HanesBrands, the parent of Champion, Hanes, and Gear for Sports, said that for the first-quarter 2014, net sales increased 12

percent to $1.06 billion, adjusted operating profit excluding actions

increased 34 percent to $114 million, and adjusted EPS excluding actions

increased 49 percent to 76 cents a share.

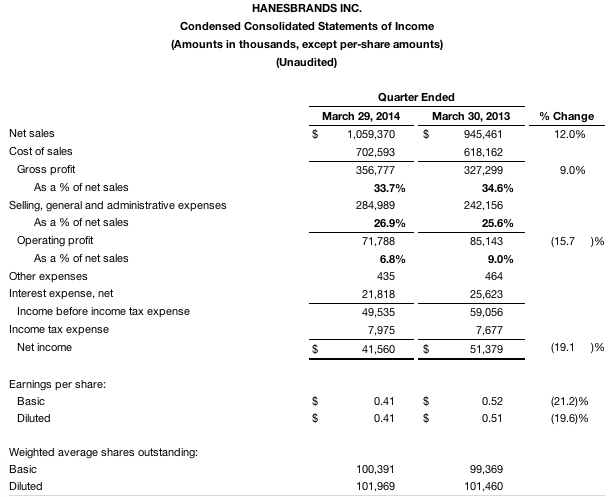

Unless noted, all consolidated measures and comparisons in this news release are adjusted to exclude first-quarter 2014 pretax charges of $43 million related to the acquisition of Maidenform Brands, Inc., and other actions. On a GAAP basis, operating profit decreased 16 percent to $72 million and EPS declined 20 percent to 41 cents a share.

Primary contributors to the record quarterly results in a difficult economic environment were increased margins driven by the company’s Innovate-to-Elevate strategy, strong Activewear segment results led by performance of the Champion brand, increased supply chain operating efficiencies, tight control of selling, general and administrative costs, and successful integration of Maidenform Brands, Inc., which was acquired in October 2013.

As a result of strong first-quarter 2014 results, the company has raised its 2014 full-year financial guidance. Increased expectations include adjusted operating profit of $665 million to $685 million, up $25 million; adjusted EPS of $4.80 to $5.00, up $0.20; and net cash from operating activities of $475 million to $575 million, up $25 million. The company continues to expect net sales for the year of slightly less than $5.1 billion.

“We had very strong first-quarter profitability and have raised our full-year profit guidance as a result of our continued confidence in our Innovate-to-Elevate strategy and our progress with the integration of Maidenform,” Hanes Chairman and Chief Executive Officer Richard A. Noll said. “Our Activewear segment achieved outstanding results across channels, particularly with our Champion brand at retail.”

Net sales in the first quarter of $1.06 billion increased by $114 million compared with the year-ago quarter as a result of the acquisition of Maidenform and Activewear segment growth. Excluding the Maidenform acquisition, net sales on a constant currency basis were flat despite the difficult retail environment exacerbated by extreme weather.

Adjusted EPS for the quarter increased to $0.76 from $0.51 in 2013. On a GAAP basis, diluted EPS was $0.41 in the quarter versus $0.51 a year ago.

Adjusted operating profit for the quarter increased to $114 million, compared with $85 million a year ago. On a GAAP basis, operating profit for the quarter was $72 million versus $85 million a year ago.

First-Quarter 2014 Financial Highlights and Business Segment Summary

Key accomplishments for the first quarter include:

Innovate-to-Elevate Drives Margin Improvement. Hanes’ Innovate-to-Elevate strategy, which harnesses synergies from combining the company’s brand power, supply chain leverage, and product innovation platforms, drove adjusted gross margin improvement of 50 basis points and adjusted operating margin improvement of 180 basis points in the first quarter. The company’s adjusted operating profit margin of 10.8 percent was a first-quarter record.

SG&A Leverage. Despite adding the acquired Maidenform operations, Hanes’ adjusted selling, general and administrative expenses increased by only $15 million in the quarter versus a year ago. As a percentage of sales, Hanes improved its adjusted SG&A leverage by 130 basis points 24.3 percent in the quarter versus 25.6 percent a year ago.

Maidenform Integration Milestones Achieved. The integration of Maidenform is progressing on schedule. All Maidenform financial reporting, forecasting, ordering, inventory, purchasing and direct-to-consumer operations moved onto Hanes’ financial and operating systems in the first quarter.

