Organic sales declined at Jarden Corp.'s Outdoor Solutions segment in the first quarter due to lack of winter closeout sales and late deliveries of fishing products caught in-transit due to congestion at West Coast ports.

Organic sales declined at Jarden Corp.'s Outdoor Solutions segment in the first quarter due to lack of winter closeout sales and late deliveries of fishing products caught in-transit due to congestion at West Coast ports.

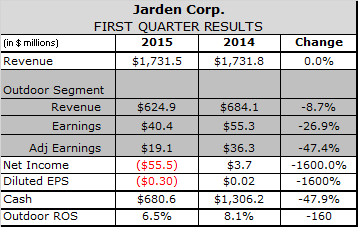

Revenues at the business, which sells 60 brands into the outdoor specialty, performance, snow and team sports channels, declined 8.7 percent to $624.9 million at the segment. Sales also declined in organic terms, which meant the segment again underperformed Jarden's Branded Consumable and Consumer Solutions segments, where organic sales grew 9.7 and 12.0 percent respectively.

Earnings at Outdoor Solutions declined 26.9 percent to $40.4 million. A $2.2 million, or 11.5 percent increase in acquisition, depreciation and amortization costs resulted in segment earnings of $19.1 million, down 47.4 percent from the first quarter of 2014.

Jarden Corp. CEO Jim Lillie attributed the decrease to a decline in winter sports close-out sales, which were limited thanks to strong fourth quarter sell-through and tight inventory. The company took an especially conservative stance on winter hardgoods inventory this season as it shifted production of K2, Marker, Ride and Völkl skis to a new factory in China that is already making the company's snowboards. Jarden Outdoor also owns Marmot, an outdoor apparel brand that has a significant winter business, as well as Backcountry Access and the Atlas, Madshus and Tubbs snowshoe brands.

Port delays snag early season fishing sales

“Like last year, we also saw good POS performance of traditional winter products in Q1 2015” Lillie explained. “It really was Fishing that was dragging down the overall [performance], and Coleman was essentially flat.”

Fishing sales were stymied largely by congestion at West Coast ports, which delayed deliveries of spring merchandise. Jarden Outdoors owns more than a dozen fishing brands, including Abu Garcia, Berkley, Penn and Shakespeare.

In-transit times for small kitchen appliances Jarden's Consumer Solutions segment imports to West Coast ports peakedat double year-earlier levels in February, when ocean container lines reached a labor agreement with dockworkers after eight months of working without a contract. Transit times improved to about 125 percent of normal in March and returned to near normal in April, Lillie said.

In an apparent response to the port situation and changes in their own management ranks, major retailers began bringing in spring merchandise earlier this year.

“Instead of traditionally waiting until after the end of their fiscal quarters before adding incremental inventory to their shelves, this year we've experienced an initial load-in of Q2-related products more consistent with anticipated POS seasonal selling patterns,” said Lillie.

2015 forecast intact

Despite the slow start to the year and a nearly 8 percent decline in the value of the euro, Canadian dollar and yen since the beginning of the year, management still expects Jarden Outdoor to post 3 percent or better organic growth rates in 2015. That's toward the bottom of the company's long-range 3-to-5 percent growth targets.

The rapidly improving throughput at West Coast ports and an anticipated windfall from lower oil prices on raw material and transportation costs as well as consumer spending are also expected to buoy second half sales and profits.

“I actually was at the Fishing business earlier this week,” said Lillie. “The containers are in, the products are flowing, and the POS is good as it relates to Fishing and Camping.”

He said Wilson's baseball products were selling in at “normal” levels and that the good sell-through of winter sports products sets the stage for good sales of those products in the back half “as retail inventories of these products are low.

“We still expect the Outdoor's business to deliver 3%-plus organic growth for the year,” he said.