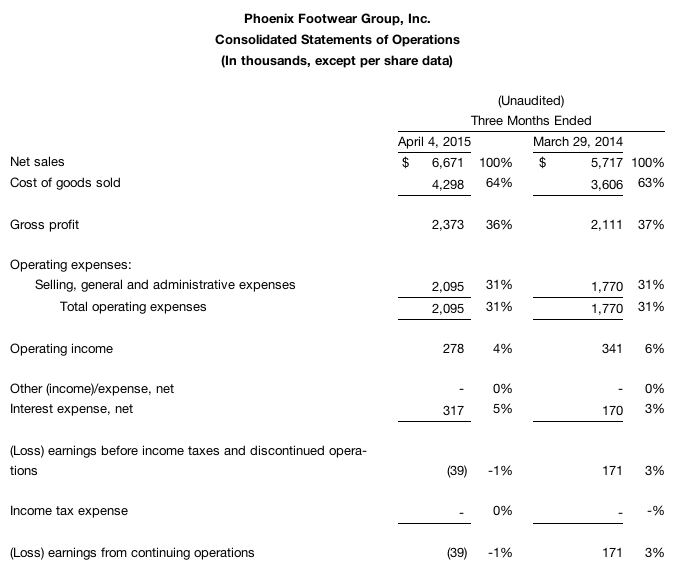

Phoenix Footwear Group, Inc., the parent of Trotters and SoftWalk, reported first-quarter sales grew 16.7 percent to to $6.7 million from $5.7 million a year ago.

The company saw growth in both its Trotters and Softwalk brands during the

quarter. Net sales of the company’s occupational footwear increased by

143 percent.

Earnings before interest, taxes, depreciation and

amortization (EBITDA) for the first quarter of fiscal 2015 were

$392,000 compared to $382,000 for first quarter of fiscal 2014.

Operating

income totaled $278,000 for the first quarter of 2015 compared to

$341,000 for the comparable period a year ago. During the current

quarter, the company added to its sales, customer service and

distribution staff in order to support current and projected growth. In

addition, during the quarter, the company incurred a non-cash charge of

$66,000 related to the full vesting of previously granted stock options.

Net

loss of $39,000, or $0.01 per share, for the first quarter of fiscal

2015 compared to net income of $171,000 or $0.02 per share, for the

first quarter of fiscal 2014. Interest expense for the first quarter of

2015 included nonrecurring prepayment and other refinancing costs of

$167,000 incurred with the entry into a new loan and security agreement.

First Quarter 2015

For

the first quarter of fiscal 2015 ended March 29, 2015, net sales

increased 16.7 percent, or $954,000, to $6.7 million from $5.7 million

when compared to the first quarter of fiscal 2014 ended March 29, 2014.

The increase in net sales for the first three months of fiscal 2015 was

the result of a 143 percent increase in the sales of licensed footwear

sold into the medical uniform channel of distribution and an increase in

customer demand of Trotters and Softwalk’s Spring product offering.

Gross

profit for the first quarter of fiscal 2015 increased $262,000, or 12.4

percent, to $2.4 million from $2.1 million when compared to the first

quarter of fiscal 2014. Gross profit as a percentage of net sales for

the first quarter of fiscal 2015 declined to 35.6 percent compared to

36.9 percent for the first quarter of fiscal 2014. The 130 basis point

decline in the gross profit as a percentage of net sales was primarily

associated with the clearance of phased out and discontinued fall styles

and increased sales volume of lower margin licensed footwear when

compared to the same period of the prior year.

Selling, general

and administrative expenses or SG&A increased to $2.1 million during

the first quarter of fiscal 2015 compared to $1.8 million for first

quarter of fiscal 2014. SG&A as a percentage of net sales increased

to 31.4 percent for the first quarter of fiscal 2014 compared to 31.0

percent for the first quarter of fiscal 2014. The 18.4 percent increase

in SG&A was primarily attributable to additional sales, customer

service and warehouse distribution staff necessary to support current

and anticipated future growth. In addition, during the quarter the

Company incurred a non-cash charge of $66,000 related to the full

vesting of previously granted stock options.

Interest expense

from continuing operations was $317,000 compared to $170,000 for the

first quarter of fiscal 2014. The increase in interest expense is

primarily associated with the accelerated expensing of deferred

financing costs and early termination fees of $167,000 with the

termination of the AloStar Bank of Commerce and Gibraltar Business

Capital loan and security agreements on February 2, 2015.

The company reported a loss from continuing operations of $39,000, or 1 cent

per share, for the first quarter ended April 4, 2015, compared to

earnings from continuing operations of $171,000, or 2 cents per share, for

the first quarter ended March 29, 2014.

Earnings before

interest, taxes, depreciation and amortization (or “EBITDA”) from

continuing operations for the first quarter of fiscal 2015 were $392,000

compared to $382,000 for first quarter of fiscal 2014.