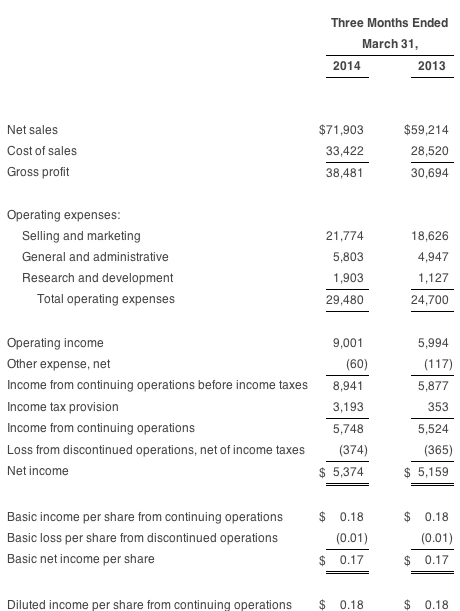

Nautilus, Inc. reported net sales for the first quarter of 2014 totaled $71.9 million, a 21 percent increase compared to $59.2 million in the same quarter of 2013. The strong growth was driven by higher sales in both the Direct and Retail segments. Gross margins for the first quarter improved by 170 basis points, reflecting margin increases in both the Direct and Retail segments. Operating income from continuing operations for the first quarter of 2014 was $9.0 million, a 50 percent increase over operating income from continuing operations of $6.0 million reported in the same quarter of 2013. The increase in operating income reflects higher sales and gross margins in both the Direct and Retail segments combined with improved leverage of sales and marketing and general and administrative costs across higher sales volumes.

Pretax income from continuing operations for the first quarter of 2014 was $8.9 million, or $0.28 per diluted share compared to pretax income from continuing operations of $5.9 million, or $0.19 per diluted share for first quarter of last year. Net income from continuing operations for the first quarter of 2014 was $5.7 million, or $0.18 per diluted share, compared to $5.5 million, or $0.18 per diluted share for the same period last year. Beginning in the first quarter of 2014, the company started to record income taxes at a normalized rate following the partial release, in 2013, of its valuation allowance recorded against its deferred tax assets. The effective income tax rate for continuing operations in the first quarter of 2014 was 35.7 percent compared to 6.0 percent in the first quarter of 2013. Cash payments related to income taxes were minimal due to the company’s significant domestic net operating loss carry forwards.

For the first quarter of 2014, the company reported net income (including discontinued operations) of $5.4 million, or $0.17 per diluted share. In the first quarter of 2013, the company reported net income (including discontinued operations) of $5.2 million, or $0.17 per diluted share. Net income for both the first quarter of 2014 and 2013 included a loss from discontinued operations of $0.4 million.

Bruce M. Cazenave, Chief Executive Officer, stated, “We are off to a strong start in fiscal year 2014, as sales grew at a double digit pace in both our Direct and Retail segments and gross margins and operating margins continued to improve. In the Direct business, we are pleased with early sales contributions from the Bowflex MAX Trainer product line we started shipping in the first quarter. Sales of MAX Trainer, along with the continued steady growth of our TreadClimber® product line, combined with a number of cost and efficiency initiatives were the primary drivers enabling us to achieve 54 percent growth in the Direct business operating income compared to the first quarter last year.”

Mr. Cazenave continued, “Our Retail business also delivered solid growth in the first quarter, and we continue to be encouraged by retailer feedback regarding the new cardio product lineup that we launched in the fall of last year. With our expanded and diversified new product offerings in both segments and improved product margins, we are well positioned to build on the trajectory of growth and improved financial performance that began three years ago. Our team has continued its focus on new product innovation, margin improvement and achieving operating leverage; and we are pleased that the first quarter results continue to validate that our focus on driving improvements in these three key areas is working.”

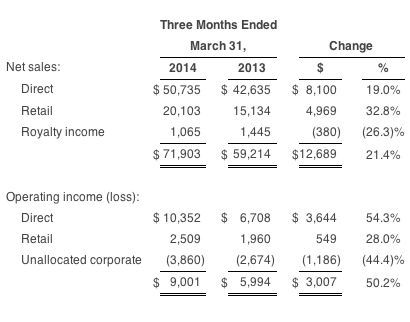

Segment Results

Net sales for the Direct segment were $50.7 million in the first quarter of 2014, an increase of 19 percent over the comparable period last year. Direct segment sales benefited from continued strong demand for cardio products, especially the Bowflex® TreadClimber® product line and the new Bowflex MAX Trainer product line, partially offset by a decline in Direct sales of strength products, which continue to migrate to the Retail business. U.S. credit approval rates rose to 41.3 percent in the first quarter of 2014, up from 35.1 percent for the same period last year which the company attributes to its media strategy focused on driving quality customer leads, and an expanded lender base.

Operating income for the Direct segment was $10.4 million for the first quarter 2014, an increase of 54 percent compared to the first quarter 2013. Higher sales and higher gross margins for the Direct segment were partially offset by higher media and advertising investment designed to help drive new product awareness and expand sales leads. Gross margin for the Direct business was 63.7 percent for the first quarter of 2014, compared to 59.8 percent in the first quarter of last year. Direct business gross margin also benefited from improved overall overhead operating efficiency and product cost improvements.

Net sales for the Retail segment were $20.1 million in the first quarter 2014, an increase of 33 percent when compared to $15.1 million in the first quarter last year. The improvement in Retail net sales reflects strong retailer and consumer acceptance of the company’s new lineup of cardio products launched last fall.

Operating income for the Retail segment was $2.5 million for the first quarter 2014, compared to $2.0 million in the first quarter last year. Retail gross margin was 25.4 percent in the first quarter of 2014, compared to 24.9 percent in the same quarter of last year.

Royalty revenue in the first quarter 2014 was $1.1 million, compared to $1.4 million for the same quarter of last year. Last year first quarter royalty revenue included a $0.3 million onetime positive event that was not applicable this year.

Balance Sheet

As of March 31, 2014, the company had cash, cash equivalents, and marketable securities of $55.6 million and no debt, compared to cash, cash equivalents, and marketable securities of $41.0 million and no debt at year end 2013. Working capital of $53.9 million as of March 31, 2014 was $8.2 million higher than the 2013 year-end balance of $45.7 million, primarily due to growth in cash equivalents and marketable securities of $14.6 million during the quarter. Inventory as of March 31, 2014 was $13.5 million, compared to $15.8 million as of December 31, 2013 and $13.7 million at the end of the first quarter last year.

Non-GAAP Presentation

In addition to disclosing results determined in accordance with GAAP, Nautilus discloses certain non-GAAP operating results that exclude certain charges. In this news release, the company has presented pretax income per diluted share from continuing operations which is a non-GAAP financial measure.

When presenting non-GAAP information, the company includes a reconciliation of the non-GAAP results to the most directly comparable financial measure calculated and presented in accordance with GAAP. The company presents pretax income per diluted share from continuing operations because management believes that the partial reversal of valuation allowances in fiscal year 2013, resulting in significant changes to the effective tax rate, makes meaningful comparisons between periods difficult. Including the non-GAAP results assists investors in assessing the company's operational performance relative to its competitors and its historical financial performance. The company presents these non-GAAP results as a complement to results provided in accordance with GAAP, and these results should not be regarded as a substitute for GAAP. The company strongly encourages you to review all of its financial statements and publicly-filed reports in their entirety and to not rely on any single financial measure.