Pacific Sunwear of California Inc. reported sales grew 4.7 percent in the third quarter ended Nov. 2 as a 4.0 percent increase in same-store sales and higher merchandise margins more than offset having 15 fewer stores compared with the same period in 2013.

Pacific Sunwear of California Inc. reported sales grew 4.7 percent in the third quarter ended Nov. 2 as a 4.0 percent increase in same-store sales and higher merchandise margins more than offset having 15 fewer stores compared with the same period in 2013.

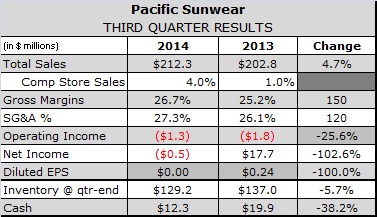

The retailer, which targets 17-to-24-year-olds, reported sales increased $9.5 million to $212.3 million, with $7.1 million of the increase coming from comps growth and $2.4 million from an increase in non-comp sales.

E-commerce sales increased 1 percent and represented 7 percent of total sales in the third quarter of 2014.

“I dont think were executing online as well as we can,” said CEO Gary Schoenfeld. “We have made some organizational changes as recently as the last two weeks. We think some of that contributed even to improve performance over the weekend and with Cyber Monday.”

Average dollar sale increased 9 percent, helping offset a 5 percent decline in total transactions compared to the same period a year ago.

The comparable store net sales increase was driven largely by a 6 percent increase in Mens sales, while Womens sales were flat. The increase in Mens sales was driven primarily by sales of bottoms, footwear and tops. Women’s sales of tops increased, offset by a decrease in non-apparel. The third quarter marked the 11th straight quarter of comp store sales growth for PSUN.

Gross profit increased 10.7 percent and reached 26.7 percent of net sales, up 150 basis points (bps) from the third quarter of 2013. Margin got a 100 bps lift from improved merchandise margin and a 50 bps lift from leveraging of occupancy costs.

SG&A rose 9.4 percent and increased to 27.3 percent of net sales, up 120 bps as increased spending on consulting and one-time software impairment charges more than offset lower store payroll related expenses and higher depreciation and amortization costs.

Operating losses narrowed 26 percent to $1.3 million, but net income plunged from a gain of $17.7 million in the third quarter of 2013 to a loss of $469,000. The sharp decline reflected a 78 percent drop in the value of a preferred shares PSUN issued to Golden Gate Capital in conjunction with a five-year, $60 million loan.

Accounting rules require public companies mark the value of such derivative liabilities to market value every quarter and charge that to net income. In PSUN’s case, that added $5 million in non-cash gains in the third quarter of 2014, down from $23 million in the year earlier quarter. On a non-GAAP basis (excluding the financial impact of the non-cash derivative liability and asset impairment charges, store closure, markdown allowances and using an normalized income tax benefit of approximately $1.9 million), PSUN’s loss from continuing operations was approximately $2 million, or – 3 cent per share, compared with $3 million, or – 5 cents per share in the third quarter of 2013.

PSUN ended the quarter with inventory valued at $129.2 million, down 5.7 percent from a year earlier and down about 3.8 percent per square foot of retail space. Cash and cash equivalents stood at $1.23 million, down by nearly 40 percent.

PSUN’s guidance for the fourth quarter calls for comparable store sales growth of 0-4 percent and net sales ranging from $218 million to $227 million. Gross margin is expected to be 21-24 percent, up from 20 percent in 2013, implying the retailer anticipates the positive trend in merchandise margins will continue. PSUN is forecasting non-GAAP loss from continuing operations of between -17 and -12 cents per diluted share.