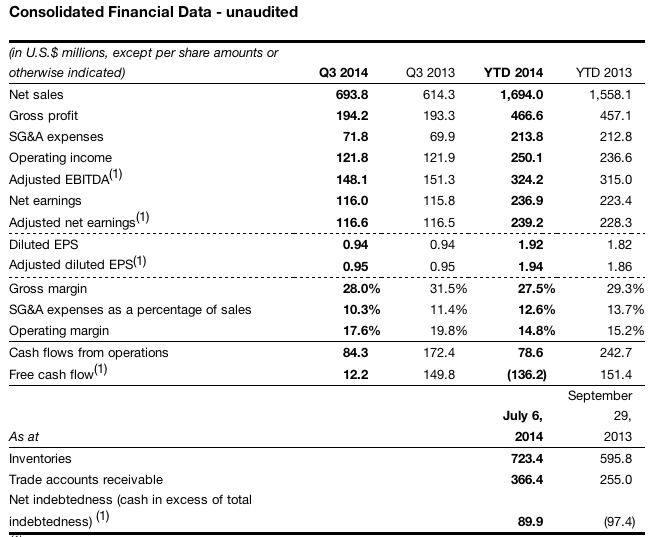

Gildan Activewear reported sales in the third quarter amounted to $693.8 million, up 12.9

percent from $614.3 million in the third quarter of fiscal 2013. The

company had projected net sales for the quarter to be close to $700

million. Net earnings were basically flat at $116.0

million, or 94 cents per share, compared with net

earnings of $115.8 million, or 94 cents, for the third quarter of

fiscal 2013. Gildan said quarterly results were impacted by transitional manufacturing inefficiencies and capacity constraints to fully service sales demand in its branded apparel.

Before reflecting restructuring and acquisition-related

costs, adjusted net earnings were $116.6 million, or 95 cents per share, in the latest period. Adjusted

net earnings were unchanged compared to the third quarter of fiscal

2013 and were as projected in the company's most recent EPS guidance.

The third quarter of fiscal 2014 included an extra week which occurs

every sixth year in order to realign the company's 52-week fiscal year

with the calendar year. The benefit of the extra week was moderated as

it included the extended July 4th holiday.

The positive EPS impact of higher sales was offset by the approximate 17 cents per share impact of manufacturing inefficiencies and inflationary cost increases and the approximate 10 cents per share impact of higher cotton costs compared to last year. The company is making manufacturing investments to enhance product capabilities and expand production capacity in its sock and textile operations and is training sewing operators to support the rapid growth in Branded Apparel sales revenues and brand penetration. As a result, the company is incurring transitional manufacturing inefficiencies and experiencing production constraints which prevented it from fully capitalizing on sales opportunities in Branded Apparel in the third quarter.

The growth in sales in the third quarter reflected double-digit sales increases in both operating segments in spite of uncertain economic and market conditions and constraints in production capacity in Branded Apparel. The increase in consolidated net sales for the third quarter of fiscal 2014 compared to the third quarter of fiscal 2013 was due to unit volume growth in both the North American and international printwear markets, higher Printwear net selling prices and more favourable activewear product-mix, together with continued strong momentum in consumer demand for Gildan® and Gold Toe® branded products, increased shipments to global lifestyle brands and higher licensed brand sales. The Gildan® brand was in the no. 3 position in men's underwear in the June quarter, with a market share of 6.5 percent, according to the NPD Group/Total Market Data report. The company is currently doubling its underwear capacity to support its planned growth in fiscal 2015.

Consolidated gross margins in the third quarter were 28.0 percent compared to 31.5 percent in the third quarter of last year, largely due to the transitional manufacturing inefficiencies in Branded Apparel which also included the unanticipated impact of product rework and repackaging costs to service key retail programs and mitigate the impact of capacity constraints. Gross margins were also negatively impacted by higher cotton costs and other inflationary cost increases compared to last year. The impact of higher cotton costs was only partially passed through into higher net selling prices in Printwear and selling prices for Branded Apparel were not increased.