Momentum Drives Guidance for a Record Year. Hanes has increased its full-year 2014 adjusted EPS guidance for the second time. “We set a company record for earnings last year, and our guidance calls for another record earnings year in 2014,” said Richard D. Moss, Hanes chief financial officer. “The midpoint of our EPS guidance represents 25 percent growth over 2013 adjusted EPS, which was up 49 percent over 2012.”

Key business highlights include:

Innerwear Segment. Innerwear net sales increased 15 percent in the first quarter, with all of the growth a result of the Maidenform acquisition. Operating profit increased 7 percent. Excluding Maidenform, net sales decreased 6 percent, while operating profit increased 1 percent.

Retail Environment. Sales in the quarter were affected by a mixed retail environment disrupted frequently by extreme weather, as well as the timing of the Easter holiday selling period, which occurs in the second quarter of 2014 versus the first quarter in 2013. Innerwear basics, including socks and panties, performed better than intimate apparel, which is more sensitive to the timing of Easter.

Profit Increase. Despite a difficult selling environment, operating profit increased, both including and excluding Maidenform results. Innovate-to-Elevate, including product innovation platforms, is driving success.

Activewear Segment. The Activewear segment continued to deliver strong performance with net sales increasing 10 percent in the first quarter and operating profit increasing 50 percent.

Strong Profitability. Just two years after recording a loss in the first quarter, the Activewear segment posted record first-quarter profits. The segment’s operating profit margin in the quarter increased 290 basis points to 10.9 percent. The retail Champion business led the way with strong double-digit sales and operating profit growth.

Strength Across Businesses. In addition to retail Champion, the branded printwear and Gear for Sports businesses also delivered strong quarters of sales and profit growth. Branded printwear, which now focuses on higher-value branded products for the screen-print industry, turned itself around from an operating loss in the year-ago quarter.

International Segment. Currency had a significant impact on International net sales and profits. On a constant-currency basis, International net sales increased 19 percent in the first quarter and operating profit increased 300 percent. Maidenform contributed to both sales and operating profit. As reported, International net sales increased 9 percent and operating profit more than tripled.

Direct to Consumer Segment. Net sales for the Direct to Consumer segment increased 4.5 percent, driven by the addition of Maidenform, and recorded a slight operating loss.

Maidenform Acquisition. Maidenform contributed net sales of approximately $125 million in the quarter.

Acquisition synergies. Hanes expects to achieve full synergies from the Maidenform acquisition within three years. After full synergies, the acquisition is expected to annually contribute more than $500 million in net sales and $80 million in operating profit.

Synergies are expected from selling, general and administrative savings as a result of the elimination of duplicative corporate and operational costs; cost-of-goods-sold savings as a result of the integration of Maidenform’s 100 percent sourced production model into Hanes’ predominately self-owned manufacturing operations; and complementary revenue, driven by the application of Hanes’ Innovate-to-Elevate strategy to Maidenform’s products.

The majority of the corporate SG&A savings are anticipated to begin by mid-2014. Benefits of supply chain actions to cost of goods sold are expected to start in 2015 and be fully realized in 2016. Complementary revenue opportunities are expected to deliver benefits in late 2015, with the majority of the benefits coming in 2016.

Integration progressing on schedule. Hanes expects to substantially complete its integration of Maidenform headquarter business functions by the end of the second quarter 2014. All Maidenform financial reporting and business operations have moved onto Hanes’ financial and operating systems. The company anticipates closing the Maidenform Fayetteville, N.C., distribution center by the end of 2014.

2014 Guidance

Based on first-quarter results, Hanes has significantly increased its profit outlook for 2014 and has increased its guidance for adjusted operating profit, adjusted EPS and net cash from operating activities.

For 2014, Hanes expects net sales of slightly less than $5.1 billion; adjusted operating profit excluding actions of $665 million to $685 million; adjusted EPS excluding actions of $4.80 to $5.00; and net cash from operating activities of $475 million to $575 million. Previous guidance, issued in January 2014, was for adjusted operating profit of $640 million to $660 million; adjusted EPS of $4.60 to $4.80; and net cash from operating activities of $450 million to $550 million. Sales guidance is unchanged.

The company expects its acquisition of Maidenform to contribute approximately $500 million in sales and approximately $30 million of operating profit in 2014.

Interest expense and other expense are expected to be approximately $85 million combined. Inherent in the company’s guidance is a full-year tax rate in the low teens. As is typical, Hanes expects its tax rate will fluctuate by quarter, with the rate being slightly higher in the first half of the year.

The company expects to make pension contributions of approximately $60 million and net capital expenditures of approximately $60 million to $70 million.

The company expects slightly more than 103 million weighted average shares outstanding in 2014.