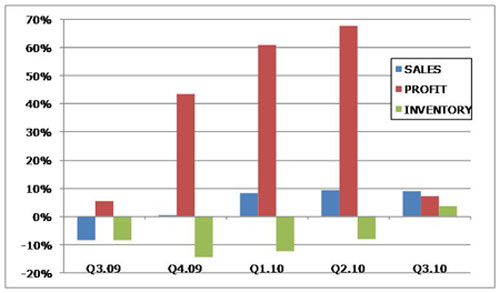

The theme for the fiscal second quarter may have been “tighten, tighten, tighten” as sporting goods industry vendors focused on bottom line growth, but the trends for the third quarter have settled into a more normalized pre-recession pattern that saw sales outpace profit gains and inventory trends moving back into growth mode.

Third quarter results shown in the charts on pages 4 and 5 are posted for those vendor companies that have reported for the period ended closest to the end of September. However, because the report is based primarily on public company filings and is not a complete picture of the entire industry, Sports Executive Weekly feels the total numbers are less significant than the trending information provided in the percentage increases and decreases.

After shaving inventories by more than 8% in the second quarter, manufacturer inventories increased in the low-single-digits for the third quarter versus the year-ago period when inventories shrunk in the high-single-digits, swinging more than 11 percentage points on a quarter-over-quarter basis. Much of the increase came from the Hardgoods sector, as vendors started to build back after the austerity programs enforced over the last year in hops that spending on discretionary items is on the upswing this holiday season.

The growing inventory levels were accompanied by more moderate bottom line growth compared to the previous three quarters. Consolidated vendor earnings climbed in the mid to high-single-digits compared to very strong double-digit growth over the last year (see graph on page 2 for quarterly comparisons). Margins improved at a slower pace, as well, expanding an average of 80 basis points on a year-over-year basis compared to an average improvement of more than 300 basis points in the second quarter.

Aggregate revenues for vendors tracked by Sports Executive Weekly were up in the high-single-digits in Q3 as only 10 of 49 reporting companies posted sales declines during the quarter compared with 37 of 48 in the year-ago period. The Hardgoods category, which saw 19 of 23 manufacturers report sales declines in the year-ago period, had 16 of the 23 companies post positive sales for the third quarter of 2010.

As Inventories Start to Build Again…

Of the Hardgoods vendors reporting sales declines, three were firearms companies confronted with insurmountable year-ago sales numbers, three were golf companies that promoted less and Yonex, a Japanese racquet sports manufacturer that saw foreign exchange fluctuations affect results.

Moreover, 24 of 48 companies reported a negative trend in their bottom line during the year-ago quarter compared to 16 companies in the third quarter of 2010, yielding an average bottom line improvement of almost 9%.

Consolidated return-on-sales (ROS) averaged 8.1% of sales for the reporting companies, slightly down from an average of 8.3% in the year-ago period.

Of the Hardgoods vendors, a generally solid quarter for revenue growth was partially offset by sharp revenue declines from a few major vendors, including gunmakers Smith & Wesson, Freedom Group (Remington) and Sturm Ruger, each of which has seen consumer demand drop substantially following a fiscal 2009 that was inflated by post-election fears of a gun crackdown.

That never happened, of course, and even after a June Supreme Court ruling (McDonald vs. Chicago) extended citizens’ second amendment rights, gun-makers have been unable to come close to replicating last year’s historic sales.

Excluding the double-digit sales drop-off for these three companies, third quarter aggregate sales growth was more than two percentage points better for the Hardgoods sector. Conversely, firearms companies (which did not include Freedom Co. in Q3 2009) boosted total revenue total by a full point and a half in the year-ago period. On the bright side, declining sales of handguns, “black guns,” and personal protection products have yielded to rebounding demand for hunting products for firearms makers.

