With currency effects continuing to have negative impact on margins, Puma SE widened its loss in the second quarter to €6.8 million from €3.3 million a year ago. Sales growth was seen across all regions, driven by footwear.

2015 Second Quarter Facts

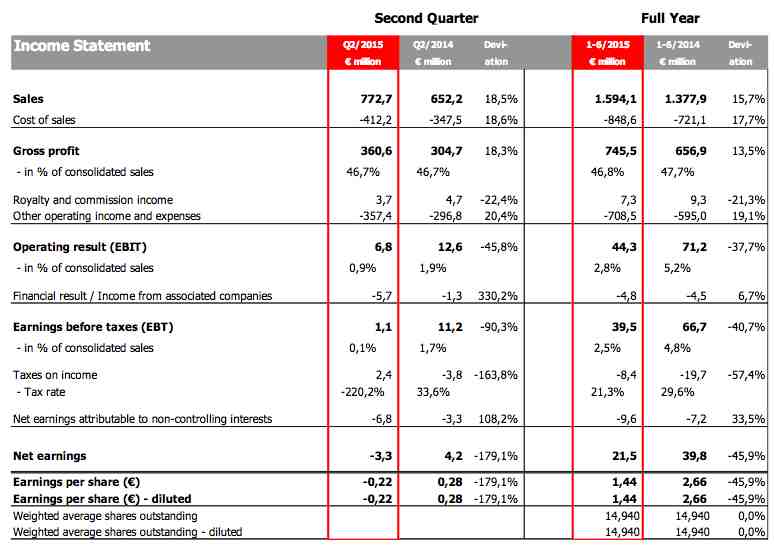

- Currency adjusted sales up by 7.6 percent to €772.7 million, or 18.5 percent reported

- Strong growth in Footwear driven by Running and Training categories

- Gross profit margin stable at 46.7 percent despite adverse currency effects

- OPEX increase based on additional marketing activity, IT investments and currency impacts

- Operating income (EBIT) comes in at €6.8 million

- Tretorn trademark rights sold

- Puma-sponsored national football team of Chile wins Copa América title for the first time

2015 Half Year Facts

- Currency adjusted sales grow across all regions by 5.9 percent to €1,594.1 million, exceeding expectations

- Gross profit margin falls by 90 basis points to 46.8 percent due to currency effects

- OPEX rise by 19.1 percent to €708.5 million due to higher marketing activities, retail expansion, IT investments and adverse currency impacts compared to last year

- Operating income (EBIT) amounts to €44.3 million

- Earnings per share come in at €1.44

- Innovative Ignite running product platform shows good sell-through

Bjørn Gulden, CEO, Puma SE said “We saw a continued positive development of our sales in Q2. This was again driven by a strong growth in Footwear. We have said that growth in footwear is key for us to turn the company around and feel that the investment in new and innovative products is starting to pay off. The negative effect of currencies is continuing to hurt our gross profit margin and increase our operational expenses, thus reducing our earnings. We are, of course, working to offset the impact of this by gradually increasing sales prices in markets that are hurt by the negative effects, and we are, when possible, moving some of the sourcing to local markets. These measures are currently not enough to totally offset the loss in reported gross profit margin. Despite the pressure on margins, we have decided to continue our investments in marketing, IT, and in the modernizing of our retail network. We believe these investments are needed to regain the strength of the brand and to ensure long-term growth for the company. We have a vision of becoming the fastest sports brand in the world and know that we have to invest now to achieve our goal long term. Furthermore, we confirm our financial guidance from Q1.”

Second Quarter 2015

Currency adjusted sales exceed expectations

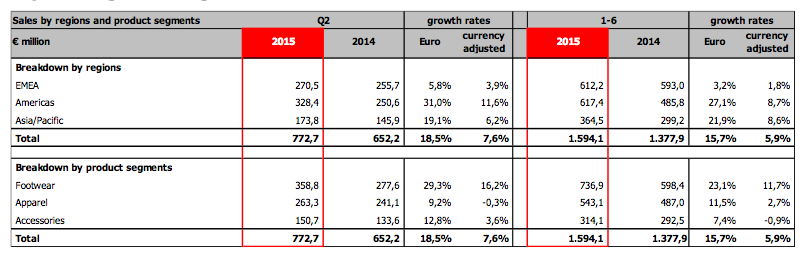

In the second quarter of 2015, Puma's consolidated sales improved by 7.6 percent currency adjusted to

€772.7 million and were above company expectations. This positive development was primarily driven by the growth in Footwear sales across all regions. In reported terms, consolidated sales rose a strong 18.5 percent.

