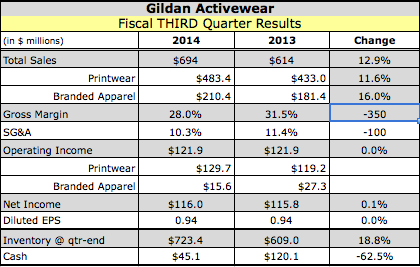

Gildan Activewear reported healthy double-digit gains in both its Printwear and Branded Apparel segments in the third quarter ended July 6. But its bottom line was impacted by transitional manufacturing inefficiencies and capacity constraints to fully service sales demand in its branded apparel. Sales reached $693.8 million, representing a gain of 12.9 percent. The company had projected net sales for the quarter to be close to $700 million. Sales in its Printwear segment jumped 11.6 percent to $483.4 million. Sales of Branded Apparel leapt 16.0 percent to $210.4 million.

Gildan Activewear reported healthy double-digit gains in both its Printwear and Branded Apparel segments in the third quarter ended July 6. But its bottom line was impacted by transitional manufacturing inefficiencies and capacity constraints to fully service sales demand in its branded apparel. Sales reached $693.8 million, representing a gain of 12.9 percent. The company had projected net sales for the quarter to be close to $700 million. Sales in its Printwear segment jumped 11.6 percent to $483.4 million. Sales of Branded Apparel leapt 16.0 percent to $210.4 million.

Earnings were basically flat at $116.0 million, or 94 cents a share, compared with $115.8 million, or 94 cents, a year ago. Before reflecting restructuring and acquisition-related costs, adjusted net earnings were $116.6 million, or 95 cents per share, most recent EPS guidance.

On a conference call with analysts, Gildan officials said the positive EPS impact of higher sales was offset by the approximate 17 cents per share impact of manufacturing inefficiencies and inflationary cost increases and the approximate 10 cents per share impact of higher cotton costs compared to last year.

The company said it is making manufacturing investments to enhance product capabilities and expand production capacity in its sock and textile operations and is training sewing operators to support growth in Branded Apparel sales revenues and brand penetration. The ramp up resulted in transitional manufacturing inefficiencies and production constraints which prevented it from fully capitalizing on sales opportunities in Branded Apparel in the third quarter.

“Our brands continue to achieve market penetration in retail in spite of production constraints which limited our ability to maximize our sales growth opportunities,” said Laurence Sellyn, EVP, CFO and CAO.

Consolidated gross margins eroded to 28.0 percent from 31.5, largely due to the transitional manufacturing inefficiencies, which included the unanticipated impact of product rework and repackaging costs to service key retail programs and mitigate the impact of capacity constraints. Higher cotton costs and other inflationary cost increases were only partially passed through into higher net selling prices in Printwear. Selling prices for Branded Apparel were not increased.

As a percent of sales, SG&A declined to 10.3 percent from 11.4 percent a year ago, reflecting the benefit of volume leverage in Branded Apparel.

The 11.6 percent gain in the Printwear segment a was primarily attributable to increased unit sales volumes, combined with higher net selling prices, including the non-recurrence of a distributor inventory devaluation discount in the prior year’s quarter and more favorable activewear product-mix. Gildan said inventory levels in the distributor channel at the end of the quarter continued to be in good balance relative to projected industry demand. Sales to international markets in Europe and Asia-Pacific increased by over 40 percent, partially offset by lower shipments to Mexico compared to last year.

Printwear’s operating income reached $129.7 million, up 8.8 percent. Operating margins improved to 26.8 percent compared with 27.5 percent as higher net selling prices and more favorable product-mix were more than offset by higher cotton costs and other inflationary cost increases.

The 16.0 percent increase in Branded Apparel included the initial stocking of the Gildan national mass-market underwear program. But growth was seen in all categories, including activewear, underwear and socks. Strong growth was achieved for both the Gildan and Gold Toe brands and brand extensions, as well as for licensed brands. Shipments to global lifestyle brands also increased as many of those programs were ramped up.

On the call, Sellyn said the success of its initial Gildan, Gildan Platinum and Gildan Smart Basics branded programs is continuing to result in new branded program, increase shelf space and better placement. Gold Toe men socks continue to add to its leading market share, helping support extensions in particular G by Gold Toe into other markets and other product categories. Its new Mossy Oak underwear brand will be expanded to more product categories in 2015 with the brand “continuing to generate high interest in multiple channels of distribution.”

Branded Apparel’s operating income fell 42.9 percent to $15.6 million. Operating margins eroded to 7.4 percent versus 15.0 percent a year ago. Transitional manufacturing inefficiencies to support the introduction of new retail products and new retail programs and inflationary cost increases negatively impacted margins by approximately 700 basis points. Higher cotton costs were also not passed through into higher selling prices in order to drive its brand penetration and market share growth.

Inventories were maintained at the same level as the end of the second quarter, as increases in raw material and work in progress inventories to support sales growth in the fourth quarter and fiscal 2015 were offset by a seasonal decrease in finished goods inventories.

The company is projecting sales revenues for fiscal 2014 to be slightly in excess of $2.4 billion, including the acquisition of Doris Inc., which the company completed on July 7. Sales revenues for Printwear are projected to be slightly in excess of $1.55 billion, up 5.5 percent. Sales for Branded Apparel are projected to be $850 million, up 19 percent. The projected sales contribution of $20 million in the fourth quarter of fiscal 2014 from the acquisition of Doris is expected to be offset by the impact of sales lost due to production constraints, primarily in the third quarter.

Adjusted EPS for the year are now projected to be in the range of $3.00-$3.03 compared to the company's previous adjusted EPS guidance range of $3.00-$3.10 due to the projected dilutive earnings impact of approximately 2 cents a share per share from the acquisition of Doris due to a non-recurring acquisition-related inventory charge, continuing manufacturing inefficiencies and slightly more unfavorable product-mix.

For the fourth quarter, revenues are projected to be in excess of $700 million, up more than 11.8 percent. The company is projecting adjusted EPS for the fourth fiscal quarter of $1.06-$1.09, up 27.7 percent to 31.3 percent compared with adjusted EPS of 83 cents in the fourth quarter of fiscal 2013.