Performance Sports Group reported profits declined sharply in its fiscal first quarter on an 11 percent drop in sales due to the timing off product launches and foreign currency exchange headwinds.

Fiscal Q1 2016 Financial Overview vs. Year-Ago Quarter

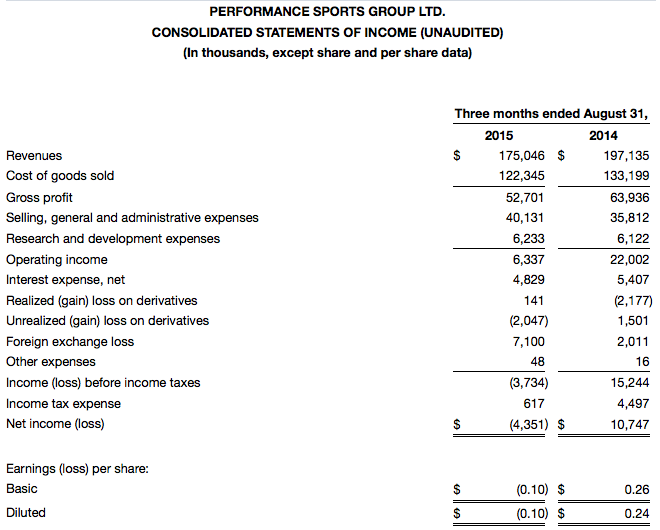

- Revenues totaled $175.0 million, declining 11 percent (down 4 percent in constant currency)

- Adjusted Gross Profit was $55.6 million, declining 24 percent (down 5 percent in constant currency)

- Adjusted Gross Profit margin was 31.8 percent, down 540 basis points (down 50 basis points in constant currency)

- Gross profit was $52.7 million, declining 18 percent (up 4 percent in constant currency) and gross profit margin was 30.1 percent, down 230 basis points (up 270 basis points in constant currency)

- Adjusted EBITDA was $16.7 million, down 58 percent (down 21 percent in constant currency)

- Adjusted Net Income totaled $6.0 million or $0.13 per share, compared to $21.8 million or $0.49 per share (Adjusted Net Income of $16.2 million or $0.34 per share in constant currency)

- Net loss totaled $4.4 million or $(0.10) per share, compared to net income of $10.8 million or $0.24 per share (net income of $9.3 million or $0.20 per share in constant currency)

The company's brands include: Bauer, Mission, Maverik, Cascade, Inaria, Combat And Easton. All figures are in U.S. dollars.

Management Commentary

“As we anticipated, product launch timing in our hockey and baseball/softball businesses along with foreign currency exchange rates affected our first quarter financial results,” said Kevin Davis, CEO of Performance Sports Group. “We estimate the strengthened U.S. dollar lowered our first quarter Adjusted EPS by approximately 60 percent or $0.21 compared to the prior year. Despite the ongoing impact of currency on our reported results, we continue to see solid growth across our brands, including continued market share gains in the recently completed back-to-hockey season, which runs from April through September.

“In terms of product timing, based upon retailer demand, this year we launched our new hockey products earlier in the season, resulting in more sales than usual in our fourth quarter. We also launched only one new Easton bat family compared to two last year, yet were able to maintain our sales in baseball. This was driven in part by 76 percent sales growth in Easton batting helmets and solid double-digit sales growth in our senior league bats across both our Easton and Combat brands. In fact, our Combat brand had a very strong first quarter, growing constant currency revenues by 80 percent. The effect of product launch timing, a characteristic of our business, was partially offset by our fast-growing lacrosse business. In the first quarter, lacrosse sales were up 24 percent, driven by continued strong growth in Maverik’s head and shaft categories, including the new Centrik head launch.

“As we look to the remainder of fiscal 2016, we reiterate our expectation that, on a currency-neutral basis, our brands will continue to outpace the growth of the markets we serve, resulting in market share gains and increased profitability. Supporting this outlook is our plan for a two-family launch in our hockey business in the fourth quarter of fiscal 2016, as well as other new product initiatives across all of our sports. We will also continue to leverage the strength of our performance sports platform with the goal of delivering significant cost reductions and operating efficiencies, with these efforts designed to support a profit growth rate that exceeds the pace of our revenue growth in fiscal 2016 and beyond, on a constant currency basis.”

Fiscal Q1 2016 Financial Results

Revenues in the fiscal first quarter decreased by 11 percent to $175.0 million, compared to $197.1 million in the same year-ago quarter. On a constant currency basis, revenues were down 4 percent to $189.5 million. The 11 percent decline was primarily due to the unfavorable impact from foreign exchange, variations in product launch cycles in the company’s hockey and baseball/softball segments, as well as challenging market conditions in the company’s hockey business in Russia. Offsetting the revenue declines noted above was 80 percent constant currency sales growth in the Combat brand, a 24 percent increase in lacrosse sales, and a 27 percent constant currency increase in Inaria soccer uniform sales.

