Pacific Sunwear of California Inc. reported its operating income dropped 83 percent in the second quarter due to highly promotional denim sales and store impairment charges at second tier malls.

Pacific Sunwear of California Inc. reported its operating income dropped 83 percent in the second quarter due to highly promotional denim sales and store impairment charges at second tier malls.

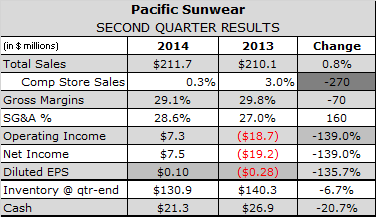

The retailer reported sales reach $211.7 million in the second quarter ended Aug.2, up just 0.8 percent from the second quarter ended Aug. 3, 2013. Comparable store sales grew 0.3 percent and average unit sales grew 7 percent, while total transactions were down 6 percent, reflecting weak traffic at many malls. Gross margin declined 70 basis points to 29.1 percent as denim sales, which generate about 20 percent of PSUN’s sales, remained highly promotional.

“Denim is not a very fun business to be in right now,” said Schoenfeld. “Promotions are pretty aggressive out in the marketplace and overall, it is a down-trending category for the moment, in both Men's and Women's.”

SG&A expense crept up 160 basis points to 28.6 percent of sales, due to both a shift in marketing expenses and store impairments charges at lower performing malls.

“People are recognizing, top-performing malls are continuing to win and drive traffic and be important destinations,” PSUN CEO Gary Schoenfeld. “Secondary malls are finding the marketplace more competitive and with a portfolio of 600 stores like we have, we are seeing a few stores hit the impairment limitations.”

Operating income fell to $976,000 from $5.90 million a year earlier, but GAAP enabled the retailer to report income from continuing operations of $7.5 million, or 10 cents per diluted share, compared to a loss from continuing operations of $18.6 million, or 27 cents per diluted share for the second quarter of fiscal 2013. The big swing was due to a non-cash gain of $10.4 million, or 14 cents per diluted share, taken to recognize the fair market value of preferred stock the company issued in fiscal 2011. A year earlier, PSUN took a non-cash charge of $21.2 million, or 31 cents per diluted share, against earnings on the same derivative. Excluding the non-cash gain on the derivative liability, and assuming a tax benefit of approximately $1.3 million, PSUN would have incurred a loss from continuing operations of $1.8 million, or 3 cents per diluted share, compared with income from continuing operations of $1.6 million, or 2 cents per diluted share, for the same period a year ago.

Sales trends improved as the quarter progressed, led by continued growth in the Men's business, where comparable sales grew 3 percent thanks to gains in June and July. Men's tops and footwear performed particularly well and sales of joggers helped offset weak denim sales. Joggers are loose-fitting, canvas pants with drawstring wastes that sometimes feature ribbed cuffs.

Comparable sales declined 3 percent in the Women’s business, as declines in footwear and accessories sales more than offset gains in apparel. Schoenfeld said he was pleased overall with the growth in key tops and shorts category and that the retailer is working to bring in more branded accessories and footwear for the holiday shopping season and next spring.

For the fiscal third quarter, PSUN forecast a non-GAAP loss per diluted share from continuing operations of between 9-4 cents, compared to 5 cents in the third quarter of fiscal 2013. The guidance assumes comparable store sales growth of between 0 and 3 percent; revenue of $203-$208 million (-1.7-+0.6 percent); gross margin, including buying, distribution and occupancy, of 25-27 percent (flat to +200 basis points); and SG&A of $54-$56 million (flat to +3.7 percent).

The guidance excludes the quarterly impact of the change in fair market value of PSUN preferred stock due to the inherently variable nature of derivative financial instruments.