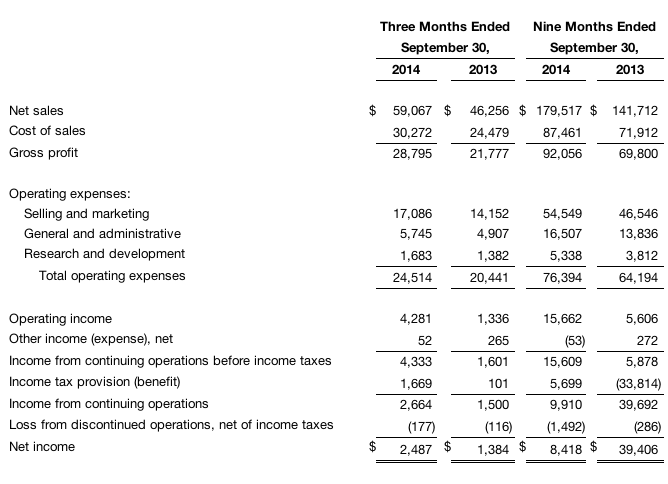

Nautilus, Inc. reported sales for the third quarter of 2014 totaled $59.1 million, a 28 percent increase compared to $46.3 million in the same quarter of 2013. The strong growth was driven by higher sales in both the Direct and Retail segments.

Gross margins for the third quarter improved by 170 basis points to 48.8 percent, reflecting margin increases in both the Direct and Retail segments. Operating income from continuing operations for the third quarter of 2014 was $4.3 million, a 220 percent increase compared to $1.3 million in the same period last year. The increase in operating income reflects higher sales and gross margins in both the Direct and Retail segments combined with improved leverage of sales and marketing, general and administrative, and product development costs across higher sales volumes.

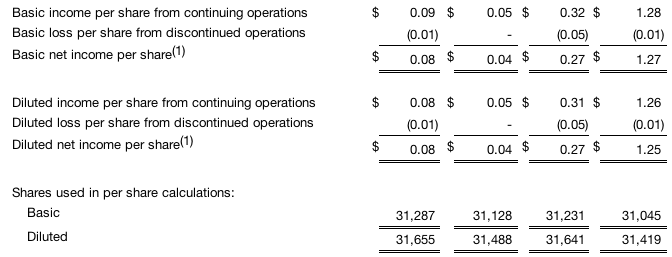

Pretax income from continuing operations for the third quarter of 2014 was $4.3 million, or $0.14 per diluted share, compared to pretax income from continuing operations of $1.6 million, or $0.05 per diluted share, for the third quarter of last year. For the first nine months of 2014, pretax income from continuing operations was $15.6 million, or $0.49 per diluted share, compared to pretax income of $5.9 million, or $0.19 per diluted share, for the same period of last year.

Net income from continuing operations for the third quarter of 2014 was $2.7 million, or $0.08 per diluted share, compared to net income from continuing operations of $1.5 million, or $0.05 per diluted share, for the third quarter of 2013.

As previously stated, beginning in the first quarter of 2014, the company started to record income taxes at a normalized rate following the partial release, in 2013, of its valuation allowance recorded against its deferred tax assets. The effective income tax rate for continuing operations in the third quarter of 2014 was 38.5 percent. The effective tax rate for the remainder of the year is expected to be between 35 percent and 40 percent. Cash payments related to income taxes were minimal due to the companys significant domestic net operating loss carry forwards.

For the third quarter of 2014, the company reported net income (including discontinued operations) of $2.5 million, or 8 cents per diluted share; this includes a loss from discontinued operations of $0.2 million. In the third quarter of 2013, the company reported net income of $1.4 million, or 4 cents per diluted share; this includes a loss from discontinued operations of $0.1 million.

For the first nine months of 2014, net sales were $179.5 million, an

increase of 27 percent over the same period last year. For the first

nine months of 2014, operating income from continuing

operations was $15.7 million, compared to $5.6 million in the same

period last year, an increase of 179 percent.

