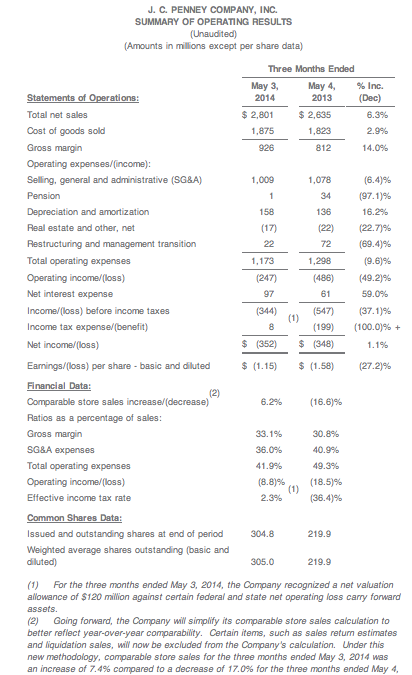

JC Penney Co. reported a loss of net loss of $352 million, or $1.15 a share, in the first quarter but it exceeded the $1.26 consensus expected by Wall Street. Same store sales increase 6.2 percent.

First Quarter Highlights:

- Same store sales increase 6.2 percent, exceeding guidance; second consecutive quarter of growth

- Gross margin improved 230 basis points from same quarter last year

- SG&A savings of $69 million; 490 basis point improvement from last year

- New upsized credit facility further strengthens Company's financial position

- Opened 30 new Sephora inside JCPenney locations, bringing total to 476

Financial Results

For the first quarter, JCPenney reported net sales of $2.80 billion compared to $2.64 billion in the first quarter of 2013. Same store sales increased 6.2 percent and improved sequentially each month within the quarter.

The Company said that, going forward, it will simplify its same store sales calculation to better reflect year-over-year comparability. Certain items, such as sales return estimates and liquidation sales, will now be excluded from the Company's same store sales calculation. Under this new methodology, comparable store sales in the first quarter rose 7.4 percent, which includes online sales that grew 25.7 percent over the same period last year. For the full year, the Company expects the new sales reporting methodology to have a 10 to 20 basis point impact.

Women's and Men's apparel, Home, and Fine Jewelry were the company's top performing merchandise divisions in the quarter. Sephora inside JCPenney also continued its strong performance. Geographically, all regions delivered sales gains over the same period last year with the best performance in the western and central regions of the country.

For the first quarter, gross margin was 33.1 percent of sales, compared to 30.8 percent in the same quarter last year, representing a 230 basis point improvement. While better than last year, gross margin was negatively impacted by an increase in clearance sales as a percentage of total sales in February and March, as well as negative clearance margins. Gross margin improved sequentially throughout the quarter, and the clearance sales mix returned to historic levels by quarter end.

SG&A expenses for the quarter were down $69 million to approximately $1.01 billion or 36.0 percent of sales, representing a 490 basis point improvement from last year. These savings were primarily driven by lower corporate support costs, advertising and improved credit income.

Operating income for the quarter was a loss of $247 million which represents a 49.2 percent improvement over last year. For the first quarter, the Company incurred a net loss of $352 million or ($1.15) per share.

Financial Position

The company also announced today that it has obtained a fully committed and underwritten $2.35 billion senior secured ABL credit facility to replace the company's existing $1.85 billion ABL bank line, which matures in April 2016. Due to favorable market conditions, the company decided to pursue this new facility proactively to extend the maturity several years and enhance its liquidity position. This financing is expected to provide better pricing terms and is expected to add $500 million of incremental liquidity during peak seasonal needs. The company expects to close the facility during the second quarter.

Mr. Ullman continued, “With a solid plan in place to complete the turnaround, we are pleased with the support of our banking partners and their confidence in our ability to succeed.”

Outlook

The company's guidance for the second quarter of 2014 is as follows:

- Comparable store sales: expected to increase mid-single digits;

- Gross margin: expected to improve sequentially versus first quarter of 2014;

- SG&A expenses: expected to be slightly below last year's levels; and

- Depreciation and amortization: expected to be approximately $155 million.

- Comparable store sales: expected to increase mid-single digits;

- Gross margin: expected to improve significantly versus 2013;

- Free cash flow: expected to be breakeven;

- Liquidity: expected to be in excess of $2 billion at year-end;

- Capital expenditures: expected to be approximately $250 million; and

- Depreciation and amortization: expected to be approximately $630 million.