Among the headliners for the quarter, Amer’s Winter & Outdoor sub-segment jumped double-digits in revenues and posted the highest profit for the period, while Jarden Outdoor — the second largest earner in the Hardgoods segment — posted weaker earnings but saw sales improve 6.9% on strength from its Coleman brand. Shimano, which posted the third highest profit for the quarter in Hardgoods, saw sales jump 16% and profits nearly triple on strength from its Asia business and strong demand for its bicycle components.

Sales growth looks to have been short-lived for the golf segment, which saw aggregate Q3 sales sink against to a highly-promotional year-ago period.

Golf manufacturers have drastically scaled back promotions this year as they struggle to revive their margins. Aggregate margins improved an average of 380 basis points in the third quarter. At Callaway, where third quarter sales fell 8%, management admitted they had misjudged how bad the golf market would be in the quarter and issued a somewhat tepid outlook for Q4 and the fiscal year. Acushnet continued to see its top line affected by the March 2010 divesture of its Cobra Golf brand. On the other hand, Adams Golf swung to a third quarter profit on double-digit sales growth and weak year-ago comparisons. Even as aggregate sales were down only fractionally, golf manufacturers saw their net losses widen by more than half and margins narrow by more than 220 basis points.

Similar to the front-half of 2010, the Fitness sub-segment continues to struggle on tightening consumer credit and declining health club orders. Aggregate sales for Cybex, Nautilus, and Precor improved slightly, but margins contracted more than 170 basis points while the net loss nearly doubled for the aggregate group.

For the Softgoods sector, inventories widened by a more modest 2.9%. Aggregate revenues for the Softgoods sector improved a healthy 9.6% for the third quarter, led by outstanding top-line growth from Adidas (+16.3%), Gildan (+22.3%), Skechers (+36.8%) and VF Outdoor (+14.0%), among others. Only four of the 26 companies tracked during the quarter reported a decline in revenues, compared with 18 of 26 reporting revenue declines in the year-ago period. Of the four companies reporting weaker top-line figures, three (Heelys, LaCrosse, K-Swiss) were footwear companies while the other (Quiksilver) saw softness in its juniors and footwear businesses contribute to the decline.

Profits for the Softgoods sector improved nearly 15% for the quarter on double-digit growth from the Apparel and Outdoor Footwear sub-segments.

When backing out a much deeper Q3 loss for K-Swiss, which was largely due to a one-time charge, profits for the Softgoods sector were up two full percentage points to 17.0% over the year-ago period.

Slow sales and contracting bottom lines at K-Swiss and Heelys partially offset generally robust growth throughout the Athletic Footwear sub-segment of Softgoods, which still reported 8.6% and 8.1% growth for revenues and profits, respectively. Backing out the Heelys and K-Swiss numbers improved the sub-segment’s top line by about half a percentage point and bolstered aggregate profits by full three percentage points.

For the Apparel manufacturers, which generated roughly a third of the revenue of the Softgoods sector, sales climbed more than 12% and earnings jumped 22.8% on revenue growth from all tracked companies except Quiksilver (-8.1%). Leading the way for aggregate top-line growth was Columbia (+16.0%), which benefitted from strong wholesale and direct revenue in its U.S. region; Gildan (+22.3%), which saw significant unit strength from its activewear business; and Under Armour (+21.9%), which saw its burgeoning e-commerce business supplement already-strong compression sales. Profit growth for the Apparel manufacturers was driven by the aforementioned vendors along with VF Corp, which reported double digit bottom line growth from its VF Outdoor and VF Imagewear businesses.

For the Outdoor Footwear sub-segment, 11.6% top-line growth was spurred by strength from every company except LaCrosse (-7.6%). Revenue growth was robust for the rest of the companies, with Deckers (+21.7%) and Crocs (+21.7%) providing the biggest gains. The aggregate Q3 gross margin for Outdoor Footwear improved more than 200 basis points on very healthy margins from Crocs (+440 BPS), Deckers (+425 BPS) and Timberland (+165 BPS). Earnings improved 26.9% for the sub-segment.