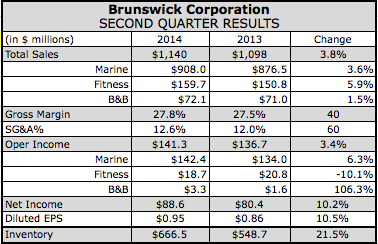

Brunswick Corporation’s second-quarter sales grew 3.8 percent in the second quarter. Earnings rose 10.2 percent to $88.6 million, or 93 cents a share, besting Wall Street’s consensus estimate of 91 cents a share. The latest quarter included 2 cents per share in restructuring, exit and impairment charges. The year-ago reflected 38 cents per share in charge, 32 cents of it tied to the early extinguishment of debt. On an adjusted basis, pretax earnings increased 8 percent. Gross margin of 27.8 percent reflected an increase of 30 basis points from the prior year. Operating expenses increased 7 percent during the quarter.

Brunswick Corporation’s second-quarter sales grew 3.8 percent in the second quarter. Earnings rose 10.2 percent to $88.6 million, or 93 cents a share, besting Wall Street’s consensus estimate of 91 cents a share. The latest quarter included 2 cents per share in restructuring, exit and impairment charges. The year-ago reflected 38 cents per share in charge, 32 cents of it tied to the early extinguishment of debt. On an adjusted basis, pretax earnings increased 8 percent. Gross margin of 27.8 percent reflected an increase of 30 basis points from the prior year. Operating expenses increased 7 percent during the quarter.

The strongest growth came in its Fitness segment, which makes Life Fitness and Hammer Strength fitness equipment. Sales in the segment increased 5.9 percent to $159.7 million. International sales, which represented 51 percent of total segment sales in the quarter, gained 3 percent. The overall increase in sales reflected growth to U.S. health clubs, as well as modest gains in international markets.

Operating profits in the Fitness segment, however, slid 10.1 percent to $18.7 million, as the benefit from higher sales was more than offset by investments in growth initiatives.

In the Marine Engine segment, consisting of the Mercury Marine Group, including the marine parts and accessories businesses, revenues advanced 3.3 percent to $652.4 million. Gains in outboard and parts and accessories offset a decline in sterndrive engines. Operating profits improved 2.6 percent to $122.5 million. Increased investments to support growth as well as the absence of favorable insurance settlements received in the second quarter of 2013 held back profit gains.

In the Boat segment, comprised of the Brunswick Boat Group, sales rose 4.2 percent to $324.1 million. Growth in outboard boats offset declines in the fiberglass sterndrive/inboard boats. Operating profits jumped 36.3 percent to $19.9 million. Restructuring charges reached $400,000 in the latest quarter against $2.5 million in the year-ago period.

Revenues in the Bowling & Billiards segment – comprised of Brunswick retail bowling centers, bowling equipment and products, and billiards tables and accessories – inched up 1.5 percent to $72.1 million. Increasing bowling products sales, as well as gains in U.S. equivalent retail center sales offset reduced retail center count and a decrease in billiards sales. Operating profits improved to $3.3 million from $1.6 million although the year-ago period included restructuring charges of $1.5 million.

With its agreement reached in mid-July to sell its bowling alleys to Retail Bowling business as well as related plans to sell its bowling products business, the Bowling & Billiards segment will be reported as discontinued operations beginning in the third quarter.

Looking ahead, Brunswick is revising its previously stated 2014 EPS guidance to $2.25 to $2.35 from a previous range of $2.40 to $2.55 to reflect the divestiture of its bowling businesses and the associated discontinued operations treatment. The company continues to expect adjusted pretax earnings growth of 24 percent to 30 percent.

“We continue to target 2014 to be another year of strong earnings growth with outstanding cash flow generation,” said CEO Dustan McCoy on a conference call with analysts. “Our plan reflects 5 percent to 6 percent sales growth, which is supported by our increased investment in new products and by the continuation of growth demonstrated in the US in the second quarter of 2014, and growth in certain international markets.”

Its Life Fitness segment is expected to see gains in the mid-single to high-single digit range for the year. New products reaching the marketplace include Insignia Strength Power Mill, Synergy Blue Sky, and Flex Strider equipment.