Growth in all regions

Second-quarter sales for the EMEA region (Europe, Middle East and Africa) rose by 3.9 percent currency adjusted to €270.5 million. The development was particularly encouraging in Germany, France and Turkey, while Italy and Switzerland suffered a decline on high comparables, with last year's World Cup replica sales not repeating this year.

Sales performance in the Americas was stronger in the second quarter with growth in both North and Latin America. Currency adjusted sales increased by 11.6 percent to €328.4 million. In particular, Argentina and Mexico showed above average sales developments.

Asia/Pacific (APAC) showed a satisfying second-quarter performance, with sales rising by 6.2 percent currency adjusted to €173.8 million. The increase was primarily attributable to good performances in China and India, each reporting double-digit growth.

Footwear leads product segment performance

Sales in Footwear increased for the fourth quarter in a row, rising by 16.2 percent currency adjusted to

€358.8 million. This development was mainly driven by the Running, Training and Sportstyle categories and especially the Puma Ignite product platform.

Apparel sales were broadly flat at €263.3 million. This is against high comparables in the second quarter 2014, when sales in replica jerseys driven by the FIFA World Cup were particularly strong.

Accessories grew by 3.6 percent currency adjusted to €150.7 million and developed in line with expectations.

Gross profit margin stable

Gross profit margin was stable at 46.7 percent, despite significant negative currency effects. The footwear gross profit margin decreased slightly from 42.7 percent to 42.3 percent. The apparel margin rose from 48.2 percent to 50.7 percent and the margin for accessories fell from 52.4 percent to 50.0 percent.

Higher OPEX in line with expectations

Operating expenditures (OPEX) – significantly impacted by adverse currency effects – saw an increase of 20.4 percent in reported terms, rising to €357.4 million. During the quarter, the company continued to invest heavily in marketing activities to strengthen Puma's positioning as the Fastest Sports Brand in the World. The main cause for the increase was higher media spend and the partnerships with global sports and pop culture icons Rihanna and Arsenal, which both commenced in the second half of 2014. The opening of new retail stores at selected locations and investing into the IT-infrastructure also contributed to the increase of OPEX in the second quarter. In constant currencies, the increase in OPEX amounts to 10.6 percent versus last year.

Operating income (EBIT)

The rise in operating expenses led to a decrease of operating income (EBIT) from €12.6 million to €6.8 million.

Financial result

In the second quarter, the financial result declined from €-1.3 million last year to €-5.7 million this year due to unfavorable impacts from currency conversion.

Net earnings

Net earnings came in at €-3.3 million in the second quarter, resulting in earnings per share of €-0.22.

First Half-Year 2015

In the first half-year 2015, consolidated sales increased by 5.9 percent, currency adjusted to €1,594.1 million, and were above company expectations. In reported terms, the improvement is significantly higher with an increase of 15.7 percent.

All regions contribute to sales growth

In the EMEA region, sales rose by 1.8 percent currency adjusted to €612.2 million. Germany, France, Spain and Turkey showed a positive development in Europe, while the Middle East and Africa regions continued their solid performance.

In the Americas, sales grew by 8.7 percent, currency adjusted to €617.4 million. Argentina and Mexico stood out within the Latin American region, driving double-digit growth, while North America was growing at a mid-single-digit pace with acceleration in the second quarter.

Asia/Pacific also developed well, with an increase of 8.6 percent currency adjusted to €364.5 million. Performances in China and India were strong, while sales in Japan were stagnant and Korea declined in a difficult economic environment.

Footwear supported by Ignite

In terms of product segments, Footwear was positively impacted by the successful launch of the Puma Ignite product platform, leading to an overall increase of 11.7 percent currency adjusted to €736.9 million. The Running, Training and Football categories were the main growth drivers. Apparel also grew with sales amounting to €543.1 million, up 2.7 percent, while Accessories decreased slightly to €314.1 million, down 0.9 percent.

Puma's retail sales grew

Supported by the increased number of stores operating– 44 more stores compared to one year ago and 4 less than at the end of 2014– retail sales increased by 9.3 percent currency adjusted to €322.2 million in the first half of 2015. This represented 20.2 percent of total sales compared to 19.6 percent last year.

Gross profit margin impacted by adverse currency effects

Puma has already taken and will continue to take countermeasures to offset the negative currency impact on the gross profit margin. The effect of these measures helped us to limit the impact on the gross profit margin to 90 basis points for the first half-year, as the second quarter gross profit margin was stable. However, Puma cannot currently fully neutralize the impact of volatile currencies, as prices can only be adjusted very carefully in order not to impact consumer demand. Furthermore, in some countries, the costs of hedging outweigh its financial benefits, or in some instances, currency hedging is not possible at all. In addition, the company is considering the option to source products more in local markets, in order to reduce exposure to foreign currencies in these markets. Puma's gross profit margin for the first half-year went down by 90 basis points to 46.8 percent. The footwear gross profit margin decreased from 43.4 percent to 42.6 percent, the apparel margin was largely stable at 50.7 percent and the margin for accessories decreased from 50.9 percent to 49.8 percent.

