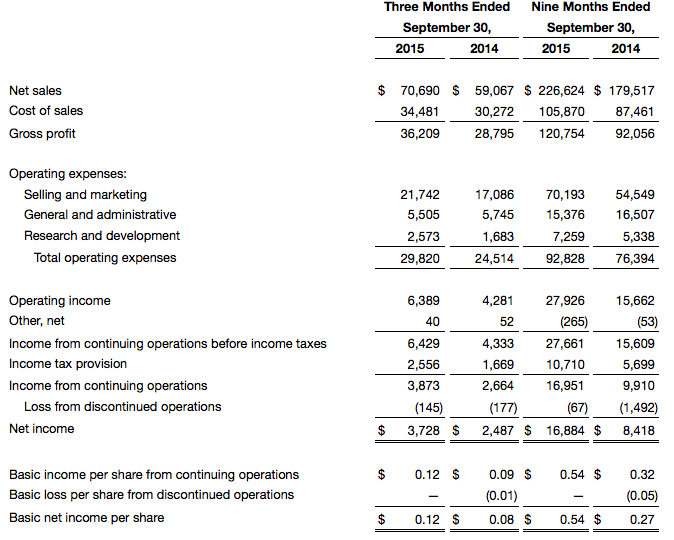

Nautilus Inc. reported sales rose 19.7 percent in the third quarter ended Sept. 30, to $70.7 million compared to $59.1 million in the same quarter of 2014. The strong growth was driven by higher sales in both the Direct and Retail segments. For the first nine months of 2015, net sales were $226.6 million, an increase of 26.2 percent over the same period last year.

Gross margins for the third quarter improved by 250 basis points to 51.2 percent, reflecting a margin increase in the Direct segment, a favorable mix between segments, and higher royalty revenue as a percentage of total net sales.

Operating income from continuing operations for the third quarter of 2015 was $6.4 million, a 49.2 percent increase over operating income from continuing operations of $4.3 million reported in the same quarter of 2014. The increase in operating income primarily reflects higher net sales and gross margins in the Direct segment, higher royalty revenue, and improved leverage of general and administrative costs across the higher sales volumes. For the first nine months of 2015, operating income from continuing operations was $27.9 million, compared to $15.7 million in the same period last year, an increase of 78.3 percent.

Income from continuing operations for the third quarter of 2015 was $3.9 million, or $0.12 per diluted share, compared to income from continuing operations of $2.7 million, or $0.08 per diluted share, for the third quarter of last year. For the first nine months of 2015, income from continuing operations was $17.0 million, or $0.53 per diluted share, compared to $9.9 million, or $0.31 per diluted share, in the same period last year, an increase of 71.0 percent.

For the third quarter of 2015, the company reported net income of $3.7 million, or $0.12 per diluted share, which includes a loss from discontinued operations of $0.1 million. In the third quarter of 2014, the company reported net income of $2.5 million, or $0.08 per diluted share, which included a $0.2 million loss from discontinued operations.

Bruce M. Cazenave, chief executive officer, stated, “Our third quarter performance is a result of continued successful execution across all aspects of our business. Strong top line growth of 20 percent reflects steady momentum for the Max Trainer product line in the Direct segment, coupled with increased market penetration in a number of product categories within the Retail segment. As importantly, we delivered robust operating income growth of 49 percent for the quarter, resulting from the higher sales and consolidated gross margins, as well as further leverage of supply chain and general and administrative costs.”

Cazenave continued, “At our recent new product showcase event, we introduced new strength and cardio products that will launch in the coming months. We are encouraged by initial retailer and consumer response and interest in our newest products, which feature enhanced connectivity and more interactive and tailored workouts. These products re-affirm our commitment to further diversify our portfolio and to drive the business for long-term profitable growth via industry leading design and innovation.”

Segment Results

Net sales for the Direct segment were $42.9 million in the third quarter of 2015, an increase of 24.3 percent over the comparable period last year. Direct segment sales benefited from continued strong demand for cardio products, especially the Bowflex Max Trainer® product line. For the first nine months of 2015, net sales for the Direct segment were $158.6 million, an increase of 34.9 percent over the same period last year.

Operating income for the Direct segment was $5.4 million for the third quarter of 2015, an increase of 30.5 percent compared to the third quarter 2014. Operating income benefited from higher net sales and gross margins. Gross margin for the Direct business improved 210 basis points to 64.3 percent for the third quarter of 2015, compared to 62.2 percent in the third quarter of last year. Gross margin improvement reflected leveraging of supply chain costs and lower reserve requirements.

Net sales for the Retail segment were $25.7 million in the third quarter of 2015, an increase of 9.6 percent when compared to $23.5 million in the third quarter last year. The improvement in Retail net sales reflects strong SelectTech® dumbbell sales coupled with continued retailer and consumer acceptance of the company’s new lineup of cardio products. For the first nine months of 2015, net sales for the Retail segment totaled $64.4 million, an increase of 9.9 percent over the same period last year.

Operating income for the Retail segment was $3.2 million for the third quarter of 2015 compared to $3.7 million in the third quarter of last year. The decline in Retail operating income was primarily due to increased investments in research and development along with higher selling and marketing expenses. Retail gross margin was 25.6 percent in the third quarter of 2015, compared to 26.5 percent in the same quarter of the prior year. Retail gross margins for the third quarter of 2015 were negatively impacted by unfavorable product and customer mix, reflecting increased sales of lower margin treadmills and lower sales to Canadian customers.

Royalty revenue in the third quarter 2015 was $2.1 million, compared to $1.1 million for the same quarter of last year. Royalty revenue increased due to the resumption of royalty payments under certain license agreements, along with the payment of back royalties attributable to the first and second quarters of 2015.

Balance Sheet

As of September 30, 2015, the company had cash and investments of $74.7 million and no debt, compared to cash and investments of $72.2 million and no debt at year end 2014. Working capital of $94.0 million as of September 30, 2015 was $11.0 million higher than the 2014 year-end balance of $83.1 million, primarily due to growth in inventory. Inventory as of September 30, 2015 was $35.6 million, compared to $24.9 million as of December 31, 2014 and $21.3 million at the end of the third quarter last year. The increase in inventory compared to the 2014 year-end balance and the third quarter of last year is due to higher net sales, new product introductions, and the addition of a new distribution center.

The company utilized $9.6 million during the third quarter of 2015 and a total of $11.6 million in the nine months ended September 30, 2015 to repurchase shares of its common stock under the $15.0 million share repurchase program it announced in November, 2014. Up to an additional $3.4 million may be expended for share repurchases under the program.

Headquartered in Vancouver, WA, Nautilus' portfolio includes Nautilus, Bowflex, TreadClimber, Schwinn, Schwinn Fitness and Universal.