HanesBrands reported net sales increased 13 percent in the second quarter, to $1.52 billion in the quarter ended

July 4, while adjusted operating profit excluding actions

increased 15 percent to $265 million and adjusted EPS excluding actions

increased 16 percent to 50 cents a share.

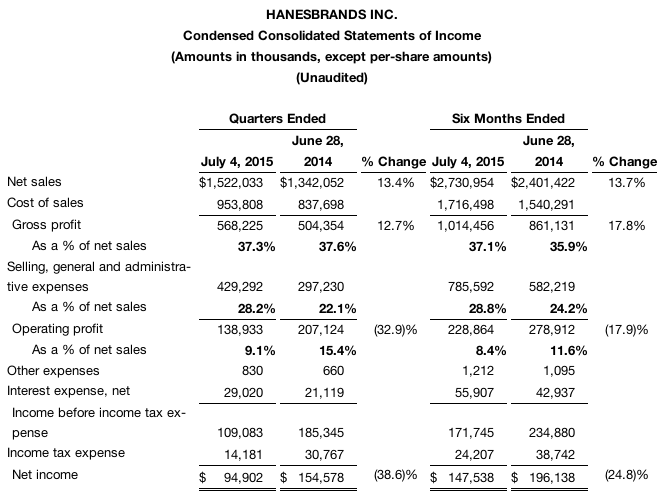

Results were driven by continued acquisition benefits, global supply chain performance and margin expansion. Net sales increased 13 percent to $1.52 billion in the quarter ended July 4, 2015, while adjusted operating profit excluding actions increased 15 percent to $265 million and adjusted EPS excluding actions increased 16 percent to $0.50.

On a GAAP basis, operating profit decreased 33 percent to $139 million and EPS decreased 39 percent to $0.23.

All adjusted consolidated measures and comparisons exclude approximately $126 million and $24 million of pretax charges related to acquisitions and other actions in the second quarters of 2015 and 2014. See GAAP reconciliation section below for additional details.

Net sales in the quarter, excluding foreign currency fluctuations and the acquisitions of DBApparel and Knights Apparel, increased 1 percent. The company drove significant margin expansion in its Innerwear and Activewear segments.

“We continue to deliver double-digit growth in adjusted operating profit and EPS as expected, and we are tracking to our full-year profit expectations,” Hanes Chairman and CEO Richard A. Noll said. “The integrations of our DBApparel and Knights Apparel acquisitions are proceeding on plan and we continue to reap benefits from the past acquisitions of Gear for Sports and Maidenform. Our brand innovation platforms and global supply chain performance continue to drive margin improvement.”

For 2015, Hanes has updated its full-year guidance for net sales. The company now expects full-year net sales of slightly less than $5.9 billion, with adjusted operating profit of $855 million to $875 million, and a continued projection of adjusted EPS of $1.61 to $1.66.

The company’s 2015 guidance represents growth over 2014 results of nearly 11 percent for net sales, 12 percent to 15 percent for adjusted operating profit, and 13 percent to 17 percent for adjusted EPS.

Second-Quarter 2015 Financial Highlights and Business Segment Summary

Key accomplishments for the second quarter of 2015 include:

- Sales growth was driven by Activewear and acquisitions of DBApparel and Knights Apparel. Activewear net sales increased 19 percent in the second quarter, driven by high-single-digit growth of Champion, as well as $37 million in net sales from Knights Apparel– a licensed apparel leader that was acquired April 6, 2015. In the International segment, DBApparel, a leading marketer of intimate apparel and underwear in Europe that was acquired August 29, 2014, contributed net sales of $149 million (€134 million) in the second quarter.

- Significant adjusted operating profit and margin growth was noted. The company’s adjusted operating profit margin increased 20 basis points in the second quarter to 17.4 percent. Innerwear and Activewear operating profit margins increased 190 basis points and 130 basis points. Contributors included strong supply chain performance, Innovate-to-Elevate benefits, and performance associated with the previous acquisitions of Gear for Sports and Maidenform.

- Acquisition integrations are set to proceed on plan. The DBApparel integration planning continues to progress on schedule with implementation to begin in the fourth quarter, subject to pending consultations with appropriate works councils and unions. Four of the five works council consultations have been completed. The integration plan for Knights Apparel has been designed and communicated to employees, with implementation beginning late in the fourth quarter of 2015.

Key segment highlights include:

- Innerwear net sales decreased 1 percent in the second quarter, while operating profit increased 7 percent. Sales of basics, including underwear and socks, increased while intimate apparel sales decreased. The consumer sales environment remains uneven.

- Activewear net sales increased 19 percent and operating profit increased 30 percent, each led by Champion, Gear for Sports and the acquisition of Knights Apparel. The company has announced it will integrate Gear for Sports and Knights Apparel businesses into a combined Licensed Sports Apparel commercial business in the Activewear segment, to take advantage of complementary expertise in brand building, marketing, graphic design, licensing relationships, supply chain and retailer relationships across channels.

- International sales and operating profit increased significantly as a result of the acquisition of DBApparel in Europe and strong results in Japan. DBApparel outperformed company expectations in the first half and is expected to outperform initial full-year expectations.

2015 Financial Guidance

For 2015, Hanes updated its full-year guidance for net sales and adjusted operating profit. The company now expects full-year net sales for 2015 of slightly less than $5.9 billion, compared with a previous guidance range issued with first-quarter results of $5.9 billion to $5.95 billion.

The company expects adjusted operating profit of $855 million to $875 million, up $2 million on the low end and high end of the range versus previous guidance, and continues to expect adjusted EPS of $1.61 to $1.66.

The guidance reflects expectations for Knights Apparel and increased profit expectations for DBApparel. Knights Apparel is expected to contribute net sales of approximately $160 million and adjusted operating profit of approximately $18 million. DBApparel is expected to contribute approximately €630 million in net sales and approximately €40 million in adjusted operating profit, up from previous expectations of approximately €30 million in adjusted operating profit.

The company expects net cash from operating activities to total approximately $550 million. Interest expense and other expense are expected to be approximately $100 million combined. The 2015 full-year tax rate is expected to be approximately 13 percent, similar to 2014. The tax rate is expected to vary by quarter with the rate being higher in the first half of the year.

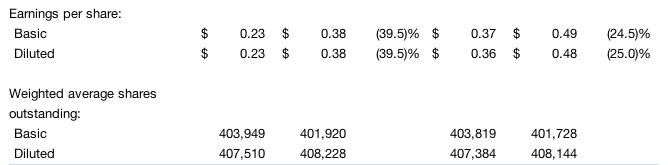

The company made a 2015 pension contribution of $100 million. Capital expenditures are expected to be approximately $95 million. The company expects approximately 408 million weighted-average fully-diluted shares outstanding in 2015.