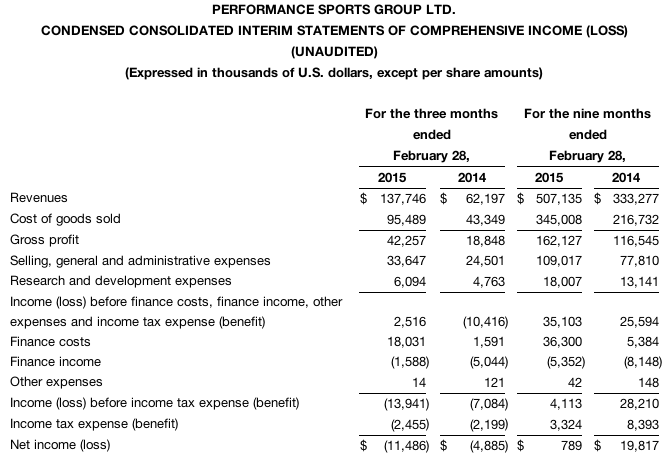

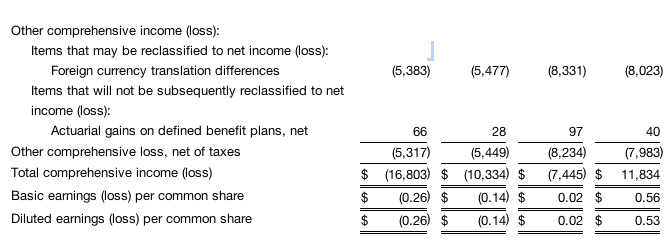

Performance Sports Group widened its loss in its third quarter ended Feb. 28, to $16.8 million, or 26 cents a share, from $10.3 million, or 14 cents, a year ago. But the parent of Bauer and Easton netted a profit against a loss before special items a year ago.

Fiscal Q3 2015 financial highlights vs. year-ago quarter, include:

- Revenues up 121 percent to a record $137.7 million, up 127 percent currency-neutral (c-n);

- Hockey revenues up 9 percent to a record $53.9 million (up 16 percent c-n);

- Lacrosse revenues up 19 percent;

- Adjusted gross profit up 134 percent to $46.3 million with Adjusted gross profit margin up 180 basis points to 33.6 percent;;

- Adjusted EBITDA up significantly to $14.4 million from a loss of $3.0 million; and

- Adjusted net income up significantly to $6.2 million or 13 cents per share from a loss of $4.2 million or 11 cents per share.

Management commentary

“We reported another record quarter due to the continued strong performance of Easton and 16 percent organic sales growth,” said Kevin Davis, president and CEO of Performance Sports Group. “Easton continued to experience solid demand for its Mako family of products, including the revolutionary Torq bat. Our hockey business had its fifth consecutive quarter of double-digit growth, up 16 percent on a constant currency (c-n) basis and driven by the successful launch of our Vapor 1X stick, underscoring our well-defined strategy to grow our stick business – the largest hockey category. With this launch, our stick category grew 26 percent in constant currency year-to-date and 92 percent in Q3.

“Our third quarter results also benefited from the resurgence in our lacrosse business, with revenues up 19 percent,” Davis continued. “After completing a simple modification to the Cascade R helmet early in the second quarter, the brand experienced a strong uptick in both January and February, and delivered 11 percent helmet sales growth for the quarter. We also continued to see growth in every equipment category of our Maverik line due to continued strength in our Optik and Tank heads, as well as our new line of shafts and gloves.

“Our consolidated business continues to perform well despite currency headwinds that have had, and will continue to have, a significant impact -particularly on our hockey business. For perspective, changes in foreign currency have reduced our year-to-date Adjusted EPS by approximately $0.17 compared to the same period last year. The U.S. dollar has strengthened even further as we head into two very significant quarters for our hockey business. This $0.17 decline is a clear example of how foreign currency markets continue to impact our reported results, but it also reflects the strength of our business and our ability to generate strong results despite these volatile currency markets.”

Fiscal Q3 2015 financial results

Revenues in the fiscal third quarter of 2015 increased 121 percent to $137.7 million compared to $62.2 million in the same year-ago quarter. On a currency-neutral basis, revenues were up 127 percent. The increase was primarily due to the addition of revenues generated by Easton and solid growth in ice hockey equipment, partially offset by an unfavorable impact from foreign exchange. Excluding the results of Easton, as well as the impact from foreign exchange, revenues grew organically by 16 percent.

Adjusted Gross Profit (a non-IFRS measure) in the third quarter increased 134 percent to $46.3 million compared to $19.8 million in the year-ago quarter. As a percentage of revenues, Adjusted Gross Profit increased 180 basis points to 33.6 percent compared to 31.8 percent in the year-ago quarter. The increase in Adjusted Gross Profit margin was primarily driven by the addition of Easton, partially offset by the unfavorable impact from foreign exchange (see “Non-IFRS Measures” below for further discussion).

