Iconix Brand Group, Inc. reported total revenue for the third quarter of 2014 was approximately $113.8

million, a 6 percent increase as compared to approximately $107.2

million in the third quarter of 2013.

Highlights of the quarter include:

- Record Q3 diluted non-GAAP EPS of $0.73, a 23 percent increase over prior year quarter

- Record Q3 revenue of $113.8 million, a 6 percent increase over prior year quarter

- Raising 2014 diluted non-GAAP EPS guidance to $2.72-$2.77

- Providing 2015 revenue guidance of $485-$500 million

- Providing 2015 diluted non GAAP EPS guidance of $2.90-$3.10

Q3 2014 Results for Iconix Brand Group, Inc.:

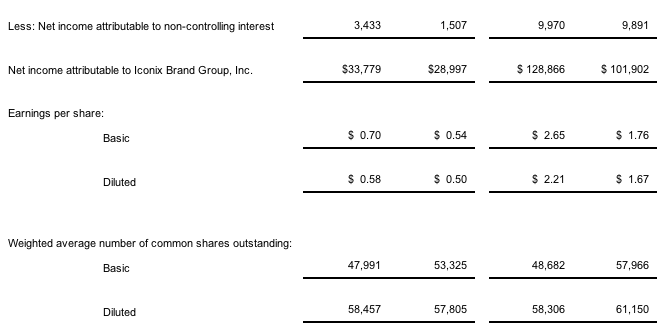

Total revenue for the third quarter of 2014 was approximately $113.8 million, a 6 percent increase as compared to approximately $107.2 million in the third quarter of 2013. On a non-GAAP basis, as described in the tables below, net income attributable to Iconix was $38.3 million, a 16 percent increase as compared to the prior year quarter of approximately $33.1 million. Non-GAAP diluted EPS for the third quarter of 2014 increased 23 percent to $0.73 compared to $0.59 in the prior year quarter. GAAP net income attributable to Iconix for the third quarter of 2014 was approximately $33.8 million, a 16 percent increase as compared to $29.0 million in the prior year quarter, and GAAP diluted EPS for the third quarter of 2014 was $0.58, a 15 percent increase compared to $0.50 in the prior year quarter. Free cash flow attributable to Iconix for the third quarter was approximately $61.8 million, a 14 percent increase as compared to the prior year quarter of approximately $54.3 million. EBITDA attributable to Iconix for the third quarter was approximately $65.5 million, as compared to approximately $65.6 million in the prior year quarter.

Nine months ended September 30, 2014:

Total revenue for the nine months ended September 30, 2014 was approximately $348.8 million, a 7 percent increase as compared to approximately $327.4 million for the prior year period. On a non-GAAP basis, as defined in the tables below, net income attributable to Iconix for the nine month period was approximately $117.2 million, a 5 percent increase as compared to approximately $112.0 million in the prior year period, and non-GAAP diluted earnings per share was approximately $2.22 for the nine month period, a 20 percent increase versus $1.85 for the prior year period. GAAP net income attributable to Iconix for the nine month period of 2014 was approximately $128.9 million, a 26 percent increase as compared to $101.9 million in the prior year period, and GAAP diluted EPS for the nine month period of 2014 increased 33 percent to $2.21 compared to $1.67 in the prior year period. Free cash flow attributable to Iconix for the nine month period was approximately $179.8 million, an 8 percent increase over the prior year period of approximately $167.0 million. EBITDA attributable to Iconix for the nine month period was approximately $213.4 million, a 5 percent increase as compared to approximately $202.8 million in the prior year period.

EBITDA, free cash flow, non-GAAP net income and non-GAAP diluted EPS are all non-GAAP metrics and reconciliation tables for each are attached to this press release.

Neil Cole, Chairman and CEO of Iconix Brand Group, Inc. commented, “Our strong third quarter and year to date results reflect the continued strength of our overall portfolio and the power of our business model. With solid brand performance domestically supported by large direct-to-retail licenses, and double digit growth around the world driven by our global brands and joint ventures, we continue to execute in line with our successful track record. As we look to 2015, we expect to continue to drive positive organic growth, and with our strong balance sheet we plan to deliver additional value as we execute on our acquisition strategy and continue to opportunistically repurchase stock.”

2014 Guidance for Iconix Brand Group, Inc.:

- Maintaining 2014 revenue guidance of $455-$465 million

- Raising 2014 non-GAAP diluted EPS guidance to $2.72-$2.77 from $2.60-$2.70

- Raising 2014 GAAP diluted EPS guidance to $2.61-$2.65 from $2.50-$2.60

- Maintaining 2014 free cash flow guidance of $215-$222 million

- This guidance relates to the company’s existing portfolio of brands and does not include any additional acquisitions.

2015 Guidance for Iconix Brand Group, Inc.:

The company is initiating the following guidance for 2015

- 2015 revenue guidance of $485-$500 million

- 2015 non-GAAP diluted EPS guidance of $2.90-$3.10

- 2015 GAAP diluted EPS guidance of $2.82-$3.00

- 2015 free cash flow guidance of $220-230 million

- This guidance relates to the company’s existing portfolio of brands and does not include any additional acquisitions.

Iconix Brand Group, Inc. owns, licenses and markets a growing portfolio of consumer brands including: Candie’s, Bongo, Badgley Mischka, Joe Boxer, Rampage, Mudd, Mossimo, London Fog, Ocean Pacific, Danskin, Rocawear, Cannon, Royal Velvet, Fieldcrest, Charisma, Starter, Waverly, Zoo York, Ed Hardy, Sharper Image, Umbro, Lee Cooper, Ecko Unltd., And Marc Ecko. In Addition, Iconix Owns Interests In The Artful Dodger, Material Girl, Peanuts, Truth Or Dare, Billionaire Boys Club, Ice Cream, Modern Amusement, Buffalo And Nick Graham brands.