Continued higher OPEX due to heavy marketing activities

Puma OPEX increased by 19.1 percent to €708.5 million, as negative currency effects continued to have an impact and the company continued its marketing activities. Opening new stores and investing in IT-infrastructure also contributed to the rise in OPEX. At the same time, Puma's management continued to put a strong emphasis on strict control of other operating costs. In constant currencies, the increase in OPEX amounts to 9.7 percent versus last year.

Operating result (EBIT)

Operating income was down by 37.7 percent to €44.3 million in the first half 2015, impacted by the negative currency effects already described.

Financial result

The financial result was almost stable at €-4.8 million compared to €-4.5 million in the first half year of 2014.

Net earnings / earnings per share

Half-year consolidated net earnings came in at €21.5 million, representing earnings per share of €1.44 compared to €2.66 in the prior year.

Net Assets and Financial Position

Increase in inventory and trade receivables broadly aligned with sales growth

To ensure product availability and support sales growth, as well as a higher demand from new stores, inventories increased by 20.6 percent to €704.5 million. This represents a currency adjusted increase of 13.4 percent. Trade receivables went up by 13.1 percent to €523.8 million, broadly in line with reported sales growth. Trade payables were at €557.9 million, rising 27.6 percent compared to last year's figure. In total, working capital rose 7.3 percent to €640.0 million.

Cashflow / Capex

As a consequence of the higher working capital requirement, the free cash flow before acquisitions was at €-167.8 million compared with €-69.7 million for the same period last year.

Cash and cash equivalents

Puma cash and cash equivalents went up from €300.0 million to €337.9 million, while borrowings increased due to the higher working capital requirements as part of Puma's short term financing activities.

Tretorn

Puma sold trademark rights of Tretorn

Continuing focus on core categories under the Puma and COBRA brands, the company divested industrial property rights of the Tretorn subgroup, which include trademark rights, patents and designs. In addition, the related operating business was sold and the respective entities were excluded from the scope of consolidation accordingly. Due to the very small size of the Tretorn business, with respect to sales, profit and net assets, these transactions had no material impact on the results and financial position of the Puma group.

Brand and Product Update

Underlining its strong position in Teamsport, Puma achieved a great visibility at both the Copa América in Chile and the FIFA Women's World Cup in Canada.

At the Copa América, Puma partnered host nation Chile, who garnered their first continental trophy. The Puma team secured triumph with a penalty shootout over archrival Argentina and its Puma star Sergio Agüero, who was amongst the tournament's best goal scorers, with three goals. Agüero's run of success follows an outstanding English Premier League 2014/15 season, finishing as the top scorer with 26 goals. In Germany, Bundesliga's top scorer list was led by Puma player Alexander Meier of Eintracht Frankfurt, with 19 goals.

At the FIFA Women's World Cup, Puma star Marta Vieira Da Silva made the headlines by becoming the all-time leading scorer in Women's World Cup history, while Germany's Célia aic finished the tournament as the game's top goal scorer with six goals. Together with the three participating Puma teams– Cameroon, Ivory Coast and Switzerland– more than 50 Puma players contributed to a strong on-pitch presence for Puma.

Both the Copa América and the FIFA Women's World Cup in Canada served as a great stage for the introduction of Puma's innovative football boot evoSPEED SL. The newly revealed boot is Puma's lightest match boot to date, thanks to a super light, almost translucent textile upper material. Whilst maintaining the necessary stability, the low weight Puma Speedframe adds to the overall lightweight theme of the evoSPEED SL. Designed to give footballers a new game advantage enhancing speed and agility, the evoSPEED SL is worn on pitch by some of the world's best players including Sergio Agüero, Marco Reus, Radamel Falcao, Marco Verratti and Antoine Griezmann.

At the end of May, Puma's top football club Arsenal FC became the most successful club in the history of the English FA Cup, with a record of 12 wins by outplaying Aston Villa to win 4:0 in the Final. Two weeks later, Puma launched the much anticipated 2015/16 Arsenal home kit for the second year of partnership. The kit combines a modern approach to materials, with a traditional silhouette. The kit was launched through a live show at the Emirates Stadium by club legend and Puma ambassador Thierry Henry.

