Nordstrom, Inc. reported earnings per diluted share of $0.72 for the first quarter ended May 3, 2014, which exceeded the Company’s prior outlook of $0.60 to $0.70. The Company continued its progress in executing its customer strategy while maintaining disciplined execution around inventory and expenses.

Nordstrom also announced it will seek a financial partner for its Nordstrom credit card receivables, which totals approximately $2 billion. The Company believes there is an opportunity to explore a financial partnership in which it can maintain its customer focus while gaining greater financial flexibility. With any potential transaction, the Company does not expect any change to the customers’ experience and plans to retain all key aspects of the customer relationship. The Company expects any such partnership to have a minimal impact on existing operations and jobs.

There can be no assurance that the process of exploring any partnership will result in a consummated transaction. The Company does not expect to disclose further developments with respect to the process unless and until a definitive agreement is reached or the process of exploration is otherwise terminated. Any potential transaction will be subject to certain strategic and financial considerations, as well as regulatory approvals and other customary conditions. Goldman, Sachs & Co. and Guggenheim Securities, LLC are serving as financial advisors to Nordstrom in this process.

FIRST QUARTER SUMMARY

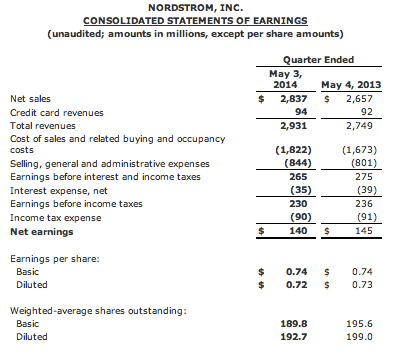

First quarter net earnings were $140 million compared with $145 million for the same period last year. This decrease reflected planned technology investments to improve service and experience across channels and infrastructure costs related to the upcoming entry into Canada. Total Company net sales of $2.8 billion increased 6.8 percent compared with the same period in fiscal 2013 and total Company comparable sales increased 3.9 percent.

Nordstrom comparable sales, which consist of the full-line and Direct businesses, increased 3.3 percent compared with last year’s comparable sales increase of 3.1 percent. Top-performing merchandise categories included Accessories, Women’s Shoes, and Cosmetics.

Full-line comparable sales decreased 1.9 percent. The Southwest and Southern California regions were the top-performing geographic areas.

Direct net sales increased 33 percent in the first quarter, on top of last year’s first quarter increase of 25 percent, driven by expanded merchandise selection and ongoing technology investments to enhance the online experience.

Nordstrom Rack net sales increased $126 million, or 20 percent, compared with the same period in fiscal 2013, reflecting 27 store openings since the first quarter of fiscal 2013. Nordstrom Rack comparable sales increased 6.4 percent.

Gross profit, as a percentage of net sales, decreased 124 basis points compared with the same period in fiscal 2013 in part due to increased markdowns in response to the heightened promotional environment. The decrease was also attributable to Nordstrom Rack’s accelerated store expansion and growth in the Nordstrom Rewards loyalty program. With 3.9 million active members, sales from members represented 38 percent of sales, increasing from 36 percent for the same period last year.

Ending inventory increased 10.2 percent per square foot compared with the same period in fiscal 2013, which outpaced the increase in sales per square foot of 3.6 percent. The difference primarily reflected planned inventory investments to fuel growth at Nordstrom Rack, in well-performing merchandise categories, and at NordstromRack.com.

Selling, general and administrative expenses, as a percentage of net sales, decreased 40 basis points compared with the same period in fiscal 2013, primarily due to the combination of lower variable expenses and expense leverage from increased sales volume.

Earnings before interest and taxes was $265 million, or 9.3 percent of net sales, compared with $275 million, or 10.3

percent of net sales, for the same quarter last year.

During the quarter, the Company repurchased 3.2 million shares of its common stock for $192 million. A total of $478 million remains under existing share repurchase board authorization. The actual number and timing of future share repurchases, if any, will be subject to market and economic conditions and applicable Securities and Exchange Commission rules.

Return on invested capital (ROIC) for the 12 months ended May 3, 2014 was 13.3 percent compared with 14.0 percent for the same period last year. A reconciliation of this non-

GAAP financial measure to the closest GAAP measure is included below.

EXPANSION UPDATE

Nordstrom announced plans to open three full-line stores and 17 Nordstrom Rack stores during the remainder of fiscal 2014. In the first quarter of 2014, Nordstrom opened the following stores:

Nordstrom, Inc. reported earnings per diluted share of $0.72 for the first quarter ended May 3, 2014, which exceeded the Company’s prior outlook of $0.60 to $0.70. The Company continued its progress in executing its customer strategy while maintaining disciplined execution around inventory and expenses.

FISCAL YEAR 2014 OUTLOOK

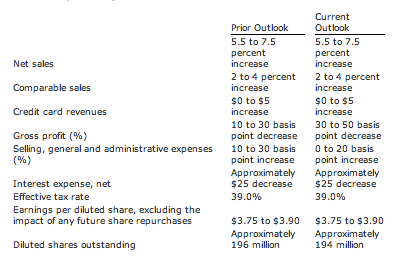

The Company’s annual earnings per diluted share expectations are unchanged, incorporating first quarter results, the impact of share repurchases in the first quarter, and assumptions around the promotional environment over the near-term. Our updated expectations for fiscal 2014 are as follows: