Pacific Sunwear, Inc. reported sequential improvement for the third quarter ended Oct. 30, but weakness from its struggling Juniors business continued to impede any hope of year-over-year improvement.

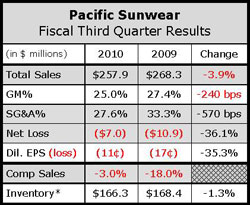

PacSun saw its top line dip 3.9% for the quarter, although the retailer managed to outperform earnings forecasts, posting a smaller-than-expected net loss of $7.0 million, or 11 cents per diluted share, on cost cuts that offset slowing merchandise sales. Total revenues for the quarter were $257.9 million compared to sales of $268.3 million a year ago. The year-ago loss was $10.9 million, or 17 cents per share.

Emulative of other mall-based teen retailers that are struggling amidst a slow spending environment, PacSun’s same store sales slipped 3% on a 10% decline from the Women’s business. Sequentially, PacSun’s Women’s sales improved substantially from 20-plus declines reported in the last several quarters. In recent quarters, PacSun has taken an initiative to market its Juniors’ business to an older, more sophisticated crowd, evidenced by the fact that management now refers to the segment as “Womens” instead of “Juniors.” Men’s merchandise sales saw positive comps for the second consecutive quarter and improved mid-single digits over the year-ago period.

Gross margins for the quarter narrowed 240 basis points to 25.0% versus 27.4% a year ago. Merchandise margins narrowed by 250 basis points, primarily due to higher markdowns as a percent of sales and lower initial markdowns. Company management said PacSun had to be more promotional than expected during the back-to-school period due to weakness in denim and wovens.

In a conference call with analysts, management said that although the opening weeks of November have been below expectations, it’s “nothing nearly as ghastly” as the year-ago period. At the time of the call, management said PacSun personnel was “eagerly awaiting” Black Friday to gauge the Holiday sales outlook.

Looking ahead, the company expects Q4 same-store sales in be in a range of negative 5% to flat with a gross margin improvement of between 100 and 400 basis points versus last year’s 22.6% gross margin. The company's earning guidance range for Q4 includes a GAAP net loss per share of between 10 cents and 29 cents which reflects the continuing impact of maintaining a valuation allowance against deferred tax assets and a very low effective tax rate.