Adjusted Gross Profit in the first quarter decreased 24 percent to $55.6 million, compared to $73.4 million in the year-ago quarter. On a constant currency basis, Adjusted Gross Profit decreased 5 percent to $69.6 million. As a percentage of revenues, Adjusted Gross Profit decreased 540 basis points to 31.8 percent compared to 37.2 percent in the year-ago quarter, primarily driven by unfavorable foreign exchange rates, and lower margins in baseball/softball due to the impact of Easton product mix and higher freight and distribution costs. On a constant currency basis, Adjusted Gross Profit margin was down 50 basis points to 36.7 percent.

Gross profit in the first quarter decreased 18 percent to $52.7 million, compared to $63.9 million in the year-ago quarter. On a constant currency basis, gross profit increased 4 percent to $66.5 million. As a percentage of revenues, gross profit decreased 230 basis points to 30.1 percent, compared to 32.4 percent in the year-ago quarter. On a constant currency basis, gross profit margin was up 270 basis points to 35.1 percent.

SG&A expenses in the first quarter increased by 12 percent to $40.1 million, compared to $35.8 million in the year-ago quarter due to start-up costs related to the “Own the Moment” retail initiative, higher legal, audit and other corporate costs, due in part to regulatory compliance costs associated with the company’s transition to a U.S. domestic issuer, and corporate IT infrastructure investments. On a constant currency basis, SG&A expenses increased by 16 percent to $41.5 million. As a percentage of revenues and excluding acquisition-related charges and share-based payment expenses,SG&A expenses increased 390 basis points to 19.9 percent, compared to 16.0 percent in the year-ago quarter.

R&D expenses in the first quarter increased by 2 percent to $6.3 million, compared to $6.1 million in the year-ago quarter due to the continued focus on product development. On a constant currency basis, R&D expenses increased 8 percent to $6.6 million. As a percentage of revenues, R&D expenses increased 50 basis points to 3.6 percent, compared to 3.1 percent in the year-ago quarter.

Adjusted EBITDA decreased 58 percent to $16.7 million, compared to $39.9 million in the year-ago quarter due to the aforementioned factors. On a constant currency basis, Adjusted EBITDA was $31.4 million, down 21 percent.

Adjusted Net Income in the first quarter decreased by 73 percent to $6.0 million or $0.13 per diluted share, compared to $21.8 million or $0.49 per diluted share in the year-ago quarter. The impact of foreign currency reduced Adjusted Net Income by approximately $0.21 per diluted share compared to the first quarter last year. On a constant currency basis, Adjusted Net Income was down 26 percent to $16.2 million or $0.34 per diluted share.

Net loss in the first quarter was $4.4 million or $(0.10) per diluted share, compared to net income of $10.8 million or $0.24 per diluted share in the year-ago quarter. On a constant currency basis, net income was $9.3 million or $0.20 per diluted share.

On August 31, 2015, working capital was $374.5 million, compared to $363.7 million on August 31, 2014. Total debt was $454.5 million at August 31, 2015, compared to $419.8 million at August 31, 2014. Performance Sports Group’s leverage ratio, as defined under the company’s credit facilities, stood at 5.73x as of August 31, 2015, compared to 3.61x one year ago. Excluding the impact of foreign currency on the company's trailing 12-month EBITDA, the leverage ratio was 4.11.

Segment Review

Hockey revenues in the first quarter decreased by 14 percent (down 5 percent on a constant currency basis) to $137.5 million compared to the year-ago quarter, driven by an unfavorable impact from foreign exchange, lower sales in most ice hockey equipment categories as a result of the timing of product launches compared to the prior year, a decline in performance apparel related to the prior year’s launch of a complete line of 37.5 apparel, and lower sales to the company’s Russian distributor.

Hockey EBITDA in the first quarter decreased by 51 percent (down 12 percent on a constant currency basis) to $19.2 million compared to the year-ago quarter, driven by the aforementioned unfavorable impact from foreign exchange, product launch timing differences as well as higher freight and distribution costs.

Baseball/Softball revenues in the first quarter were essentially unchanged (including and excluding the impact of foreign currency) compared to the year-ago quarter at $32.3 million. This was due to the launch of only one bat family for Easton compared to a two-family launch last year, which was offset by 80 percent constant currency sales growth in Combat during the quarter.

Baseball/Softball EBITDA in the first quarter decreased by 68 percent (down 70 percent on a constant currency basis) to $1.2 million, driven by the aforementioned product launch timing differences, Easton product mix, higher freight and distribution costs, as well as other SG&A investments in marketing and IT.

Revenues in the company’s “Other Sports” segment, which comprises lacrosse and soccer, increased by 23 percent (or 25 percent on a constant currency basis) to $5.4 million. This was driven by a 24 percent increase in lacrosse, which was driven by continued strong growth in Maverik’s head and shaft categories, as well as a 27 percent constant currency increase in Inaria soccer uniform sales.

Other Sports EBITDA in the first quarter improved to a loss of $1.0 million (a loss of $1.1 million on a constant currency basis), compared to a loss of $1.4 million in the year-ago quarter.