Puma reported first-quarter profits fell 30 percent despite a 13 percent

revenue gain. Sales grew 4.4 percent on currency-neutral terms. The

company said its profit would be lower than expected in 2015 after the

strong U.S. dollar hit its first-quarter earnings, adding plans to

compensate through higher prices and more local sourcing were taking

longer than expected

2015 First Quarter Facts

Sales up by 4.4 percent currency-adjusted (+13.2 percent reported) to

€821 million, growth across all regions and mainly driven by Footwear

Gross profit margin down, solely due to foreign currency impacts

OPEX increase because of marketing expenses, investments in IT, opening of new retail

stores, also strongly impacted by unfavorable currency rates EBIT stands at €38 million

Puma IGNITE running shoe technology successfully launched in February

Outlook adjusted to reflect currency impact

Bjørn

Gulden, Chief Executive Officer of Puma SE: “Puma ́s first quarter

sales grew slightly stronger than expected. This was mainly caused by a

very positive development in footwear. We are working very hard to

improve our product offer, and although we know we have some ways to go,

we feel that this growth in footwear confirms that we are on the right

path.

The negative development in currencies, had a significant

negative impact on our gross profit margin and operational expenses and

therefore also on our EBIT and net earnings. We do work hard to

counter“ these negative currency effects, but do currently not have

enough leverage to fully neutralize the impact and have therefore

adjusted our outlook for the full year EBIT and net earnings.

We

will continue our strategy to become the Fastest Sports Brand in the

World and will continue to invest in Product, Marketing, Retail and IT

to lay the foundation for solid profitable growth in the future.”

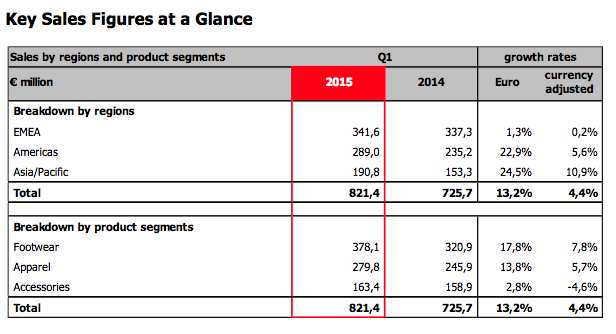

Sales

growth in the first quarter Puma’s first quarter sales performance in

2015 was slightly ahead of our expectations. Currency-adjusted sales

increased by 4.4 percent to €821 million. In reported terms, this

corresponds to a growth of 13.2 percent.

Positive sales

development in all regions Sales in the EMEA region rose by 0.2 percent

currency-adjusted to €342 million. Southern European countries developed

positively in the first quarter, while the United Kingdom saw a decline

due to a softer Lifestyle business. The Middle East and Africa regions

continued to show a solid performance in most of the countries and

across all categories.

In the Americas region, sales grew by 5.6

percent currency-adjusted to €289 million, with both North America and

Latin America developing positively.

Asia/Pacific sales increased

by 10.9 percent currency-adjusted to €191 million with strong

performance in China and India supported by the improved Footwear

business.

Footwear leads segment performance in the first quarter

Footwear sales increased by 7.8 percent currency-adjusted to €378

million. This was driven by a higher demand for Puma’s Running, Training

& Fitness products, which was partly triggered by the successful

launch of the Puma IGNITE running shoe in mid-February.

Apparel

sales increased by 5.7 percent currency-adjusted to €280 million. A

strong demand for Puma’s Fundamentals, Running, Training & Fitness

and Golf products underpinned this good performance.

Accessories

sales decreased by 4.6 percent currency-adjusted to €163 million. This

is related to lower sales of socks and bodywear in the North American

market.

Satisfying retail performance Puma’s first quarter Retail

sales increased by 7.3 percent on a currency-adjusted basis to €144

million, with comparable sales in full-price stores and outlets slightly

up. Puma also operated a higher number of stores. Retail sales

represented 17.5 percent of total sales compared to 17.1 percent last

year.