SG&A expenses in the third quarter were $71.8 million, compared with $69.9 million in the third quarter of last year. The slight increase in SG&A expenses was primarily due to higher volume-driven distribution expenses, partially offset by lower variable compensation expenses and the favourable impact of the weaker Canadian dollar on corporate head office expenses. As a percentage of sales, SG&A expenses declined to 10.3 percent from 11.4 percent a year ago, reflecting the benefit of volume leverage in Branded Apparel.

During the third quarter of fiscal 2014, the company generated $12.2 million of free cash flow, after financing capital expenditures of $75.5 million and an increase in accounts receivable. Inventories were maintained at the same level as the end of the second quarter, as increases in raw material and work in progress inventories to support sales growth in the fourth quarter and fiscal 2015 were offset by a seasonal decrease in finished goods inventories. The company ended the third quarter with cash and cash equivalents of $45.1 million and outstanding bank indebtedness of $135.0 million.

Third Quarter Segmented Results

Net sales for the Printwear segment amounted to $483.4 million, up 11.6 percent from $433.0 million in the third quarter of fiscal 2013. The increase in Printwear net sales was primarily attributable to increased unit sales volumes, combined with higher net selling prices, including the non-recurrence of a distributor inventory devaluation discount in the third quarter of fiscal 2013 and more favourable activewear product-mix. Inventory levels in the distributor channel at the end of the third quarter continued to be in good balance relative to projected industry demand. Sales to international markets in Europe and Asia-Pacific increased by over 40 percent, partially offset by lower shipments to Mexico compared to last year.

Net sales for Branded Apparel were $210.4 million, up 16.0 percent from $181.4 million in the third quarter of last year. Sales in the third quarter of fiscal 2013 included the initial stocking of the Gildan® national mass-market underwear program. Higher Branded Apparel segment net sales reflected sales growth in all product categories, including activewear, underwear and socks, as the company continued to build its brands and gain market share. Strong growth was achieved in sales for both the Gildan® and Gold Toe® brands and brand extensions, as well as for licensed brands. Shipments to global lifestyle brands also increased compared to the third quarter of last year, as the company ramped up new programs.

In the third quarter, the Printwear segment reported operating income of $129.7 million, up 8.8 percent from $119.2 million in the third quarter of fiscal 2013. Operating margins for Printwear were 26.8 percent compared with 27.5 percent in the third quarter of last year as higher net selling prices and more favourable product-mix were more than offset by higher cotton costs and other inflationary cost increases. The Branded Apparel segment reported operating income of $15.6 million, compared to $27.3 million in the third quarter of fiscal 2013. Operating margins were 7.4 percent versus 15.0 percent a year ago. The decline in operating margins for Branded Apparel was primarily attributable to transitional manufacturing inefficiencies to support the introduction of new retail products and new retail programs and inflationary cost increases, which negatively impacted margins by approximately 700 basis points, together with the impact of higher cotton costs, which the company has not passed through into higher selling prices in Branded Apparel in order to drive its brand penetration and market share growth. These factors more than offset the continuing positive impact on operating margins of increased sales volume leverage on SG&A expenses.

Year-to-date Sales and Earnings

Net sales revenue for the first nine months of fiscal 2014 amounted to $1.7 billion, up 8.7 percent from $1.6 billion in the same period last year. The increase in consolidated net sales was mainly due to higher unit sales volumes in both operating segments, more favourable Printwear product-mix and higher net selling prices for Printwear.

Net earnings for the first nine months of fiscal 2014 were $236.9 million, or $1.92 per share on a diluted basis, compared to $223.4 million, or $1.82 per share, up 6.0 percent and 5.5 percent respectively compared to the first nine months of fiscal 2013. Before reflecting after-tax restructuring and acquisition-related costs in both years, adjusted net earnings were $239.2 million or $1.94 per share in the first nine months of fiscal 2014, up 4.8 percent and 4.3 percent respectively compared to adjusted net earnings of $228.3 million or $1.86 per share in the same period last year. The increase in net earnings was mainly due to the increased sales in Printwear and Branded Apparel and lower financial expenses, partially offset by higher cotton costs, the transitional manufacturing costs to upgrade the company's manufacturing operations and support future growth, and higher income tax expense.

