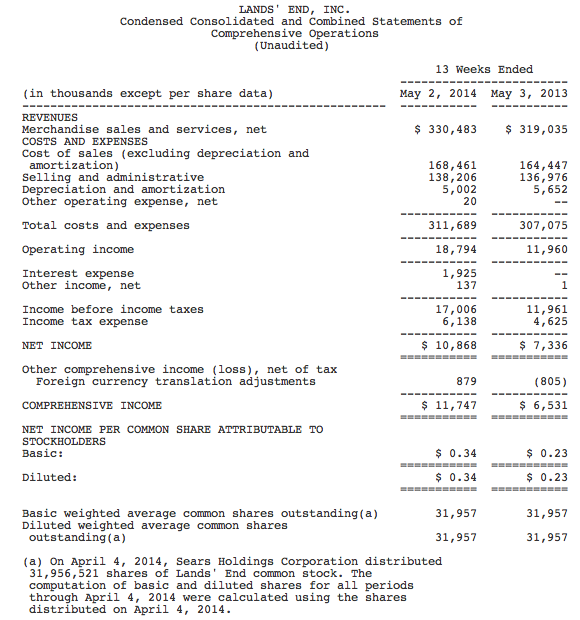

Lands' End, which was recently spunoff from Sears Holdings, reported net income increased 48.1 percent in the first quarter on a 3.6 percent revenue gain.

First Quarter Highlights:

— The Lands' End separation from Sears Holdings Corporation was completed

on April 4, 2014.

— Merchandise sales and services, net increased 3.6 percent to $330.5 million from

the first quarter last year. This was comprised of an increase in the

Direct segment of 4.8 percent to $276.0 million and a decrease in the Retail

segment of 2.3 percent to $54.4 million; same store sales increased 3.4 percent.

— Gross margin increased approximately 60 basis points to 49.0 percent from the

first quarter last year.

— Selling and administrative expenses increased 0.9 percent to $138.2 million and

included approximately $1.0 million of stand-alone public company related

costs as compared to the first quarter last year. As a percentage of

Merchandise sales and services, net, Selling and administrative expenses

decreased 110 basis points to 41.8 percent compared to the first quarter last

year.

— Operating income increased 57.1 percent to $18.8 million compared to $12.0

million last year.

— Net income increased 48.1 percent to $10.9 million compared to $7.3 million last

year.

— Diluted earnings per share increased 48.1 percent to $0.34 from $0.23 last year.

— Adjusted EBITDA1 increased 35.2 percent to $23.8 million compared to $17.6

million last year.

Edgar Huber, Lands' End's President and Chief Executive Officer, stated, “We are very pleased with our first quarter results and our progress towards growing the business and building Lands' End into a global lifestyle brand. We are encouraged by the positive customer response to our merchandising and marketing strategies and remain focused on improving the contemporary relevance of the Lands' End brand. Despite a very challenging retail apparel environment, we drove strong earnings growth through an improved merchandise assortment architecture, more targeted promotions, improved inventory management and continued expense controls. In the first quarter, merchandise sales and services revenue increased 3.6 percent to $330.5 million while gross margin improved approximately 60 basis points to 49.0 percent and operating income increased 57.1 percent to $18.8 million. We are excited to be operating, once again, as an independent public company and believe we are well positioned to execute against our strategic initiatives to drive sales and earnings growth.”

First Quarter Results

Merchandise sales and services, net increased 3.6 percent to $330.5 million in the first quarter of 2014 from $319.0 million in the first quarter of 2013. Merchandise sales and services, net in the Direct segment increased 4.8 percent to $276.0 million and was driven by growth in the U.S. consumer business. Merchandise sales and services, net in the Retail segment decreased 2.3 percent to $54.4 million driven by a decrease in the number of Lands' End Shops at Sears and a decrease in Shop Your Way redemption credits resulting from the commercial agreements entered into with Sears Holdings Corporation and its subsidiaries as part of the Company's separation, partially offset by an increase in same store sales. Same store sales in the Retail segment increased 3.4 percent, driven by higher sales in the Company's Lands' End Shops at Sears. On May 2, 2014, the Company operated 251 Lands' End Shops at Sears and 14 independent Inlet stores.

Gross margin increased 4.8 percent to $162.0 million and increased approximately 60 basis points to 49.0 percent in the first quarter of 2014 compared to the first quarter of 2013. The increase in Gross margin was driven primarily by an increase in Gross margin in the Direct segment, which improved 160 basis points to 49.6 percent, and was fueled by significantly higher Gross margin in the U.S. consumer business attributable to improved merchandise assortment architecture and more targeted promotions. Gross margin in the Retail segment decreased approximately 450 basis points to 46.1 percent driven primarily by lower gross margins associated with an increased mix of clearance units and by incremental net costs associated with the Shop Your Way program.

Selling and administrative expenses increased 0.9 percent to $138.2 million in the first quarter of 2014 compared to the first quarter of 2013 primarily due to approximately $1.0 million of stand-alone public company related expenses. As a percentage of Merchandise sales and services, net, Selling and administrative expenses decreased 110 basis points to 41.8 percent.

Depreciation and amortization expense decreased 11.5 percent to $5.0 million in the first quarter of 2014 from $5.7 million in the first quarter of 2013 primarily attributable to an increase in fully depreciated assets.

As a result of the above factors, Operating income in the first quarter of 2014 increased 57.1 percent to $18.8 million compared to $12.0 million in the first quarter of 2013.

Interest expense was $1.9 million in the first quarter and was attributable to higher debt levels and costs related to the issuance of the term loan used to pay a $500 million dividend to a subsidiary of Sears Holdings Corporation immediately prior to the separation.

Income tax expense was $6.1 million for the first quarter of 2014 compared to $4.6 million in the first quarter of 2013. The effective tax rate was 36.1 percent in the first quarter of 2014 compared to 38.7 percent in the first quarter of 2013. The change in our effective tax rate was primarily due to decreased effective state tax rates and one-time separation related items.

Net income increased 48.1 percent to $10.9 million, or $0.34 per diluted share, in the first quarter of 2014 compared to $7.3 million, or $0.23 per diluted share, in the first quarter of 2013.

Adjusted EBITDA(1) increased 35.2 percent to $23.8 million in the first quarter of 2014 from $17.6 million in the first quarter of 2013.

Cash flow generated from operating activities was $31.4 million for the first quarter of 2014 compared to $19.5 million in the first of quarter of 2013. The increase was primarily attributable to more efficient inventory management and an increase in Net income.

Balance Sheet Highlights

Cash was $65.0 million on May 2, 2014 compared to $21.8 million on May 3, 2013. The increase in cash was driven by our retention of cash beginning with our separation April 4, 2014 from Sears Holdings Corporation, more efficient inventory management and an increase in Net income.

The Company had $160.2 million of availability under its asset-based senior secured credit facility and had long-term debt of $509.9 million as of May 2, 2014. Inventory decreased 5.4 percent to $327.0 million and Accounts receivable increased 43.1 percent to $39.8 million on May 2, 2014 from Inventory of $345.6 million and Accounts receivable of $27.8 million on May 3, 2013. The increase in Accounts receivable was primarily related to amounts owed from Sears Holdings Corporation following the separation, and the timing of sales in the Lands' End Business Outfitters business.