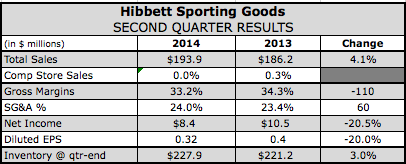

Hibbett Sports, Inc. reported net income slid 20.0 percent to $8.4 million, or 32 cents a share. Results came in at the high-end its previously projected range between 30 cents and 32 cents provided on Aug. 8. Sales increased 4.1 percent to $193.9 million. Comparable store sales were up 0.1 percent, missing plan.

Hibbett Sports, Inc. reported net income slid 20.0 percent to $8.4 million, or 32 cents a share. Results came in at the high-end its previously projected range between 30 cents and 32 cents provided on Aug. 8. Sales increased 4.1 percent to $193.9 million. Comparable store sales were up 0.1 percent, missing plan.

On the positive side, Jeff Rosenthal, president and CEO, said on a conference call with analysts, “During the back of July we saw our trend turn more positive and that has continued into the back-to-school season where we are currently running a low single-digit comp.”

On the call, Becky Jones, SVP merchandising, called branded apparel “the shining star of the quarter with strong results across all divisions.”

The women's business achieved high single-digit comps with both Nike and Under Armour “performing very well.” Men's branded apparel achieved low single-digit comps while boy's branded grew high single-digit comps. The gains were driven by shorts and tees as typical during the summer months.

The licensed apparel division “had a disappointing result,” impacted by weakness in MLB, NBA and collegiate men's. College women's apparel had “substantial double-digit growth as the customers focused on new fashion offerings.” Hibbett also continues “to have headwinds in our licensed headwear business as the consumer is shifting to branded headwear, in particular, Under Armour headwear which performed very well.”

Footwear strength came from the basketball division with high double-digit growth. Nike's signature products, including Lebron, Kobe and KD, “have been very good and Jordan footwear continues to be excellent,” said Jones.

Traditional running was soft with consumers “showing interest in lifestyle running silos instead.” Sandals was also “disappointing,” said Jones.

In equipment, the World Cup product gave the soccer category “a very nice boost. Across the board World Cup product did well and we've seen continued momentum in the soccer category. The performance in men's World Cup product bodes well for next year women's opportunity,” said Jones.

Across brands, Nike “was a clear choice in this category in apparel and cleats while Adidas World Cup ball had a very strong sell through.” Baseball and softball comped negative and the football business “tapered off slightly.”

Jones concluded, “Although our overall comp performance was disappointing we are managing inventory well and aged product is less than last year. We will continue to assess assortments in inventory as needed to ensure we drive sales in the right categories.”

Gross margins in the quarter eroded to 33.2 percent compared with 34.3 percent a year ago. The decline was partially due to markdowns related to slow selling and aged inventory. Gross profit was also impacted by store occupancy and logistics costs, as these expenses increased as a percentage of net sales due to lower than anticipated comparable store sales.

Store operating, selling and administrative expenses increased to 24.0 percent of sales from 23.4 percent, in line with its original expectations, but were higher as a percentage of net sales mainly due to lower-than-anticipated comparable store sales.

Inventories increased 3 percent over last year and were 3.3 percent lower on a per-store basis

In line with the update given on Aug. 8, Hibbett now anticipates that EPS are expected to be in the range of $2.63 to $2.73 for the full year, with comparable store sales increasing in the low single-digit range for the year.

During the quarter Hibbett expanded one high-performing store, closed five and opened 16 for a net total of 11, putting Hibbett at 950 stores at the end of quarter. Said Rosenthal, “Our new store pro forma continues to be strong and healthy and we are on pace to net around 65 new stores by the end of the year.”

Rosenthal said the chain has begun to see some of the benefits from its new warehouse, wholesale and logistics facility. He added, “It is still in the early process and the wins have been small but we are still very excited at the potential this facility will have in assisting us in getting the right product to the right stores at the right time.”

He further said that although margins were under pressure in the period, “we are still optimistic with our markdown optimization program. We are currently a little over 75 percent rolled out.”

“Long term we still have a lot to learn on how to properly use this tool,” Rosenthal added. “However, our company's aged inventory is much improved from where we were this time last year, a benefit that can be attributed to the disciplined markdown optimization that is putting in place.”

Related to its omnichannel push, the first phase investing in its IT infrastructure and upgrading its store technology and hardware – is “well underway” and expected to be completed over the next year. Hibbett is currently planning the second phase. Said Rosenthal, “This major initiative and others that we are working on gives us confidence that we are investing wisely in the long-term success of our company.”

In the Q&A session, management was asked what’s particularly causing Hibbett’s flattish comps given the gains of 7 percent at Foot Locker and 7.8 percent at Dick’s SG, excluding golf and hunting. Rosenthal said basketball is “much higher” at Foot Locker “even though our basketball business has been excellent.” Its brand business was likewise “very good” in apparel and “very comparable” to Dick’s SG.

“Where we had a little bit of a shortfall compared to them is really a little bit in our licensed area and in some of our equipment areas,” said Rosenthal. “But proportionately at Foot Locker basketball is much higher and then just the concentration of branded in our stores is not quite as concentrated as maybe a Dick's store. So those two things would probably be the biggest difference.”

Looking at potential sales drivers for the second half, Rosenthal said women’s represents “a huge opportunity both from Under Armour and Nike.” He added, “We see that becoming a more important business as we get into fall.”

He also said Hibbett still sees “basketball being a big driver as we go and then just some of the more penetration of men's branded apparel product, we think there's an opportunity there.”

Asked whether Hibbett is seeing the promotional pressures as mentioned by retailers such as Dick’s SG and other mainstream stores, Rosenthal said Hibbett hasn’t been affected.

“We are not a big promotional anyways. We really run a few promotions a year at some key periods,” said Rosenthal. “But most of the time we run promotions, or really we run it off of age of inventory, not necessarily that we are running any type of promotion. And most of our markets the things that are selling the best are selling at full price. So that's what we do.”