Outlook

The company is projecting sales revenues for fiscal 2014 to be slightly in excess of $2.4 billion, including the acquisition of Doris Inc., which the company completed on July 7, 2014. Sales revenues for Printwear are projected to be slightly in excess of $1.55 billion, up approximately 5.5 percent compared with fiscal 2013. Sales revenues for Branded Apparel for fiscal 2014 are projected to be approximately $850 million, up approximately 19 percent compared with fiscal 2013. The projected sales contribution of $20 million in the fourth quarter of fiscal 2014 from the acquisition of Doris is expected to be offset by the impact of sales lost due to production constraints, primarily in the third quarter.

Adjusted EPS for the full year are now projected to be in the range of $3.00-$3.03 compared to the company's previous adjusted EPS guidance range of $3.00-$3.10 due to the projected dilutive earnings impact of approximately $0.02 per share from the acquisition of Doris due to a non-recurring acquisition-related inventory charge, continuing manufacturing inefficiencies and slightly more unfavourable product-mix.

Net sales revenues in the fourth quarter of fiscal 2014 are projected to be in excess of $700 million, up more than 11.8 percent compared with $626.2 million in the fourth quarter of last year. The company is projecting adjusted EPS for the fourth fiscal quarter of $1.06-$1.09, up 27.7 percent-31.3 percent compared with adjusted EPS of $0.83 in the fourth quarter of fiscal 2013. Sales and EPS for the fourth quarter are expected to be a record for any fiscal quarter in the company's history. The projected increase in EPS in the fourth quarter compared with the fourth quarter of last year reflects higher unit sales volumes, higher Printwear net selling prices and more favourable product-mix. In spite of continuing transitional manufacturing inefficiencies and inflationary cost increases, manufacturing costs are forecast to be favourable compared to the fourth quarter of last year. Cotton costs in the fourth quarter of fiscal 2014 are expected to be comparable to cotton costs in the fourth quarter of last year. Cotton costs in the first half of fiscal 2015 are expected to be higher than the fourth quarter of fiscal 2014. Cotton costs in the second half of fiscal 2015 are expected to be lower than the first half of the year and lower than the second half of fiscal 2014.

The company still expects that capital expenditures will be at the high end of its previous range of $300-$350 million. The company today announced plans for the construction of a new textile facility in the Rio Nance complex in Honduras to bridge capacity requirements until the start of the planned facility in Costa Rica. The new Rio Nance facility will support planned sales growth for higher-valued products, and optimize manufacturing efficiencies at the company's other textile facilities. Development of the site for this facility is already underway and the facility is expected to begin production in time to support the company's sales growth in fiscal 2016. The company intends to proceed with its plans of a new textile facility in Costa Rica which is expected to begin production in fiscal 2017. The company is projecting that its overall textile capacity will increase by approximately 40 percent when production at the new Honduras facility and the company's planned facility in Costa Rica are fully ramped up, compared with the capacity exit rate at the end of fiscal 2014.

The company now projects that free cash flow for fiscal 2014 will be below $50 million as a result of higher inventories to support the company's sales growth and the timing of receivables which are impacted by the higher proportion of fleece shipments in the fourth quarter of the fiscal year.

Declaration of Quarterly Dividend

The Board of Directors has declared a cash dividend of $0.108 per share, payable on September 8, 2014 to shareholders of record on August 14, 2014. This dividend is an “eligible dividend” for the purposes of the Income Tax Act (Canada) and any other applicable provincial legislation pertaining to eligible dividends.

Disclosure of Outstanding Share Data

As of July 29, 2014, there were 122,270,641 common shares issued and outstanding along with 1,129,751 stock options and 499,686 dilutive restricted share units (Treasury RSUs) outstanding. Each stock option entitles the holder to purchase one common share at the end of the vesting period at a pre-determined option price. Each Treasury RSU entitles the holder to receive one common share from treasury at the end of the vesting period, without any monetary consideration being paid to the company. However, the vesting of at least 50 percent of each Treasury RSU grant is contingent on the achievement of performance conditions that are primarily based on the company's average return on assets performance for the period as compared to the S&P/TSX Capped Consumer Discretionary Index, excluding income trusts, or as determined by the Board of Directors.