Genesco Inc. reported first-quarter earnings on an adjusted basis slid 13.3 percent and came in 10 cents lower than Wall Street's consensus estimate. But the company reaffirmed its guidance for the full year.

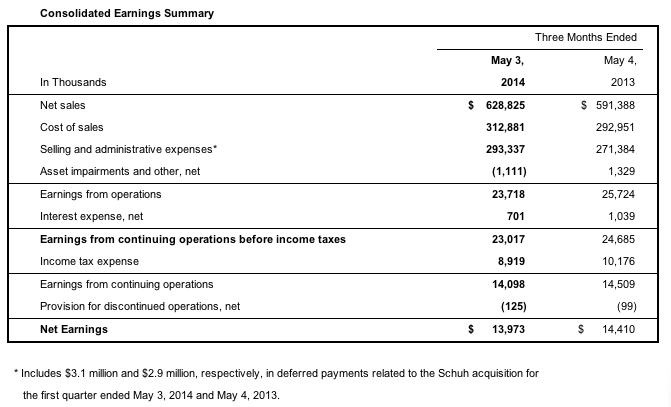

Earnings from continuing operations for the first quarter ended May 3, 2014, reached $14.1 million, or 60 cents per share, compared to earnings from continuing operations of $14.5 million, or 61 cents, a year ago.

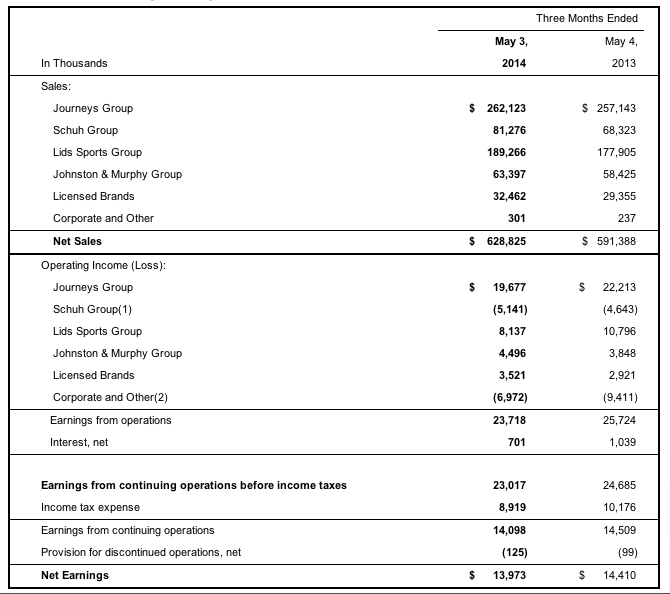

Fiscal 2015 first quarter results reflect expenses of $7.7 million, or 21 cents per diluted share after tax, including $5.7 million related to a change in accounting for bonus awards; $3.1 million related to deferred purchase price payments in connection with the acquisition of Schuh Group Limited; and $2.0 million in network intrusion expenses, asset impairment charges and other legal matters, offset by a $3.1 million gain on a lease termination. Fiscal 2014 first quarter results reflected expenses of $10.7 million, or 33 cents per diluted share after tax, including $6.5 million associated with a change in accounting for bonus awards, $2.9 million related to deferred purchase price payments in connection with the acquisition of Schuh Group Limited, and $1.3 million for impairment charges and network intrusion expenses.

Adjusted for the items described above in both periods, earnings from continuing operations were $19.3 million, or 81 cents per diluted share, for the first quarter of Fiscal 2015, compared to earnings from continuing operations of $22.2 million, or 94 cents. Wall Street's consensus estimate had been 91 cents a share.

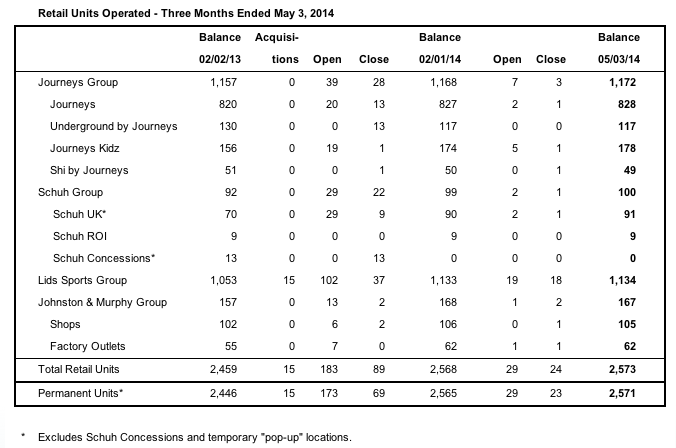

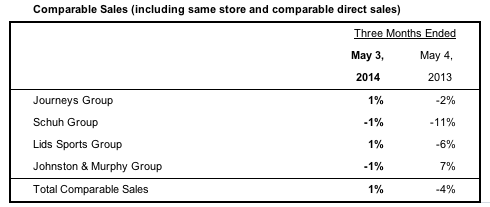

Net sales for the first quarter of Fiscal 2015 increased 6.3 percent to $629 million from $591 million in the first quarter of Fiscal 2014. Consolidated first quarter 2015 comparable sales, including same store sales and comparable e-commerce and catalog sales, increased 1 percent, with a 1 percent increase in the Journeys Group, a 1 percent increase in the Lids Sports Group, a 1 percent decrease in the Schuh Group, and a 1 percent decrease in the Johnston & Murphy Group.

Robert J. Dennis, chairman, president and chief executive officer of Genesco, said, “We are pleased with our performance given the choppy retail environment, combined with the lack of a meaningful, new fashion driver in the teen footwear space early in the year. We continue to expect stronger comparable sales gains and improved profitability as we move into the back half of the year.

“The second quarter is off to a solid start with comparable sales up 3 percent through May 24. We are encouraged by the recent pace of business and optimistic that we can build on our current momentum.

“Based on first quarter performance and current visibility, we remain comfortable with our previously announced guidance for adjusted Fiscal 2015 diluted earnings per share in the range of $5.40 to $5.55, a 6 percent to 9 percent increase over Fiscal 2014's adjusted earnings per share of $5.09. Consistent with our previous guidance, these expectations do not include non-cash asset impairments and other charges, partially offset by a gain on a lease termination in the first quarter this year, which we estimate will be in the range of $2.6 million to $3.1 million pretax, or $0.07 to $0.08 per share, after tax, in Fiscal 2015.

“They also do not reflect compensation expense associated with the Schuh deferred purchase price as described above, which is currently estimated at approximately $7.2 million, or $0.30 per diluted share, for the full year. This guidance assumes a comparable sales increase in the low single digit range for the full fiscal year.”