Bruce M. Cazenave, chief executive officer, stated, We are pleased to report another strong quarter of financial growth and improved profitability. Our business generated double digit top line growth in both the Direct and Retail segments while continuing to benefit from improved gross margins and our ability to leverage operating costs across higher sales volumes. In the Direct business, our results include strong contributions from our Bowflex Max Trainer® product line. We are very pleased with the consumer demand and positive response to this revolutionary cardio machine in its first year on the market and remain encouraged about the products long-term potential. Also, the Retail segment continued to grow and perform well underscoring the success of last years new product lineup combined with additional new products launched in September.

Cazenave continued, As part of our key growth strategy to further diversify and expand our product portfolio, we recently announced the launch of new, innovative products that encompass broad areas of fitness, including strength, cardio, and nutrition in both our Direct and Retail channels. While it is very early, we are excited about the positive initial consumer and industry reaction to these new products. Continued focus and strong execution on our three key priority initiatives of product innovation, margin improvement and achieving operating leverage has served our company well and we believe we are again well positioned going into this years peak fitness season.

Segment Results

Net sales for the Direct segment were $34.5 million in the third quarter of 2014, an increase of 34 percent over the comparable period last year. Direct segment sales benefited from the strong performance of the new Bowflex Max Trainer® product line, partially offset by a decline in Direct sales of other products. For the first nine months of 2014, net sales for the Direct segment were $117.6 million, an increase of 26 percent over the same period last year. U.S. credit approval rates rose to 40.3 percent in the third quarter of 2014, up from 34.3 percent for the same period last year. The company attributes the increase in approval rates to the launch of the Bowflex Max Trainer®, which has thus far attracted consumers with better credit scores, along with its media strategy focused on driving quality consumer leads and an expanded lender base.

Operating income for the Direct segment was $4.1 million for the third quarter 2014, an increase of 214 percent compared to operating income of $1.3 million in the third quarter 2013. Operating income benefitted from higher gross margins and improved leverage of selling and marketing expenses as a percentage of sales in the third quarter of 2014. Gross margin for the Direct business was 62.2 percent for the third quarter of 2014, compared to 61.0 percent in the third quarter of last year, benefitting from improved overall overhead operating efficiency and improved product margins.

Net sales for the Retail segment were $23.5 million in the third quarter 2014, an increase of 21 percent over the third quarter last year. The improvement in Retail net sales reflects continued strong retailer and consumer acceptance of the companys lineup of cardio products launched last fall, along with additional new products introduced this fall. The Retail results also benefited from a few customers accelerating some of their fourth quarter orders into the third quarter to get their supply chains in desired position for the upcoming peak selling season. For the first nine months of 2014, net sales for the Retail segment totaled $58.6 million, an increase of 31 percent over the same period last year.

Operating income for the Retail segment was $3.7 million for the third quarter 2014, an increase of 29 percent compared to operating income of $2.9 million in the third quarter last year. Retail gross margin was 26.5 percent in the third quarter of 2014, compared to 25.4 percent in the same quarter of last year.

Royalty revenue in the third quarter 2014 was $1.1 million, a decrease of 5 percent compared to $1.2 million for the same quarter of last year.

Balance Sheet

As of September 30, 2014, the company had cash, cash equivalents, and marketable securities of $41.7 million and no debt, compared to cash, cash equivalents, and marketable securities of $41.0 million and $27.7 million with no debt as of December 31, 2013 and September 30, 2013, respectively. Working capital of $63.3 million as of September 30, 2014 was $17.7 million higher than the 2013 year-end balance of $45.7 million, primarily due to reduced trade payables which are seasonally higher at year-end. Inventory as of September 30, 2014 was $21.3 million, compared to $15.8 million as of December 31, 2013 and $17.5 million at the end of the third quarter last year. The increase in inventory reflects inventory stocking of an additional distribution center opened during the third quarter of 2014, coupled with preparation for the fourth quarter which is the seasonally largest quarter of the year.

Share Repurchase Program

The company announced today that its Board of Directors has authorized the repurchase of up to $15 million of the companys outstanding common stock. Shares may be repurchased from time to time over the next 24 months in open market transactions at prevailing prices, in privately negotiated transactions, or by other means in accordance with federal securities laws. Share repurchases will be funded from existing cash balances and repurchased shares will be retired and returned to unissued authorized shares.