Foot Locker, Inc. (FL), the New York-based specialty athletic retailer, today reported financial results for its fourth quarter and full year ended on Feb. 1, 2014.

Fourth Quarter Results

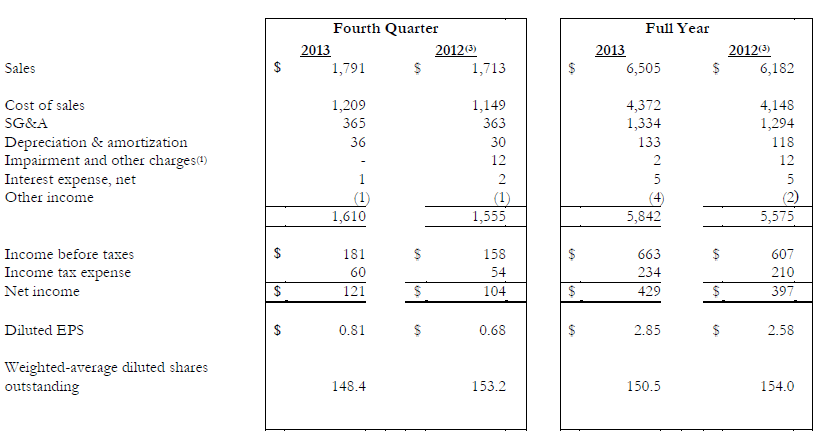

The company reported net income of $121 million, or 81 cents per share, for the 13 weeks ended Feb. 1, 2014. This represents an increase of 19 percent over earnings per share of 68 cents for the 14-week period ended February 2, 2013. On a non-GAAP basis, the company earned 82 cents per share, a 28 percent increase over the comparable 13-week non-GAAP earnings per share of 64 in 2012.

Total fourth quarter sales increased 4.6 percent, to $1.79 billion this year, compared with sales of $1.71 billion in 2012, which included $81 million of sales in the extra week last year. Fourth quarter comparable-store sales increased 5.3 percent.

Analysts on average had been expecting 75 cents a share on sales of $1.77 billion.

Fiscal Year Results

For fiscal year 2013, the company reported net income of $429 million, or $2.85 per share. In the 53-week period in 2012, the company reported net income of $397 million, or $2.58 per share. On a non-GAAP basis, earnings were $2.87 per share in 2013, an increase of 16 percent over the $2.47 per share earned on a comparable basis in 2012. In 2013 the company generated its fourth consecutive double digit percentage increase in annual earnings per share. It is also the third consecutive year in which the company achieved record earnings as Foot Locker, Inc.

Total sales increased 5.2 percent in 2013 to $6,505 million, the highest level of sales ever recorded by the company as Foot Locker, Inc., compared with sales of $6,182 million last year. Comparable-store sales increased 4.2 percent in 2013.

“The driver in achieving our best-ever financial results was the excellent execution by our team of the many initiatives we have underway,” said Ken C. Hicks, Chairman of the Board and Chief Executive Officer of Foot Locker, Inc. “I am very proud of the progress that the entire team at Foot Locker, Inc. is making towards reaching our long term goals and objectives. While we accomplished a great deal in 2013, we have many more opportunities to improve the business further. We believe these opportunities, such as the children's business, our store banner.com development, the expansion of shop-in-shops in partnership with our vendors, and the improvements we are making in our assortments, should continue to drive our performance to new heights for the next few years. Specifically for 2014, we believe we can build on our momentum and generate a mid-single digit comparable sales gain and another double digit percentage increase in earnings per share.

“Looking out longer term, we have opportunities such as our store remodel programs, expansion in Europe, technology investments, a growing team sales and services business, and our women's business that we believe will enable us to reach our long-range financial and operational objectives.”

“The team at Foot Locker, Inc. worked hard to improve our productivity measures in 2013,” added Lauren B. Peters, Executive Vice President and Chief Financial Officer. “Despite a challenging retail environment, we maintained our gross margin rate at the record high set last year, and we improved our SG&A expense rate to 20.4 percent. Our sales per gross square foot increased to $460, our EBIT margin improved to 10.4 percent, and our net income margin came in at 6.6 percent, all of which were record-best performances for our company.”

Financial Position

The company's merchandise inventory at Feb. 1, 2014 was $1,220 million, which was $53 million, or 4.5 percent, higher than at the end of last year.

At year-end 2013, the company's cash and short-term investments totaled $867 million, while the debt on its balance sheet was $139 million. During the fourth quarter of 2013, the company repurchased approximately 1.6 million shares of its common stock for $63 million. For the full year, the company repurchased 6.4 million shares for $229 million.

“Our strong financial position enabled our Board of Directors in February to authorize another double digit percentage increase in our quarterly dividend, to 22 cents per share,” said Ms. Peters. “The Board has also authorized a capital expenditure program in 2014 of $220 million, based on the successful results to date of the store remodel and other capital initiatives we have underway.”

Store Base Update

The company opened 84 new stores, remodeled or relocated 320 stores, and closed 140 stores during fiscal 2013. Including 193 Runners Point Group stores, the company operated 3,473 stores in 23 countries in North America, Europe, Australia, and New Zealand as of February 1, 2014. In addition, 46 franchised stores were operating in the Middle East and South Korea, as well as 27 franchised Runners Point and Sidestep stores in Germany and Switzerland.