Lululemon Athletica Inc., which has tied part of its growth to flowing new product through its stores more frequently, expects growing delays at West Coast ports to shave $10 million from its fourth quarter sales.

Lululemon Athletica Inc., which has tied part of its growth to flowing new product through its stores more frequently, expects growing delays at West Coast ports to shave $10 million from its fourth quarter sales.

“With the slowdown at the West Coast ports and [units] still on the water, we are actively implementing a number of strategies to mitigate the delivery issues,” said LULU CEO Laurent Potdevin. “We have been experiencing delays of 7 to 10 days, and on that basis we estimate that this can impact our fourth quarter and year end revenue guidance by approximately $10 million.”

CFO John Currie said LULU has rerouted shipments scheduled to land later this month to its home town of Vancouver, BC. From there, LULU will ship the products by rail. While rail deliveries can take up to three days longer than truck, the arrangement should speed up U.S. deliveries and mitigate the impact of a West Coast lock out of, or strike by, dockworkers who operate 27 ports along the U.S. West Coast.

“We have about a 1 million units that are stuck at the ports right now,” Currie said.

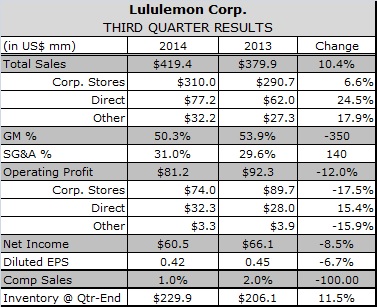

Lululemon reported net revenue increased $39.5 million, or 10.4 percent to $419.4 million in the third quarter ended Nov. 2 compared with the year earlier quarter. Nearly half, or $19.3 million of the increase, came from 42 new stores added since the third quarter of 2013, while the rest came from online sales.

In currency-neutral (c-n) terms, a 27 percent increase in Direct (online) sales and a 3 percent decline in same-store sales resulted in a blended comp store increase of 3 percent. Traffic built as the quarter wore on, but conversion and units per transaction fell. Foreign currency exchange rates erased about $7.5 million, or 1.8 percent, of revenue gains during the quarter.

Direct sales reached 18.4 percent of total revenues, up 210 basis points from the third quarter of fiscal 2013. Mobile devices accounted for a quarter of “e-commerce activity,” while the company’s first mobile app accounted for 8 percent of online sales. Since opening a new distribution center in Columbus, OH, average transit times for online orders has fallen 46 percent to just under two days.

Sales of Men’s products increased 11 percent, while sales at its Ivivva banner, which is aimed at girls, rose 37 percent and passed $1,000 per square foot. New store productivity remains between $1,100 and $1,200 in sales per square foot.

Gross profit for the quarter increased 3 percent to $211.1 million, or 50.3 percent of net revenue, down 360 basis points from 53.9 percent in the third quarter of fiscal 2013. Leading causes of the decline were: higher spending on product development and supply chain functions, 150 bps; lower product margin, 90 bps; deleverage from occupancy and depreciation, 80 bps; foreign exchange impact due to the weakening of the Canadian and Australian dollar, 40 bps.

SG&A expense increased 15.7 percent to reach 30.9 percent of net revenue, an increase of 130 bps compared with the third quarter of 2013. Operating income decreased 12 percent to $81.2 million, or 19.4 percent of net revenue, down from 24.3 percent in the third quarter of fiscal 2013.

Diluted earnings per share for the quarter were $0.42 on net income of $60.5 million, compared to diluted earnings per share of $0.45 on net income of $66.1 million in the third quarter of fiscal 2013.

LULU lowered its revenue guidance for the fiscal fourth quarter by $15 million to $570-$585 million due to the combined impact of West Coast port delays, a decline in the value of the Canadian and Australian dollars and delayed store openings.

The forecast assumes a total comparable sales increase in the low single digits – including positive bricks-and-mortar comps – on a constant dollar basis. Gross margin is expected to be between 51-52 percent, which would mark a decline from 53.9 percent from the fourth quarter of 2013 and 55.4 percent in the fourth quarter of 2012. LULU’s long-term goal is to restore gross margins to the 55 percent.

Diluted earnings per share are expected to be in the range of 65-69 cents for the quarter. For the full fiscal 2014, net revenue is expected to reach $1.77-$1.78 billion based on a total comparable sales increase in the low single digits on a constant dollar basis.