Hibbett Sports, Inc.'s fiscal fourth quarter results were slowed by winter storms, delays in the distribution of tax refund checks, and the hurdle of going against championship runs by the University of Alabama and the New Orleans Saints in the prior year period.

But sales have reportedly bounced back in early spring, with comps in the first quarter up 8% through last Thursday on top of a 17% gain in the comp period last year.

Fourth quarter net income increased 6.0% to $12.5 million, or 44 cents a share, coming in at the top-end of recent guidance. On Feb. 8, Hibbett cut its fourth quarter earnings guidance to a range of 42 cents to 44 cents a share after sales slowed in the latter half of January. In November, HIBB had raised guidance a range of 47 cents to 50 cents a share after a strong early start to the holiday selling season.

Sales increased 3.8% to $173.2 million, with comps ahead 1.3% and items per transaction in the quarter increasing 1.9%. By month, comparable-stores sales grew 15.0% in November and inched ahead 1.1% in December before tumbling 11.6% in January.

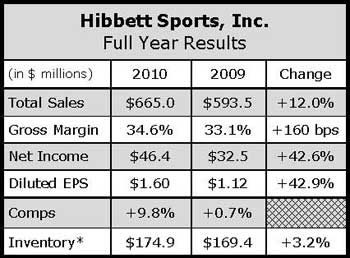

The Q4 disappointment cut into a stellar 2010 in which earnings increased 42.6%, net sales advanced 12.0% and comps grew 9.8%.

On a conference call with analysts, company President and CEO Jeff Rosenthal said January started out with positive comps until ice storms hit Georgia, Mississippi, Alabama, Texas, Arkansas, and Oklahoma. In all, 32 additional stores closed during the period because of the weather versus last year. He also said the shift in tax refund mail-outs until the first quarter particularly impacted Hibbett since the average income in its cities is around $33,000 versus a national average of around $43,000. December's moderate gain also reflected some weather constraints after Christmas as well as fewer promotions to drive footwear sales. Delayed shipments into late January or early February were also part of the January decline.

Finally, some of the softness in January as well as December reflected the weakness in licensed apparel against a particularly strong year-ago season. Excluding NFL and college licensed product, comps would have been up 4.5% in the quarter.

So far in the first quarter, however, all categories across-the-board are generating positive comps in all regions. Particularly strong has been footwear, showcasing a double-digit gain.

“Our inventory and aged inventory and assortments are in great shape and we look forward in having a great year again this year,” said Rosenthal.

In the quarter, activewear apparel was the strongest performing department, with comps up in the mid-20%, said Becky Jones, Hibbett's SVP, merchandise and marketing, on the call. All genders generated double-digit increases. “Our fleece programs were driven by The North Face and Under Armour, and the Nike Dri-FIT performance product was also quite strong,” she added.

Hibbett's licensed apparel was down double-digits. Auburn national championship product delivered half the volume of Alabama did in 2009 although management said smarter buys allowed HIBB to achieve a higher sell-through rate than a year ago with Alabama merchandise. The NFL business was off last year due to the weakness of the Saints and Cowboys specifically. NBA continued to be strong in the quarter, and MLB accessories also grew with the Fighting Tornado necklaces being particularly hot.

Footwear had low-single-digit negative comps in the quarter as lifestyle urban products underperformed due to the shift of rapid tax refund checks. Items showing strength were Nike Air Force 1, Air Max, LTDs and Command. The running category continues to be good across all genders, with standout performances by Reebok Zig, Nike LunarGlide, Nike Shox, and Nike Max+ 2010. The casual business “saw nice growth” with Polo and Timberland leading the way, added Rosenthal. Toning saw double-digit increases for the quarter and the kids’ basketball was up in double-digit comps, led by Reebok, Adidas, and Nike.

In equipment, football was up double-digit in comps; basketball, high-single-digit comps; and soccer, double-digit comps. As expected, fitness did not perform given the lack of “As Seen on TV” items. Overall top performing suppliers in equipment were McDavid, Shock Doctor and Nike. The accessory business was up low-20% comps for the quarter. Said Jones, “We continue to see consistent performance in socks. And sunglass programs continue to show strength and are a growth opportunity.”

Looking ahead, Jones said Hibbett expects to see its activewear business “being very strong,” especially in women's and kids’; while running footwear “continues to be big across-the-board” due the lightweight trend. Both footwear and activewear are also benefiting from improved allocation.

Gross profit rate in the quarter increased 70 basis points on top of 140 basis point improvement in the previous year. SG&A was down 110 basis points as sales were less than planned in the quarter, but still grew less on a per store basis than it did in the previous three quarters.

For the current year, Hibbett issued its earnings guidance for Fiscal 2012 with a range of $1.70 to $1.90 per share and an increase in comparable store sales in the low to mid single digit range. That compares with $1.60 in 2010. It expects to open 50 to 55 new stores in 2011, close 10 to 15, and expand approximately 15 high-performing stores. In 2009, it opened 45, closed 14 and expanded 14.

Asked about inflation, Hibbett said it has seen only minimal price increases in footwear so far.

“We don't really think it is incredibly impactful,” said Jones. “If you take a footwear piece that was $88 last year and maybe a new model would come out around $92, it is not that big of a shift for the consumer that is looking about for that product, because it is all about what is the right item.”