In a media call following the report of above-plan third-quarter results that led Puma to again raise its outlook for the year, Bjørn Gulden, CEO, detailed the success the brand is having in women’s, helped by the buzz created by its collaborations with the singer Rihanna.

But Gulden also indicated that the company doesn’t expect to see as strong a rate of a growth in the fourth quarter versus the third quarter, as well as high an improvement in margin, because of high inventories overall in the marketplace and a promotional climate.

While Puma’s order book for the fourth quarter is “strong,” led again by footwear, Gulden suspects “they’ll be cancellations and delays in general in the market, not only Puma,” as retailers work to get inventories back in line.

In the U.S., Gulden said Puma’s team has noticed “a lot of promotions on the big brands very early” with the impact evident in same-store declines as well as stock price hits taken by major retailers. Said Gulden, “They’ve had a tough time.”

In Europe, the weather has been “extremely warm” over the last several weeks and that has slowed sales of cold-weather product across categories, not only sports product. Said Gulden, “If you go to London, Berlin or Milan, you will see a lot of promotions.”

He said Puma will continue to focus on “solid growth of our brand at the right product at the right price and try not be very promotional.” At the same time, Puma will be open to helping retailers if they need to delay shipments to adjust inventories. Said Gulden, “It’s only mid-October but the feeling is that it is very promotional.”

Gulden added, “It’s just trying to be cautious. I hope I’m wrong.”

His comments came after the company reported sales in the third quarter increased 17 percent currency adjusted to €1.12 billion (+13 percent reported) with double-digit growth in all regions.

By region on a currency-neutral basis, Puma saw a 22.7 percent gain the EMEA region and a 15.6 percent jump in the Americas region. In the Asia/Pacific region, sales on a currency-neutral basis rose 10.2 percent. On a reported basis, EMEA’s sales climbed 22 percent to €498.3 million, Americas revenues moved up 9.8 percent to €376.6 million; and Asia/Pacific’s sales grew 3.4 percent to €246.9 million.

By product category, footwear sales climbed 23.2 percent on a currency-neutral basis and accessory sales rose 23.9 percent while apparel was up 7.6 percent. On a reported basis, footwear sales were up 18.9 percent to €545.3 million, apparel sales increased 3.8 percent to €391.8 million and accessories revenues advanced 19.9 percent to €184.7 million.

Net earnings rose 57.3 percent to €62.1 million, or €4.16 while EBIT improved to €215 million from €114 million last year.

Gross profit margin rose a better-than-planned 120 basis points at 47.3 percent. The bottom line also benefited from operating leverage with operating expenses (OPEX) increasing by only 12 percent.

Among product categories, Puma saw a healthy response to the launch of its Puma One collection while recent products continued to meet with success over the quarter, including Tsugi, Basket Heart and Ignite Limitless.

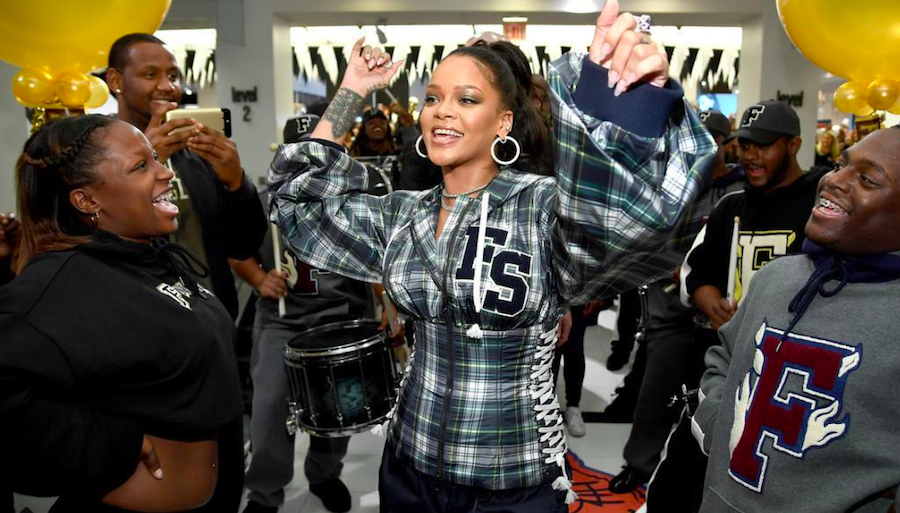

Puma’s women’s business further strengthened through the September launch of the second Rihanna collection this year. Said Gulden, “I think it’s fair to say that the momentum in the women’s business has continued and we see especially the sell through of the product to the consumer at women’s is doing extremely well.”

