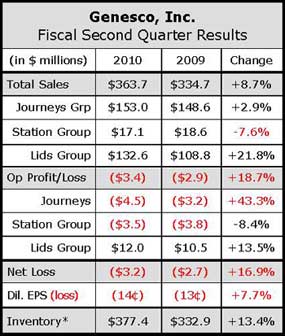

Genesco, Inc., as expected, reported its losses from continuing operations slightly narrowed to $2.4 million, or 10 cents a share, in the second-quarter, hurt by sluggish sales at its Journeys' chain and a slew of non-recurring charges.

On the brighter side, comps were up 8% for August, which should bode well for back-to-school results and the third quarter. Genesco also indicated that it had acquired Anaconda Sports, one of the larger team dealers in the Northeast.

The loss in the latest quarter reflected pretax charges of $3.2 million, or 8 cents a share, primarily related to fixed asset impairments, purchase price accounting adjustments, a loss related to a flood and acquisition expenses. The year-ago loss of $2.7 million, or 12 cents per share, came after pretax charges of $3.3 million, or 10 cents a share, primarily related to fixed asset impairments. Excluding special items in both periods, losses slightly grew to $500,000, or 2 cents a share, from $400,000, also 2 cents a share, in the year-ago period.

Overall sales jumped 8.7% to $363.7 million, with comps up 3%.

The top-performing division was Lids Sports Group, which saw total sales climb 21.8% for the period. Comps grew 7% in the second quarter and advanced 13% in August.

“The hat business continues to benefit from continued industry consolidation, positive product trends and our continued rollout of embroidery,” said Bob Dennis, chairman, president and CEO, on a conference call with analysts. He added that the Lids chain received “a nice little pop” from the Blackhawks winning the Stanley Cup while its early read on this year's NFL hats “is positive.”

Regarding growth prospects for Lids Sports, Lids still has room to add 200 more hat stores beyond the current 800, and also to expand embroidery well beyond its current penetration of about 500 stores. The Lids Locker Room concept, which focuses on sports licensed apparel, has the potential to grow to at least 300 to 400 stores.

That business was formed with the November 2009 acquisition of Sports Fan-Attic and will be complemented by the pending acquisition of Sports Avenue. Dennis was particularly enthused that the Sports Avenue acquisition will include the licensed fan shops of the Yankees, Cardinals, Dodgers and Cubs as well as a dozen team specific websites.

Lids.com, which has primarily been a headwear site, will now be adding a full range of licensed merchandise.

Lids.com, which has primarily been a headwear site, will now be adding a full range of licensed merchandise.

The Lids Team Sports segment, which is the company’s team dealer division, acquired Anaconda Sports during the quarter. Along with the purchase of Brand Innovators on the West Coast, Genesco now has a sales presence in 43 states and the potential to reach 49 states.

“While the overall business is not yet contributing economically the way we ultimately envision, we continue to make progress in streamlining the operations,” said Dennis. “Once we complete the realignment of these businesses, we feel there is very good upside potential for a major national player in this space. These two acquisitions solidify our position as the number two team dealer in the United States and provide a solid infrastructure on which to build a truly distinctive business.”

Journeys' comps grew 2% in the quarter and 7% in August. While athletics was slightly down in the quarter, casual delivered a strong increase, highlighting a fashion shift, which Dennis said is “squarely in Journeys' sweet spot” and sets them apart from their other mall competitors.

The skate category also again performed well.”To paraphrase Mark Twain, we believe the death of skate has been greatly exaggerated, at least in the case of Journeys,” said Dennis.

For BTS, Journeys plans to be “a bit more promotional this year to create demand and provide a greater sense of value.” The Journeys concept is also expanding into Canada and sees room for 80 to 120 stores there. Journeys Kidz's comps grew 4% in the quarter and 10% in August. Shi by Journeys’ comps were up 8% in the quarter and 3% in August.

Among its other divisions, Underground Station remains cash positive although its comps were down 4% in the quarter and “the demographic it serves continues to be under a great deal of pressure from the economy,” said Dennis. Johnston & Murphy's comps were flat for the quarter, but fewer markdowns and less promotional activity led to a “nice improvement” in gross margin and in operating income. Overall direct sales were off 3% in the quarter, but climbed 14% in August.

Genesco reaffirmed guidance for the year, calling for EPS between $2.10 to $2.20 a share. The guidance assumes comps in the low-single-digits for the second half. Dennis said that despite the strong August comps, GCO is not raising its sales guidance because of the uncertain economy.