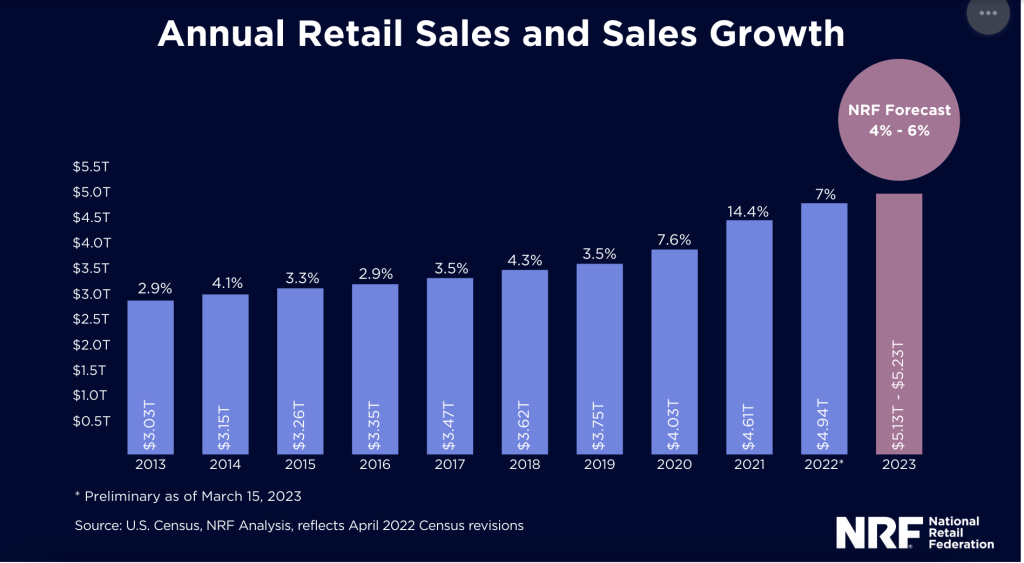

The National Retail Federation issued its annual forecast today, anticipating that retail sales will grow between 4 percent and 6 percent in 2023. In total, NRF projects that retail sales will reach between $5.13 trillion and $5.23 trillion in 2023.

“In just the last three years, the retail industry has experienced growth that would normally take almost a decade by pre-pandemic standards,” explained NRF President and CEO Matthew Shay. “While we expect growth to moderate in the year ahead, it will remain positive as retail sales stabilize to more historical levels. Retailers are prepared to serve consumers in the current economic environment by offering a range of products at affordable prices with great shopping experiences.”

NRF’s annual sales forecast was announced during the third annual State of Retail & the Consumer virtual conversation, where retail executives, economists and consumer experts discuss the health of the U.S. consumer and the retail industry.

The 2023 figure compares with a 7 percent annual growth to $4.9 trillion in 2022. The 2023 forecast is above the pre-pandemic average annual retail sales growth rate of 3.6 percent.

Non-store and online sales are included in the total figure and expected to grow between 10 percent and 12 percent year-over-year to a range of $1.41 trillion to $1.43 trillion.

While many consumers continue to use the conveniences of online shopping, much of that growth comes from multichannel sales, where physical stores still play an important part in the fulfillment process.

As the role of brick-and-mortar has evolved in recent years, it remains the primary point of purchase for consumers, accounting for approximately 70 percent of total retail sales.

NRF projects full-year GDP growth of around 1 percent, reflecting a slower economic pace and half of the 2.1 percent increase from 2022. Inflation is trending down but will remain between 3 percent and 3.5 percent for all goods and services in 2023.

Although the labor market has remained resilient, the NRF anticipates job growth to decelerate in the coming months in step with slower economic activity and the prospect of restrictive credit conditions. The unemployment rate is likely to exceed 4 percent before next year.

NRF Chief Economist Jack Kleinhenz noted that aggregate economic activity has held up well, despite a restrictive monetary policy that is working to curb inflation. He also acknowledged that recent developments in the financial markets and banking sector and some unresolved public policy issues complicate the outlook.

“While it is still too early to know the full effects of the banking industry turmoil, consumer spending is looking quite good for the first quarter of 2023,” Kleinhenz said. “While we expect consumers to maintain spending, a softer and likely uneven pace is projected for the balance of the year.”

The NRF provides monthly retail sales data and forecasts annual retail sales and spending for key periods, including the holiday season.

NRF’s calculation of retail sales excludes auto dealers, gas stations and restaurants to focus on core retail. To learn more, go here.

Graphics courtesy NRF/Kiplinger