The women’s buzz is being led by Rihanna and her Fenti collection and Gulden spent a good part of the media call discussing her impact. He said Rihanna has come out with four full collections and “quite a few footwear drops” over the last two years. Fenti has achieved “substantial sales” and Gulden admitted Puma’s officials had been “all surprised on how much she was selling. I’m very, very happy about that.”

But the bigger benefit of Rihanna is the influence she’s had on Puma’s overall range and in supporting strong sell-throughs in women’s. Said Gulden, “I would say that Rihanna’s relationship has helped make us hot again to the young consumer.”

Gulden added, “Rihanna is an icon. She’s one of the most creative people on this planet.”

He noted that Puma on the women’s side is also being supported by successful collaborations with Cara Delevingne and Kylie Jenner and soon through a new partnership reached in September with Selena Gomez.

Gulden also noted how the brand overall is benefitting from the merging of sports and fashion. As a smaller, “little more edgy,” and “we like to say a faster” brand versus its primary competitors, Puma finds itself in a “lucky situation” in being positioned to capitalize on the trend.

He stated, “Clearly more and more kids and also older people are wearing sports gear on the street and even to work and we see that the influence of sports into fashion is increasing.” He noted, for example, that fashion brands are starting to come out with their own sneaker collections and the materials, colors and graphics they’re using all play to the athletic aesthetic. Gulden said, “It is definitely going in a direction that is good for us and athletic brands.”

He also noted that while much of the focus on the trend is its influence on the western world, more people in China, India and other countries are participating in sports and activities that are “good for you” that will also support athletic brands in general.

Gulden stressed that Puma “will never ever become a fashion brand” and its investment in marketing will always be higher in sports and performance than in fashion. He added, however, “But then we also know that the kids of today are influenced heavily by other things than only the athlete and that’s why models, singers, entertainers, social media influencers are so important. It’s about finding the right mix.”

Regarding Gomez, a singer, actor and model with more than 130 million social media followers, Gulden said she was “very, very influential” in the digital space and a “perfect” fit for the brand. He added, “We will work together with on many levels. Of course she will use our product but she’ll have a say on what we do for product and then we’ll see how far we’ll take it, if we take it to her own collection.”

On other topics, Gulden said the Usain Bolt will likely be “more visible” as an ambassador for Puma now that he’s retired from running. He noted that Bolt has expressed interesting in pursuing soccer and that would lead to some marketing tie-ins.

Asked about the World Cup, Gulden estimates Puma will have four or five teams competing. Many of its teams, including Italy, Switzerland and some countries in Africa, are still attempting to quality. He noted that Puma “for the first time in a long, long time” achieved share gains in soccer boots in the quarter and the World Cup typically boosts the category’s sales while also offering opportunities to sell replica jerseys. Said Gulden, “I’m a soccer freak so I really look forward to Russia and that tournament.”

Overall, he said Puma’s marketing spend will continue to range between 10 to 12 percent of sales and should continue to increase as revenues expand. Said Gulden, “We are much smaller than Adidas and Nike so we have to be smarter in how we spend it and that’s what we’re trying to do.”

He also said the focus in advertising is reaching influencers in the digital space, which includes both major global stars but also local ones. Said Gulden, “The best marketing you can do is storytelling by people themselves.”

He reiterated that Puma is exploring re-entering team sports sponsorship in the U.S. He added, “Going forward, to be a global sports brand that should grow in the mid and long term, we have to have a point of view on American sports.”

The brand continues to “work on different options” and he said the current college basketball recruiting scandal “has had no influence on our process.”

Asked about rumors of Amazon’s entry into activewear, Gulden likened any entry to a retailer Puma already sells to coming out with a private label. He believes there will always be demand for branded product in the sports space. He said, “I personally believe that a brand in sports with all the marketing and all the innovation will always have a space and…we just need to make sure that we do our job.”

Photo courtesy Puma