Jarden Corp. reported revenues at its Outdoor Solutions (JOS) segment, which owns Coleman, K2, Marmot and 24 other sporting goods brands, grew just 1.3 percent in the third quarter ended Sept. 30, putting it on pace for flat sales this year.

Jarden Corp. reported revenues at its Outdoor Solutions (JOS) segment, which owns Coleman, K2, Marmot and 24 other sporting goods brands, grew just 1.3 percent in the third quarter ended Sept. 30, putting it on pace for flat sales this year.

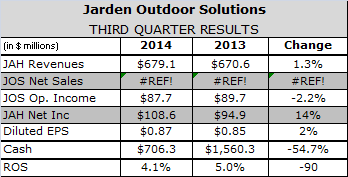

JOS sales reached $679.1 million, during the quarter, up $8.5 million from the third quarter of 2013. Organic revenue growth, which excludes the effect of currency rates, was approximately 2 percent compared with 6.4 percent companywide. JAH’s other two segments manufacture a variety of branded consumer products ranging from Crock-Pot cookers and Bicycle playing cards to First Alert carbon monoxide detectors and its recently acquired Yankee Candles brand.

Adjusted gross margin came in at 32.5 percent, an increase of approximately 15 basis points versus last year, reflecting solid performance at its sports equipment business led globally by Coleman. Segment earnings declined by $2 million, or 2.2 percent, to $87.7 million, or 12.9 percent of revenues, compared with 13.4 percent of revenue a year earlier. Segment operating earnings and margins, which include non-cash charges such as depreciation as well as restructuring and acquisition related costs, and were essentially flat at $66.4 million, or 9.8 percent.

JOS sales through the first three quarters of the fiscal year reached $2.12 billion, up just .05 percent from the same period in 2013 and well below the company’s long-standing target of 3-5 percent annual growth. While JOS sales peak in the fourth quarter, CEO Jim Lillie said he expected the slow growth to carry over into the fourth quarter as the company continues to dial in operations at a new $40 million factory in China where it has consolidated manufacturing of snowshoes, bindings, snowboards and skis. The factory began shipping product in the third quarter and is designed to enhance Jarden’s ability to flow skis to dealers within a more effective just-in-time system.

“We are really very much focused on making sure that we produce high-quality products, as opposed to just a lot of products in the hope that we can sell them,” said JAH CEO Jim Lillie. “So that will put the brakes on incremental revenue opportunities in Q4 for Outdoor solutions.”

JAH anticipates JOS sales will resume growing at 3-5 percent in 2015.

Lillie said that with oil prices and other commodities prices declining or stable, the biggest obstacle to growth for JAH’s consumer brands will come in Europe, both in the form of a more subdued consumer and currency risk. JAH expects currency exchange rates to knock $60-$90 million off its top line in the fourth quarter. Those concerns, however, did not keep JAH from declaring its fifth stock split since 2002 on Thursday. Stockholders of record at the close of business on Nov. 3 will receive one additional share of JAH common stock for every two shares of JAH common stock owned on that date. The additional shares are expected to be distributed on or about Nov. 24.

Jarden Outdoor Solutions owns one of the largest portfolios of sporting goods brands in the world, including: Abu Garcia, AeroBed, Berkley, Campingaz and Coleman, ExOfficio, Fenwick, Greys, Gulp!, Hardy, Invicta, K2, Madshus, Marker, Marmot, Mitchell, PENN, Rawlings, Ride, Sevylor, Shakespeare, Stearns, Stren, Trilene, Volkl, Worth and Zoot.