SG&A expenses in the third quarter increased 37 percent to $33.7 million compared to $24.5 million in the year-ago quarter, primarily due to the addition of Easton and higher sales and marketing costs. As a percentage of revenues and excluding acquisition-related charges, share-based payment expenses and costs related to a lacrosse helmet decertification, SG&A expenses decreased significantly to 21.0 percent compared to 32.8 percent in the year-ago quarter.

R&D expenses in the third quarter increased 28 percent to $6.1 million compared to $4.7 million in the year-ago quarter due to continued focus on product development and the addition of Easton. As a percentage of revenues, R&D expenses decreased 320 basis points to 4.4 percent compared to 7.6 percent in the year-ago quarter.

Adjusted EBITDA (a non-IFRS measure) increased significantly to $14.4 million compared to a loss of $3.0 million in the year-ago quarter. This increase was due to the addition of Easton, partially offset by the unfavorable impact from foreign exchange. On a currency-neutral basis, Adjusted EBITDA was $17.5 million.

Adjusted Net Income (a non-IFRS measure) in the third quarter increased significantly to $6.2 million or $0.13 per diluted share, compared to a loss of $4.2 million or $(0.11) per diluted share in the year-ago quarter. The impact of foreign exchange reduced Adjusted Net Income by approximately $0.05 per diluted share compared to the third quarter last year.

On February 28, 2015, working capital was $338.6 million compared to $179.9 million on February 28, 2014, primarily due to the acquisition of Easton and investment in the Company’s apparel business. Excluding the acquisition, working capital was $230.6 million as of February 28, 2015, an increase of 28 percent versus the prior year.

Total debt was $431.2 million at February 28, 2015 compared to $130.8 million at February 28, 2014. Performance Sport Group’s leverage ratio, as defined in the Company’s credit agreements, stood at 3.87x as of February 28, 2015 compared to 2.51x one year ago. The increase reflects the Company’s financing of the Easton acquisition.

Nine month fiscal 2015 financial results

Revenues in the first nine months of fiscal 2015 increased 52 percent to $507.1 million compared to $333.3 million in the same year-ago period. On a currency-neutral basis, revenues were up 56 percent. Excluding the results of Easton, as well as the impact from foreign exchange, revenues grew organically by 11 percent.

Adjusted Gross Profit in the first nine months increased 50 percent to $181.9 million compared to $120.9 million in the year-ago period. As a percentage of revenues, Adjusted Gross Profit was 35.9 percent compared to 36.3 percent in the same year-ago period.

SG&A expenses increased 40 percent to $109.0 million compared to $77.8 million in the same period a year ago. As a percentage of revenues and excluding acquisition-related charges, share-based payment expenses and costs related to the lacrosse helmet decertification, SG&A expenses decreased 150 basis points to 18.8 percent compared to 20.3 percent in the first nine months of fiscal 2014.

R&D expenses increased 37 percent to $18.0 million compared to $13.1 million in the year-ago period. As a percentage of revenues, R&D expenses decreased 30 basis points to 3.6 percent compared to 3.9 percent in the first nine months of fiscal 2014.

Adjusted EBITDA increased 65 percent to $78.5 million compared to $47.7 million in the year-ago period. Without the impact of currency fluctuations, Adjusted EBITDA increased 84 percent to $87.8 million.

Adjusted Net Income in the first nine months of fiscal 2015 increased 51 percent to $40.0 million or $0.87 per diluted share, compared to $26.5 million or $0.71 per diluted share in the year-ago period. The impact of foreign exchange reduced Adjusted Net Income by approximately $0.17 per diluted share compared to the same period last year.

Segment Review

Hockey revenues in the third quarter increased 9 percent to $53.9 million, driven by the new Vapor 1X stick launch, partially offset by the shift in timing of certain orders to earlier this year and an unfavorable impact from foreign exchange. Excluding currency impacts, hockey revenues increased 16 percent in the quarter due to composite stick sales growth of 92 percent.

Hockey EBITDA was a loss of $4.0 million in the third quarter compared to a loss of $3.2 million in the year-ago period. The slight decrease was due to the impact of foreign exchange, which more than offset higher revenues in the quarter. Excluding foreign exchange, Hockey EBITDA increased $2.5 million or 78 percent.

Baseball/Softball revenues in the third quarter increased significantly to $71.9 million from $2.9 million in the year-ago period due to the addition of Easton.

Baseball/Softball EBITDA in the third quarter increased substantially to $18.9 million from a loss of $0.1 million in the year-ago period.

Revenues in the Other Sports segment, which comprises lacrosse and soccer, increased 19 percent to $11.9 million. This was driven by 19 percent growth in lacrosse, including an 11 percent increase from Cascade and growth in every equipment category of the Maverik brand. Cascade benefited from the resumption of helmet shipments following the recertification of the R helmet and all other current models. Maverik continued to see strong demand for its new line of heads and shafts, as well as its new protective equipment and team gloves.

Other Sports EBITDA in the third quarter increased 11 percent to $2.1 million from $1.9 million in the year-ago period. This was driven by growth in lacrosse revenues, partially offset by lower gross margins in lacrosse due to higher inventory reserves and lower margins on lacrosse helmets as a result of changes required for the recertification of the Cascade R helmet.