In its Running and Training category, Puma built on the successful introduction of revolutionary running technology Ignite and continued to develop the Ignite platform with the launch of Ignite Pwrcool. Pwrcool is Puma's innovative cooling technology designed to keep the body at an optimal temperature to preserve energy, and is incorporated into a complete collection of thermo-regulated apparel and Footwear designed with CoolCell: highly functional materials that draw sweat away from the skin while anatomically placed air flow features offer temperature regulation. Puma's long history of working with Jamaican athletes such as the “Fastest Man in the World”, Usain Bolt, and Olympic medalist Hansle Parchment, provided the perfect conditions to test Pwrcool as part of the development process.

In early May, Cobra Puma Golf athlete Rickie Fowler powered his way to victory at The Players Championship in Ponte Vedra Beach, FL, in what is being called the greatest finish in all 34-years of the event. Fowler wore Puma Golf apparel and was equipped with Cobra Golf clubs. Fowler reinforced Cobra Puma Golf's message of game enjoyment coupled with excellence.

Strategy Update

The first half of this year has shown that Puma is well under way in improving its product engine. Stronger sales performance, especially in Footwear, underlines increased attractiveness of its products. With successful product initiatives in the Spring/Summer season, the company has underlined its mission of becoming the Fastest Sports Brand in the World.

One of the most important initiatives was the launch of Puma's new running technology Ignite in Q1. “Ignite has delivered very solid sell-in and sell-through performance in both Wholesale and own Retail. In the second quarter, we have further nurtured this product platform with the introduction of Ignite Pwrcool,” said the company.

In Teamsport, Puma claims back territory with its two footwear platforms evoSPEED and evoPOWER, which continue to be equipped with new designs, materials and innovations such as the newly launched EvoSPEED SL, which only weighs 103 grams. Both platforms have been prominently featured in Puma marketing campaign this year and delivered high sell-through across geographies.

Puma and Kering Eyewear signed an eyewear partnership agreement for optical frames and sunglasses to be launched in Spring/Summer 2016. These will be divided into three main segments: Performance, Active and Sportstyle. In line with Puma's focus on sports performance, the range will also include eyewear items specifically designed for Running and Golf.

The company said, “We have continued to strengthen the Puma brand with ongoing marketing investments and enhanced marketing communication. Our campaign in the first half of this year has focused on showing our athletes and products in action.”

In the second quarter, Puma started featuring its newest brand ambassador, Rihanna, prominently through an in-store marketing campaign focusing on the season's female training styles. With this campaign, Puma has affirmed its strong commitment to women athlete consumers.

According to Puma, Rihanna is an ideal brand ambassador, admired by women across the world, thanks to her personality and iconic style. While she is already generating positive PR buzz for Puma, Rihanna will be at the center of the company's ongoing marketing campaign over the upcoming months. In a television commercial, as well as online and other offline media, she will feature Puma Ignite XT training shoe and other commercial products. Rihanna is currently working closely with Puma design teams. While the first Rihanna-inspired styles are already being launched in the second half of 2015, her own collection will be in stores in 2016.

The new in-store concept for Puma's own retail was first revealed in its full price store in Herzogenaurach earlier this year. Since then, further stores have been opened in Hong Kong, Turkey and Mexico. In the new Puma stores, the company can better tell its product stories, reveal technologies behind them and strengthen the brand's positioning as a sports icon. All new and refurbished stores are showing above average performance and an increased share of footwear sales.

Outlook for the Financial Year 2015

The positive sales development registered in the first half-year 2015 came in above projected expectations. Nonetheless, Puma still continue to expect an increase in the medium single-digit range for full-year currency-adjusted net sales. For the second half of 2015, the company anticipates higher sales growth in Q4 than in Q3.

However, as already expressed in the release of the first quarter results, the adverse developments of foreign exchange rates since the beginning of the year, particularly the strengthening of the U.S. Dollar versus nearly all other currencies, had a significant negative impact on Puma's reported gross profit margin. Puma has already taken and will continue to take countermeasures, but the impact will not fully offset the negative currency impact on the gross profit margin. The company still expect a drop in the gross profit margin for the full year in a range of 100 to 150 basis points versus last year's 46.6 percent.

In 2015, Puma will continue to invest strongly in marketing to further enhance and reinforce its new brand positioning. Investments in the upgrade of Puma's current IT-infrastructure and the extension of its retail store network will also continue. This will result in an increase in OPEX that will be further impacted by negative currency effects. At the same time, Puma's management will continue to put a strong emphasis on strict control of other operating costs.

Based on the business development in the first half-year 2015, Puma reiterates expectations that adverse currency effects will continue to impact gross profit margin, OPEX and EBIT. At the current exchange rate levels, and thanks to the countermeasures, that we have already implemented, Puma expects a full-year EBIT in range between €80 million and €100 million, with net earnings impacted accordingly.