for instance, it introduced the Remington R51 Subcompact Pistol for the fast-growing concealed carry handgun market.