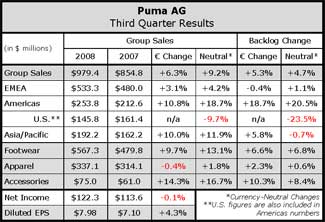

Puma AG saw net sales grow in all regions and product categories for the third quarter except for apparel, which was down on 0.4% in euro terms and actually saw sales growth on a currency-neutral basis.

More promising was strong growth in orders on hand, which were up 5.3% in euro terms at the end of the third quarter, or 4.7% currency-neutral. However, the sales gains were offset by increased SG&A costs due to investments in marketing and retail. Those increased costs caused net income to be just under flat for the third quarter.

Puma reported that third quarter consolidated sales grew 6.3% to 712.7 million from 670.4 million in Q3 2007, representing a growth rate of 9.2% in currency-neutral terms. Sales in Footwear increased 13.1% (+13.1% c-n) to 412.8 million from 376.3 million in the year-ago period. Apparel was just below flat for the quarter, down 0.4% (+1.8% c-n) to 245.3 million from 246.3 million last year, while Accessories sales jumped 14.2% (+16.7% c-n) to 54.6 million from 47.8 million in the prior-year quarter. Pumas worldwide branded sales, which include consolidated and license sales, increased 5.9% currency-neutral to 778.6 million ($1.07 bn), gaining 3.3% in euro terms.

Puma saw gross margins shrink in its Footwear business, but expand in Apparel and Accessories. For the third quarter, Footwear margins decreased 20 basis points to 52.6% from 52.8% last year. Apparel margins improved 160 basis points to 54.8% and Accessories margins increased 110 basis points to 55.2%.

The EMEA region, which includes Europe, the Middle East, and Africa, saw revenues increase 3.1% to 388.1 million. On a currency-neutral-basis, the company said sales for the region grew 4.2% for the period. Though sales were up, stronger growth in the Americas and Asia/Pacific regions led to a decrease in share of overall sales for the EMEA region to 54.5% from 56.1% of sales last year.

Gross margins in the EMEA region improved 90 basis points for the third quarter to 56.4% of net sales. Futures orders were well up for the region, growing 12.4% to 578.4 million ($825.5 mm). Currency-neutral futures orders were 1.1% higher than last year.

The Americas posted a 10.8% increase in net sales for the third quarter to 184.7 million from 166.7 million last year. Sales were particularly hurt by currency effects here, growing 18.7% on a currency-neutral basis. Strong growth in Latin America supplemented sales in the U.S. that were just above last years level.

However, the increased dependence on Latin America led to a decrease in gross margins, which were down 100 basis points to 48.9% of sales for the quarter.

Orders were well up for the Americas, but most of the growth came from outside the U.S. Order backlog for the Americas region as a whole at quarter-end increased 18.7% over the same period last year to 282.4 million ($403.3 mm). Orders were up 20.5% in currency-neutral terms.

Orders were well up for the Americas, but most of the growth came from outside the U.S. Order backlog for the Americas region as a whole at quarter-end increased 18.7% over the same period last year to 282.4 million ($403.3 mm). Orders were up 20.5% in currency-neutral terms.

Third quarter sales in the U.S. declined 9.7% when measured in U.S. dollars, coming in at $145.8 million versus $161.4 million last year. The year has been a bit of a roller coaster for Puma as first quarter sales dropped 14.2% versus last year, but second quarter sales nearly matched the year-ago number. The company did well to post only the 9.7% sales decline for Q3 as orders on hand at the end of Q2 were down 14.8% in the U.S.

Asia/Pacific region revenues increased 10.0% (+11.9% c-n) to 139.9 million for the second quarter from 127.2.5 million last year, now accounting for 20.6% of total sales. Region gross margin improved 240 basis points to 53.1% of net sales from 50.7% last year, mainly due to the consolidation of Korean market. Orders on hand were down 0.7% currency-adjusted, but were up 5.8% in euro terms to 302.5 million ($431.7 mm).

Total orders on hand at the end of September increased 5.3% in euro terms, or 4.7% currency-neutral, to 1.16 billion ($1.66 bn) The orders are mainly for deliveries scheduled for the fourth quarter of fiscal 2008 and for the first quarter of fiscal 2009. Footwear orders increased 6.8% currency-neutral to 703.5 million ($1.00 bn), Apparel increased 0.6% currency-neutral to 393.1 million ($561.0 mm) and Accessories increased 8.4% currency-neutral to 66.7 million ($95.2 mm).