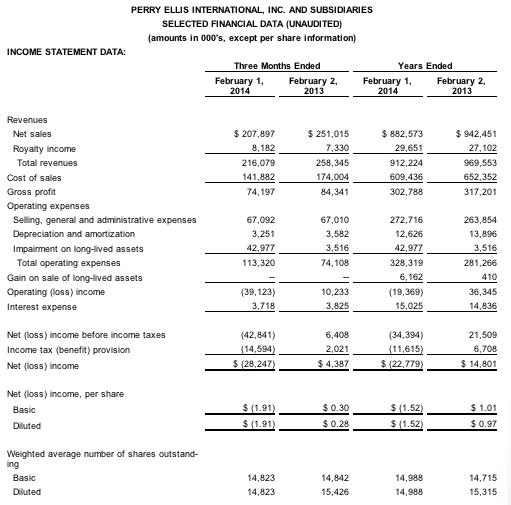

Perry Ellis International reported a net loss of $28.2 million, or $1.91 a share, after a $42.9 million non-cash writedown, primarily for intangible assets associated with brands that will be de-emphasized. On an adjusted basis, earnings reached 6 cents a share, down from 50 cents a year ago. On Feb. 24, the company had warned that earnings would come in between 2 and 5 cents a share.

For the full year ended Feb. 1:

- Adjusted diluted EPS of 0.38 for fiscal 2014 exceeds updated guidance of 0.34 – 0.37 as compared to 1.45 last year

- — company announces a 42.9 million non-cash writedown, primarily for intangible assets associated with brands that will be de-emphasized

- — Fiscal 2014 GAAP loss per share of 1.52 compared to net income per diluted share of 0.97 last year

Oscar Feldenkreis, president and chief operating officer of Perry Ellis International commented, “We were disappointed with the results of fiscal 2014. The year saw significant challenges, with unseasonal weather, consumer indifference to apparel, and declines in mall and outlet center traffic all negatively impacting our business. We also experienced a fundamental shift in the business model favoring national brands over private and exclusive brands, thereby impacting revenues and near term profitability. On a positive note, there were many encouraging areas: our overall golf lifestyle apparel business, international, as well as Nike swim continued to be strong. Licensing income grew dramatically in the fourth quarter reflecting the strength of our core brands, and gross margins expanded by 170 bps in the fourth quarter reflecting the strength of these businesses coupled with our successful turnaround of the Rafaella sportswear collection.”

Fiscal 2014 Fourth Quarter Results

Total revenue for the fourth quarter of fiscal 2014 was 216 million, a 16 percent decrease compared to 258 million reported in the fourth quarter of fiscal 2013. Revenues were adversely impacted by both inclement weather country wide as well as a cautious consumer. As a result, the company saw a lack of replenishment orders across many of the business platforms.

During the fourth quarter of fiscal 2014, gross margins expanded to 34.3 percent as compared to 32.6 percent in the same period of the prior year, reflecting a lower level of promotions in our Rafaella and Perry Ellis collections businesses as well as higher contributions from the golf lifestyle, international and licensing businesses discussed above.

The company's fourth quarter 2014 results included a 42.9 million or 1.94 per share non-cash write down of certain intangible assets, primarily trade names, goodwill and certain store leaseholds. These impairments were the product of our internal review of non-core brands and businesses.

As reported under GAAP, the fiscal 2014 fourth quarter loss was 28.2 million or 1.91 per diluted share compared to earnings of 4.4 million or 0.28 per diluted share in the fourth quarter of fiscal 2013. On an adjusted basis, the fiscal 2014 fourth quarter earnings per diluted share were 0.06 as compared to adjusted earnings per diluted share of 0.50 in the fourth quarter of fiscal 2013. Adjusted earnings per diluted share exclude certain items as outlined in Table 1 Reconciliation of GAAP diluted earnings per share to adjusted diluted earnings per share.

