Garmin lifted its guidance for the year after reporting third-quarter results that smashed Wall Street’s targets.

Highlights for the third quarter of 2019 include:

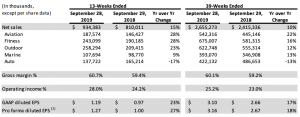

- Revenue of $934 million, a 15 percent increase over the prior year quarter, with aviation, fitness,

outdoor and marine collectively increasing 24 percent over the prior year quarter - Gross margin of 60.7 percent compared to 59.4 percent in the prior year quarter

- Operating margin of 28.0 percent compared to 24.2 percent in the prior year quarter

- Operating income of $261 million, increasing 33 percent over the prior year quarter

- GAAP diluted EPS was $1.19 and pro forma diluted EPS(1) was $1.27, increasing 27 percent over the

prior year quarter - Launched a sweeping update to our consumer wearables including the vÍvoactive® 4 series, the

vÍvomove® 3 series, and the all-new VenuTM smartwatch - Launched the fēnix®6 series of adventure smartwatches which includes our first wearable

featuring solar technology - Named Manufacturer of the Year by the National Marine Electronics Association for the fifth

consecutive year - Since its launch in 2011, Garmin inReach® has provided remote communication and rescue

facilitation in over 4,000 SOS incidents, demonstrating the crucial importance of satellite based

two-way messaging wherever our customers need assistance - Unveiled the Autoland system for general aviation, designed to safely land the aircraft in the

event of an emergency

Adjusted earnings $1.27 a share easily topped analysts’ consensus target of 94 cents. Sales of $934 million were ahead of analysts’ consensus target of $864 million.

“We delivered another quarter of strong growth thanks to our lineup of great products in every market segment,” said Cliff Pemble, president and chief executive officer of Garmin Ltd. “We are well positioned for the remainder of 2019 and are raising our revenue and EPS guidance to reflect our strong performance.”

“We delivered another quarter of strong growth thanks to our lineup of great products in every market segment,” said Cliff Pemble, president and chief executive officer of Garmin Ltd. “We are well positioned for the remainder of 2019 and are raising our revenue and EPS guidance to reflect our strong performance.”

Aviation:

Revenue from the aviation segment grew 28 percent in the quarter driven by growth in both OEM and aftermarket categories. Gross and operating margins were 74 percent and 35 percent, respectively, resulting in 30 percent operating income growth. Our OEM business saw strength due to increased revenue from both new and existing aircraft platforms. Aftermarket systems, including ADS-B, also contributed to our positive results as we began shipping the Citation Excel/XLS G5000® retrofit integrated cockpit system. During the quarter, the Cessna Citation Longitude, featuring our G5000 integrated flight deck, received final certification. Also during the quarter, the G1000H® NXi integrated flight deck was certified in the Bell 407GXi helicopter, representing the first IFR certification for the G1000H NXi system.

Fitness:

Revenue from the fitness segment grew 28 percent in the quarter driven by strength in wearables and contributions from Tacx. Gross and operating margins were 52 percent and 20 percent, respectively. At IFA, Europe’s leading consumer electronics trade show, we announced a sweeping update to our line of consumer wearable products including new versions of the vÍvoactive series in two sizes, the vÍvomove 3 hybrid smartwatch series, and the all new Venu smartwatch featuring a brilliant AMOLED color touchscreen display and long battery life.

Outdoor:

Revenue from the outdoor segment grew 23 percent in the quarter with growth in multiple product categories, led by strong performance in the adventure watch category. Gross and operating margins improved to 66 percent and 41 percent, respectively, resulting in strong operating income growth. At the recent Ultra-Trail du MontBlanc running event, we launched the fēnix 6 adventure watch series with larger displays, innovative performance features and Garmin’s exclusive solar harvesting technology. We also announced the addition of the MARQTM Commander to our collection of luxury tool watches.

Marine:

Revenue from the marine segment grew 9 percent in the quarter with growth across multiple product categories, led by strong performance in chartplotters. Gross and operating margins improved to 60 percent and 19 percent, respectively, resulting in strong operating income growth. During the quarter, we were named the exclusive marine electronics provider by both Regulator Marine and Sea Hunt, solidifying our leadership in the premier center console boat market. Garmin was also named Manufacturer of the Year by the National Marine Electronics Association for the fifth consecutive year, reflecting the strength of our innovative products and market position.

Auto:

The auto segment declined 17 percent in the quarter driven primarily by declines in our OEM business and the ongoing PND market contraction. Gross and operating margins improved to 48 percent and 15 percent, respectively, resulting in 39 percent operating income growth. During the quarter, we started shipping the Garmin OverlanderTM, an all-terrain GPS navigator specifically designed to fit the needs of the growing overlanding community.

Additional Financial Information:

- Total operating expenses in the quarter were $306 million, a 7 percent increase from the prior year. Research and development expenses increased 7 percent, primarily due to engineering personnel costs. Selling, general and administrative expenses increased 9 percent driven primarily by personnel related expenses and incremental costs associated with acquisitions. Advertising increased 5 percent, driven by higher spend in the outdoor and fitness segments partially offset by lower expense in the auto segment.

- The effective tax rate in the third quarter of 2019 was 11.6 percent compared to 8.5 percent in the prior year quarter. The increase in the effective tax rate is primarily due to lower income tax reserve releases than the prior year.

- In the third quarter of 2019, we generated $158 million of free cash flow. We ended the quarter with cash and marketable securities of approximately $2.5 billion.

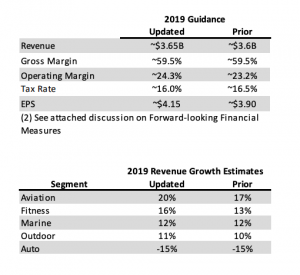

2019 Guidance (2):

We have updated 2019 guidance to reflect our strong performance. We now anticipate revenue of approximately $3.65 billion driven by higher expectations for our aviation, fitness, and outdoor segments. Our outlook for the marine and auto segments is unchanged. We anticipate our full year pro forma EPS will be approximately $4.15 based on a gross margin of approximately 59.5 percent, operating margin of approximately 24.3 percent and a full year pro forma effective tax rate of approximately 16.0 percent.