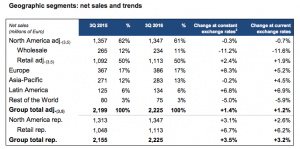

Luxottica Group, the parent of Oakley, Ray-Ban, Sunglass Hut and a number of luxury eyeglass brands, reported sales in the third quarter rose 3.2 percent to €2.23 billion. On a currency-neutral basis, sales grew 3.5 percent.

In its wholesale segment, net sales were down 3.2 percent to €800 million and off 3.6 percent on a currency-neutral basis. Retail segment net sales were up 7.2 percent to €1.43 billion and grew 7.9 percent on a currency-neutral basis.

The company said the overall gain was driven by solid results in Europe and some emerging markets, the overall acceleration of retail and an extended summer season, which favored the success of the group’s new collections.

Luxottica said it continues to grow due to vertical integration and geographic diversification, despite the temporary reduction of wholesale sales in the North American and Chinese markets in the third quarter of 2016 as a result of stricter trade policies. The enforcement of the minimum advertised pricing (MAP) policy in North America, with zero discounts from July 1, was critical in allowing Luxottica to develop the equity of its brand portfolio, clean up its distribution channels and defend the business of its wholesale customers. While the initiative has resulted in a decrease in sales to online operators by more than 60 percent, the number of discounted offers in the e-commerce channel has also seen a significant decrease.

In China, the reconfiguration of the Group’s distribution network and termination of several relationships with independent dealers resulted, at this early stage, in the withdrawal of goods from the marketplace equal to more than 30 percent of third-quarter net sales in the country.

In retail, Sunglass Hut once again confirmed its place as a leading global brand in the sun segment, with revenue growth of 14 percent at constant exchange rates.

In North America, a weak market environment and a reduction in price-based promotions at LensCrafters slowed the growth in comparable store sales for the optical retail business. The Group’s e-commerce platforms continued to grow, with revenue up by 18 percent at constant exchange rates during the third quarter of 2016. The Group has targeted e-commerce as an area for accelerated growth in 2017.

Luxottica is continuing to invest in the second half of the year to support the simplification and further integration of the business along with projects designed to enhance the Group’s technological, manufacturing and logistics infrastructure. In Sedico, Italy, the Group recently opened a ophthalmic lens production laboratory that will serve Europe, creating an integrated logistics and production hub between lenses and frames. This laboratory is an addition to the six existing facilities that are already making Luxottica a major player in the high-end ophthalmic lens business. By early 2017, new central labs will follow to serve North America and Asia-Pacific. They will produce ophthalmic lenses adapted to each frame manufactured by Luxottica, with the goal of providing consumers with a complete pair of prescription frames of the highest quality and aesthetic. Luxottica will offer eye care providers a new service model, integrating lenses and frames while also leveraging the efficiency of the Group’s global distribution network.

“We are pleased with the quality of our growth in the quarter and the vitality of our business in markets such as Europe, Latin America and Southeast Asia. We managed to achieve these results during a period of major investment, integration and organizational simplification of the Group, and an uncertain macroeconomic setting. The solid growth of retail sales more than offset the reduction in wholesale volumes, which were affected by the decision to sharply reduce sales to online operators in North America and the withdrawal of goods from Chinese independent distributors who were not aligned with the Group’s new distribution strategies. Ultimately, protecting the integrity and growth of our proprietary and licensed brands stands at the center of our strategy,” commented Leonardo Del Vecchio, executive chairman, and Massimo Vian, CEO for product and operations.

“By year’s end we will have substantially completed the integration of our businesses and we are already seeing the results of the various initiatives undertaken over the last twelve months. We therefore believe we can accelerate the growth of the Group starting in 2017, and keep it healthy and sustainable in the long run,” he added.

North America

In the third quarter of 2016, net sales at constant exchange rates in North America remained largely unchanged compared to the corresponding period of 2015, showing growth in the Retail segment that increased net sales by 2.4 percent compared to adjusted net sales in the third quarter of 2015 at constant exchange rates.

Additionally, net sales in North America accelerated compared to the first half of the year. Rising net sales for both Sunglass Hut and the optical retail brands, up by 8 percent and 1.8 percent respectively, drove the Retail segment’s performance.

The Wholesale segment’s net sales declined by approximately 11 percent in the third quarter, which is primarily attributable to the enforcement of the Group’s MAP policy and the integration of the Oakley sport channel, although sales for the first few weeks of October are already showing signs of a turnaround.

Europe

Europe continued to be an area of solid growth for the Group in the third quarter with a total increase of 8.3 percent in net sales at constant exchange rates, which is in addition to the strong top-line results reported in the same period of 2015. All markets in the region contributed to these results, with the exception of Turkey, which recorded a decline in sales after years of strong growth.

The Retail segment also contributed to the third quarter’s strong results, particularly in the U.K., Iberia and in Germany, with a strong acceleration in net sales over the first half of the year. Results were supported by the success of the latest collections, in particular Ray-Ban and Oakley, by the excellent sun season and the rising number of Sunglass Hut stores in travel retail locations and in Galeries Lafayette.

Asia-Pacific

The Asia-Pacific region closed the third quarter with net sales essentially unchanged at constant exchange rates (+4.5 percent at current exchange rates), driven by positive contributions from Japan, Korea, India and Southeast Asia.

In Mainland China, the Group’s revised distribution policies aimed at ensuring greater direct geographic coverage and enhanced quality of service lowered the Wholesale segment’s results.

The termination of several independent distributor relationships set the stage for healthier and sustainable growth in the long term. The Retail segment highlighted positive results for Sunglass Hut and LensCrafters, as well as an excellent reception for the first 37 RayBan stores, which are targeted to grow to 70 stores by year end.

Hong Kong showed the first signs of recovery, and in Australia, OPSM continued to generate growing comparable store sales due to the assortment changes and distribution policies implemented in the first half of the year.

Latin America

Latin America’s positive trend continued in the third quarter with sales up by 6.9 percent. The Group is growing by double digits in Mexico and reinforces its market share in the Brazilian market, where it maintains a positive performance at constant exchange rates in the first nine months, although the prolonged recession in the country is partially reflected in the quarter.

The Retail segment recorded strong progress in sales of GMO, especially in Chile, Peru and Colombia, as well as Sunglass Hut in Mexico and the Andean region.