Fiscal 2014 Results

Fiscal 2014 revenues were 912 million as compared to 970 million reported in the prior year (“fiscal 2013”). Revenues increased across most of the golf lifestyle brands as well as in Nike swim, the company's international businesses and in licensing income. These increases were offset by significant reductions in private label and proprietary branded sales as well as lower replenishment across many of the company's businesses. While direct e-commerce sales saw a lift of 2.3 percent driven by a strong double digit lift in the second half of the year, our retail stores registered a decline in same store sales of 5.5 percent for the year.

On a GAAP basis, net loss for fiscal 2014 was 22.8 million, or 1.52 per share compared to GAAP net income of 14.8 million, or 0.97 per diluted share for fiscal 2013. Net loss for fiscal 2014 included 1.91 per share in non-cash impairment costs.

Adjusted earnings per diluted share for fiscal 2014 were 0.38 compared to adjusted earnings per diluted share of 1.45 in fiscal 2013.

The gross margin for fiscal 2014 was 33.2 percent compared to the gross margin of 32.7 percent in fiscal 2013. Gross margin was positively impacted by a reduction in promotional activity in our sportswear collection businesses, a more favorable revenue mix between branded and private label revenues, as well as a stronger contribution from the company's higher margin international platform and licensing revenues. These margin improvements were partially offset by higher liquidation sales in the fashion swim business and a reduced mix of higher margin replenishment sales.

Selling, general and administrative expenses totaled 273 million for fiscal 2014 as compared to 264 million in fiscal 2013. The year-over-year increase reflects increased marketing and advertising expense, as well as costs associated with the strategic consolidation of the company's New York office facilities. In addition, ten new store openings added incremental store expenses.

Earnings before interest, taxes, depreciation, amortization and impairments, as adjusted (“adjusted EBITDA”) for fiscal 2014 totaled 34.8 million, or 3.8 percent of total revenue. This compares to adjusted EBITDA of 61.4 million for fiscal 2013. (See attached reconciliation “Table 2” for a reconciliation of net loss/income to adjusted EBITDA.)

Balance Sheet Update

During fiscal 2013, we commenced divesting of trade names and businesses that were small revenue and low profit contributors. During fiscal 2015, we plan to focus on our brands and businesses that provide us the greatest profit enhancement while de-emphasizing brands and businesses that we do not consider core to the company.

Our focus will be on our core businesses and brands: our strong branded golf lifestyle portfolio, Original Penguin, Perry Ellis and Rafaella collections as well as Laundry and Savane.

The company has also embarked on a strategic overhead rationalization program to review its processes and systems and to streamline its supply chain to realize greater efficiencies.

George Feldenkreis, chairman and chief executive officer of Perry Ellis International stated, “Our liquidity and leverage profile remains strong with net debt to capitalization of 29.2 percent and ample availability under our credit facility. Cash and investments totaled 42.4 million at the end of fiscal 2014 leaving us well positioned to execute our strategies to position Perry Ellis for improved long term profitability and growth. We remain committed to setting a course for Perry Ellis International that increases value for our shareholders.”

Fiscal 2015 Guidance

The company has maintained its guidance for fiscal 2015. It expects total revenues to be in a range of 910 to 920 million. Gross margins for fiscal 2015 should expand 50 to 60 basis points to a range of 33.7 percent to 33.8 percent. The company has identified and expects to realize 9 million in reductions from its expense rationalization program net of reinvestment in new businesses. As a result, the company expects adjusted earnings per diluted share for fiscal 2015 in a range of 0.75 to 0.90.

Perry Ellis International, Inc. is a leading designer, distributor and licensor of a broad line of high quality men's and women's apparel, accessories and fragrances. The company's collection of dress and casual shirts, golf sportswear, sweaters, dress pants, casual pants and shorts, jeans wear, active wear, dresses and men's and women's swimwear is available through all major levels of retail distribution. The company, through its wholly owned subsidiaries, owns a portfolio of nationally and internationally recognized brands, including: Perry Ellis, Jantzen, Laundry by Shelli Segal, C&C California, Rafaella, Cubavera, Ben Hogan, Savane, Original Penguin by Munsingwear, Grand Slam, John Henry, Manhattan, Axist, and Farah. The company enhances its roster of brands by licensing trademarks from third parties, including: Nike and Jag for swimwear, and Callaway, PGA TOUR, and Jack Nicklaus for golf apparel.