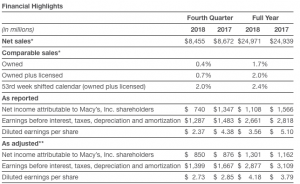

Macy’s Inc. reported earnings on an adjusted basis dipped slightly in the fourth quarter but came ahead of updated guidance provided in early January. Macy’s also announced a restructuring plan that will eliminate 100 vice-president level or above roles, “to increase the speed of decision making.”

Sales of $8.46 billion exceeded Wall Street’s average guidance of $8.44 billion. Adjusted EPS of $2.73 beat Wall Street’s consensus estimate of $2.53.

The department store chain had lowered its guidance when it reported November and December sales on January 10.

“2018 was an important year for Macy’s, Inc. as we changed the trajectory of the company and delivered positive comparable sales for the full year. I’m pleased with the impact of our strategic initiatives, particularly as they gained traction in the back half of the year,” said Jeff Gennette, Macy’s, Inc. chairman and chief executive officer. “Looking at the fourth quarter of 2018, while we delivered positive comparable sales against what was a strong holiday season in 2017, results were lower than our expectations. We experienced another quarter of double-digit growth in digital. We also saw continued improvement in our brick and mortar trends with the Growth50 stores outperforming the fleet.”

“We know that when we listen to our customers, we win. And when we invest in our business, we grow. In 2019, we will continue with a balanced investment approach, and we are confident that Macy’s, Inc. is on the right path to deliver sustainable, profitable growth,” continued Gennette.

“The North Star Strategy is working. Macy’s is heading into 2019 a stronger business than we were a year ago – with healthier stores, a growing e-commerce business and a mobile experience that is resonating with our customers. We are executing a balanced investment strategy that supports all three of these components, with investment directed towards areas we know have the highest returns,” said Gennette. “We are also a more agile and flexible organization. The steps we are announcing to further streamline our management structure will allow us to move faster, reduce costs and be more responsive to changing customer expectations. Importantly, these changes build the foundation we need to achieve meaningful enterprise productivity improvements. These actions impact colleagues who have made strong contributions to the company over the years, and I thank them for their service.”

Asset Sale Gains

Asset sale gains for the fourth quarter of 2018 totaled $278 million pre-tax, or $204 million after-tax and $0.65 per diluted share attributable to Macy’s, Inc. This compares to the fourth quarter of 2017, when asset sale gains totaled $368 million pre-tax, or $230 million after-tax and $0.75 per diluted share attributable to Macy’s, Inc.

In the fourth quarter of 2018, Macy’s, Inc. completed the sale of the former I. Magnin building in Union Square San Francisco for $250 million of cash proceeds and a gain of $178 million. Following the transaction, the Macy’s Union Square store will comprise approximately 700,000 gross square feet. Macy’s Union Square is one of the company’s flagship properties, and this transaction is part of a multi-year plan to invest in further enhancing the customer experience in the store.

Asset sale gains for fiscal 2018 totaled $389 million pre-tax, or $287 million after-tax and $0.92 per diluted share attributable to Macy’s, Inc. This compares to 2017 when asset sale gains totaled $544 million pre-tax, or $338 million after-tax and $1.10 per diluted share attributable to Macy’s, Inc.

2018 Strategic Initiatives Update

The company’s five key strategic initiatives of the North Star Strategy performed well for the year. Highlights include:

- Loyalty: Improved benefits to Macy’s Star Rewards member loyalty program led to increased loyalty penetration with platinum members, with platinum spend up 10 percent. The company also launched a tender-neutral option, which added more than three million new members to the loyalty program.

- Backstage: Opened Backstage, Macy’s on-mall, off-price business, in more than 120 new locations within Macy’s stores. For all Backstage store within a store locations, the average lift was more than 5 percent in the total store.

- Store Pickup: Expanded “Buy Online Pickup in Store” (BOPS), launched “Buy Online Ship to Store” (BOSS) feature, and built “At Your Service” centers in all stores. The company maintained approximately 25 percent associated sales on BOPS and BOSS orders.

- Vendor Direct: Expanded vendor direct program on macys.com, nearly doubling online SKUs.

- Growth50: Implemented growth investment model in 50 Macy’s stores, a mix of size and geography, with upgrades including facilities, fixtures, assortment and customer service. These stores outperformed the fleet for sales growth in fiscal 2018 and achieved higher customer retention and brand attachment scores.

Looking Ahead

2019 Strategic Initiatives to Drive Growth

The company will carry three of its 2018 strategic initiatives forward and add two new areas of focus in 2019:

- Growth150: Expand growth investment strategy to another 100 stores.

- Backstage: Add Backstage locations to 45 Macy’s stores and deliver positive comparable sales for the Backstage stores previously opened.

- Vendor Direct: Build on the success of the 2018 launch with continued aggressive expansion of vendors and SKUs.

- Mobile: Continue ‘mobile first’ strategy. Strategically enhance the Macy’s mobile app with new features and functions to deliver outsized growth in mobile sales.

- Destination Businesses: Invest in areas where the company already has strong market share to drive disproportionate growth. These categories are dresses, fine jewelry, big ticket, men’s tailored, women’s shoes and beauty.

The company also intends to focus on innovation both through technology and new economic models. The company will double the number of Market @ Macy’s locations, all of which will be powered by the b8ta platform. The company will also continue to expand its virtual reality furniture experience in 2019.

Funding Our Future

As part of the North Star strategy, Macy’s, Inc. is committed to increased productivity to fund investment in the business. The company has launched a comprehensive, multi-year program focused on growing its profitability rate by improving productivity across the enterprise. The program includes initiatives to improve margin through enhanced inventory planning and operations, supply chain efficiencies, pricing optimization, improved private brand sourcing and customer acquisition and retention strategies.

As an initial step in this productivity plan, the company has announced a restructuring that reduces the complexity of the upper management structure to increase the speed of decision making, reduce costs and respond to changing customer expectations. Importantly, it also allows the company to put additional resources behind three focus areas:

- Improving supply chain efficiency;

- Innovating and enhancing inventory management; and

- Building a larger and healthier customer base.

In addition to the expected 2019 savings, the company anticipates that these activities will fuel the productivity plan over the next 3-5 years and contribute significantly to profitable growth.

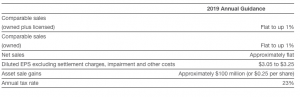

The areas for cost reduction in 2019 have been identified and are reflected in guidance. Beginning in 2019, the company expects the restructuring actions announced today to generate annual expense savings of $100 million. For fiscal 2018, the company recorded one-time charges of approximately $80 million pre-tax for restructuring activities.

2019 Guidance

Macy’s, Inc. is providing the following annual guidance for 2019.

Image courtesy Macy’s