Garmin Ltd. reported sales by its Fitness segment soared 79 percent in the second quarter ended June 28 as consumers snapped up its Vivofit fitness trackers as well as a new cycling computer and Forerunner smart watches. The growth more than offset disappointing sales of the company’s first action sports camera, which prompted Garmin to downgrade guidance for its Outdoor segment.

Garmin Ltd. reported sales by its Fitness segment soared 79 percent in the second quarter ended June 28 as consumers snapped up its Vivofit fitness trackers as well as a new cycling computer and Forerunner smart watches. The growth more than offset disappointing sales of the company’s first action sports camera, which prompted Garmin to downgrade guidance for its Outdoor segment.

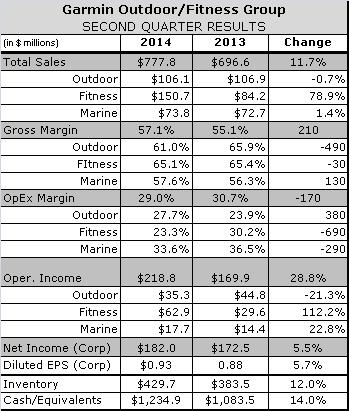

Fitness revenue grew by an astounding $67 million to $151 million in the quarter on the strength of the Vívofit, the Edge 1000 cycling computer and the Forerunner 15, 220 and 620 smart watches. Segment gross margins were steady at 65 percent compared with the second quarter of 2013, while operating margins improved 650 basis points to 41.7 percent as sales growth significantly outpaced growth in operating expenses.

While much of the growth came from sell-in rather than replenishment, GRMN President and CEO Cliff Pemble said sell-through data toward the end of the quarter was encouraging.

Revenues dipped 0.6 percent to $106 million at the Outdoor segment compared to the strong performance achieved in the second quarter of 2013. Gross and operating margins contracted compared to the prior year due primarily to inventory reserves and advertising expenses associated with the Virb action camera, which Garmin launched in the spring.

Pemble said it’s been difficult to win shelf space from Go Pro, but that could improve in the back half as the company rolls a new iteration of the product out to more of its big box and specialty accounts.

“It's a market with an entrenched competitor so definitely we view this as a marathon activity as opposed to its brand,” said Pemble, who never mentioned Go Pro by name. “We believe it will take some time focusing on both product innovation and also increasing our level of advertising promotions and in-store exposure so that we can build share over time.”

At the Marine segment, weak market conditions slowed revenue growth to 1 percent, but lower expenses and a more favorable product mix pushed up operating income 23 percent.

Consolidated net sales, including sales from the companies Aviation and Auto/Mobile segments, increased 17 percent in EMEA and APAC and 7 percent in the Americas. The strengthening recovery in Europe fueled growth at both segments during the quarter.

GRMN increased advertising spending by $5 million to 4.5 percent of sales during the quarter, up 30 basis points from the year ago quarter, to support product launches by Fitness and Outdoor. GRMN expects unit sales of activity trackers to double to 10 million in the coming year.

GRMN updated its guidance from the beginning of the year, largely on the strength of Vivofit sales. The company now anticipates revenues of $2.75-$2.85 billion, improved gross and operating margins and a lower pro forma effective tax rate. The result of these changes is a pro forma EPS range of $2.95 – $3.05.

The guidance anticipates promotional pricing for the holiday season, as well as higher marketing and advertising expense, will lower margins compared with the first half of the year. The company increased its guidance of 2014 Fitness revenue to grow by 50 percent, but lowered revenue guidance for Outdoor, where it now expects revenues to decline compared with last year.

“There'll be increased competition into the back half of the year,” said ??. “The activity tracking market in particular is very competitive so we expect existing competitors introducing products and we expect new competitors to come on the market.”