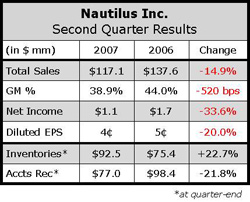

Nautilus, Inc. tripped over its own Treadclimber in the second quarter as the only thing keeping the company out of the red on the bottom line was a settlement that went its way. That litigation settlement came from an intellectual property case involving Icon Health and Fitness that saw NLS add just over $10 million to the company coffers. Without the settlement, the company would have recorded a net loss of $9.5 million, or 30 cents per share, for the second quarter.

quarter as the only thing keeping the company out of the red on the bottom line was a settlement that went its way. That litigation settlement came from an intellectual property case involving Icon Health and Fitness that saw NLS add just over $10 million to the company coffers. Without the settlement, the company would have recorded a net loss of $9.5 million, or 30 cents per share, for the second quarter.

On a conference call with analysts, Nautilus management said that the sales shortfall could be attributed to the Retail and Direct businesses. While Direct sales were down 11% to $53.7 million from $60.3 million last year, it was Retail that was the real culprit as sales in the channel plummeted 62% to $12.2 million from approximately $32.1 million in the year-ago quarter.

The International business grew 21% to $18 million, while Apparel improved 5% to $14.5 million, and the Commercial division was up 11% to $18 million for the period. The combined increase was enough to offset the decline in the Direct business, but not to put a dent in Retail decline. CEO Greg Hammann said that the quarterly results were hurt by a market that is “under pressure due to discretionary spending pullback,” but that the company can turn things around by reaching into other segments than just home strength gyms and exercise bikes; by improving on-floor presentation and merchandising; and by launching two new brands that will focus on specialty retail and help to differentiate those shops from big box. In Apparel, represented by the Pearl Izumi brand, the cycling business was said to be “a little bit flat,” but running was said to be “doing really well.”

For the second half of 2007 the company expects net sales of $350 million to $380 million and earnings of 20 cents to 30 cents per share. Gross margins for the second half are expected to be in the 42% to 43% range, with Q4 showing stronger margin results than Q3. Looking at the year as a whole, Retail channel sales should be up 20%, while Direct is expected to be down approximately 10%.