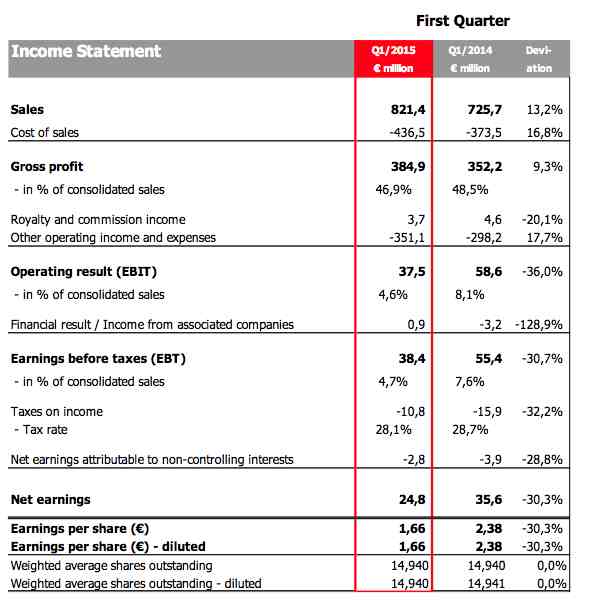

Negative currency impacts affect gross profit margin Puma’s

gross profit margin declined from 48.5 percent to 46.9 percent in the

first quarter, solely due to negative currency impacts. The strength of

the US Dollar compared to major “unhedged” and not fully hedged

currencies including Russian Ruble, Mexican Peso, Brazilian Real,

Turkish Lira and Argentinian Peso led to this decrease. The Footwear

gross profit margin declined from 44.1 percent to 42.9 percent. Apparel

decreased from 53.6 percent to 50.7 percent, and Accessories remained at

previous year’s level of 49.6 percent (Q1 2014: 49.7 percent). In

absolute figures, gross profit increased by 9.3 percent in reported

terms from €352 million to €385 million.

Higher OPEX in line with

expectations As communicated previously, Puma continued to invest in

the “Forever Faster” marketing campaign in the first quarter 2015. There

was no major campaign in the first quarter in 2014. In addition, we

have started to invest in our IT infrastructure and we continued with

our retail strategy to open additional retail stores, mainly in emerging

markets. As with the gross profit margin, OPEX was heavily impacted by

the unfavorable currency developments. As a consequence, Puma’s OPEX

increased by 17.7 percent to €351 million. Puma’s management continues

to put a strong emphasis on strict control of other operating costs. In

constant currencies, the increase in OPEX amounts to 9.5 percent.

Operating

result (EBIT) declines Despite the sales growth in the first quarter

2015, the lower gross profit margin and increased operating expenditures

both impacted by negative currency developments led to a decrease of

Puma’s operating result (EBIT) from €59 million to €38 million. The EBIT

ratio decreased from 8.1 percent to 4.6 percent.

Financial result

improves The financial result improved from €-3.2 million to €0.9

million in the first quarter. The result turned positive due to currency

conversion impacts.

Net earnings decrease Puma’s consolidated

net earnings declined by 30.3 percent from €36 million to €25 million.

As a result, earnings per share decreased from €2.38 to €1.66 in the

first quarter of the year.

Net Assets and Financial Position

Working

capital rose in line with sales Inventories increased by 23.7 percent

(11.9 percent currency adjusted) to €648 million due to earlier

deliveries in order to better service our key strategic accounts. Trade

receivables increased by 17.9 percent (6.2 percent currency adjusted) to

€596 million compared to 31 March 2014, which was driven by higher

sales. Trade payables were similarly affected by currency exchange rates

and

increased by 36.7 percent to €467 million. As a result,

Puma’s working capital rose by 10.6 percent from €674 million to €745

million at the end of March 2015.

Cashflow / Capex The free

cashflow before acquisitions declined to €-233 million mainly due to

lower cashflows from operating activities as a result of the increased

working capital.

Capex increased from €12 million to €16 million,

which was mainly invested in the opening of selected retail stores as

well as IT equipment.

Stable cash position Puma’s cash and cash

equivalents position at €295 million as of 31 March 2015 remained

broadly stable at last year’s level of €301 million.

Brand and Product Update

Following

the launch of our latest running innovation Puma IGNITE by the World’s

Fastest Man Usain Bolt on New York City’s Times Square, the sell-through

of this innovative footwear technology has been off to a good start

both in retail and wholesale. The innovative IGNITE foam technology

offers the highest energy return in the industry and strongly represents

our new “Forever Faster” positioning.

In order to further

strengthen our dominant position in Motorsport, we recently announced a

new long-term Formula 1 partnership with INFINITI RED BULL RACING.

Effective 1 January 2016, we will be the official, licensed supplier of

team and race wear. In addition, we will exclusively produce and

distribute INFINITI RED BULL RACING licensed replica, fanwear and

lifestyle collections for global distribution. We will also prominently

feature INFINITI RED BULL RACING in our brand and motorsport marketing

campaigns in 2016 and beyond.

Our partnership with Red Bull will

span beyond Formula 1 racing. We have also signed a new multi-year

partnership with the “Wings for Life World Run”, which was co-founded by

Red Bull founder Dietrich Mateschitz to fund scientific research for

spinal cord injuries. This will serve as

5

a platform to promote

our IGNITE running and CELL apparel technology. As the exclusive

official sportswear partner, event staff and athletes participating in

the Wings for Life World Run sported Puma footwear, apparel and

accessories. 100 percent of all starting fees and donations will go

directly to spinal cord research.

Our Teamsport category saw the

extension of one of Puma’s longest-standing and most successful

partnerships in Football: through our new long-term contract with the

Italian Football Federation (FIGC), Puma has increased its marketing

rights as well as retained the exclusive Master License to actively

manage the entire global licensing portfolio of the Federation. Puma,

who first became partner of “Gli Azzurri” in 2003, will also continue as

the official technical supplier to all associated FIGC teams.

In

March, Puma won the “2014 Marketing Leader Award” from Foot Locker

Europe. The award has recognized Puma’s “Forever Faster” marketing

campaign, which was launched in Autumn/Winter 2014 and the growth of

brand awareness through the effective use of advertising, public

relations and event marketing. This underlines the impact of our

“Forever Faster” campaign and the close collaboration with our retail

partners.

Strategy Update

We have made further

progress towards becoming the Fastest Sports Brand in the World. We have

launched successful products for this year’s Spring Summer season,

including our new IGNITE running technology. Over the coming seasons we

will continue to develop the IGNITE platform with innovations, material

updates and product launches supported by dedicated media activities.

We

have said that we would enhance our product communication, telling

better and simpler stories to the consumers and utilize our assets. This

promise is reflected in our ongoing marketing campaign “Forever

Faster”. The current theme is more product-focused and features Usain

Bolt running in the IGNITE as well as star-footballers including Mario

Balotelli and Cesc Fàbregas in action with our latest football boot

innovation evoPOWER.

Our new multi-year partnership with Rihanna

has already generated a lot of positive PR and social media buzz.

Rihanna is an ideal brand ambassador, thanks to both her personality and

iconic style. She is currently featured in an in-store marketing

campaign promoting Puma’s key training styles of the season. In August,

Rihanna will also play a key role in the brand campaign Forever Faster,

featured along Puma’s world-class athletes such as Usain Bolt and Sergio

Aguero. Later she will be the Creative Director for her own line of

training & lifestyle products.

In terms of improving the

quality of our distribution, our sales organizations are working hard to

intensify our relationships with key strategic accounts as well as

building new partnerships with strong retailers in both established and

emerging markets. Amongst others we have continued our collaboration

with Foot Locker and opened the first European Puma Lab at the Foot

Locker store in Milan in February. We have also added new locations to

their US portfolio in Philadelphia and Atlanta.

As for Puma’s own

retail, we have developed a new instore concept which will ensure that

our Puma stores better tell our product stories, reveal the technologies

behind them and strengthen Puma’s positioning as a sports brand. Last

month, we started the global roll-out with our Puma store in

Herzogenaurach. It will continue to be implemented in our stores

world-wide, with the shops in Hong Kong and Mexico City being next in

line. Continuing our efforts to improve and expand our online presence,

we have expanded the selection of our eCommerce website to include our

more exclusive Puma Select products as of May.

We continue to

work on simplifying our organizational structure and setup. In Indonesia

we have transitioned from a distributor to a new subsidiary which will

improve our presence in this important market. In terms of our IT

enhancement, we continue to work on our focus areas including

standardized ERP systems, overall IT infrastructure and also tools to

enable more efficient design and planning processes. These investments

are essential in order to achieve our vision of becoming the Fastest

Sports Brand in the World. We will continue to drive our growth strategy

forward with better, and faster collections, continued investments into

our brand, our organization, our distribution and our IT

infrastructure.

Outlook for the Financial Year 2015

In

2015, Puma will continue its strong marketing investments to further

enhance and reinforce our brand positioning, making a further step in

getting Puma back on a path of more profitable and sustainable growth.

After

the positive sales development in the first quarter 2015, we continue

to expect an increase in the medium single-digit range for full-year

currency-adjusted net sales.

However, as already indicated in the

outlook for 2015 at the beginning of this year, the continued adverse

developments of foreign exchange rates during the recent months,

particularly the strengthening of the US Dollar versus nearly all other

currencies, had a significant negative impact on Puma’s reported gross

profit margin. Puma has already taken and will continue to take

countermeasures, but the impact will not fully offset the negative

currency impact on the gross profit margin. As a consequence, we now

foresee a drop in the gross profit margin for the full year in a range

of 100 to 150 basis points versus last year (2014: 46.6 percent).

As

announced at the beginning of this year, we will continue to invest

strongly in marketing, in the upgrade of Puma’s current IT

infrastructure and the extension of our own retail store network. This

will result in an increase in OPEX, that will be further exacerbated by

negative currency impacts. At the same time, Puma’s management will

continue to put a strong emphasis on strict control of other operating

costs.

As a consequence of the now expected drop in gross profit

margin and adverse currency effects on OPEX, we now expect EBIT for the

full year to come in at a range between €80 million and €100 million.

Net earnings will be impacted accordingly.