Fitbit Inc. reported revenue of $393 million, GAAP net loss per share of 48 cents a share, non-GAAP net loss per share of 1 cent a share, GAAP net loss of $113 million, non-GAAP net loss of $3 million, and Adjusted EBITDA of $6 million for its third quarter of 2017.

“We continue to execute on our transition plan by delivering on our financial guidance and product roadmap, positioning Fitbit on a path back to growth and profitability,” said James Park, co-founder and CEO of Fitbit. “We believe Fitbit Ionic delivers the best health and fitness experience in the category. It has received the highest customer ratings of any Fitbit product within the first month of sales, giving us confidence in our ability to capture share of the fast-growing smartwatch market. Ionic is also a platform for us to deliver our most powerful health and fitness tools into the market, furthering our mission to make the world healthier.”

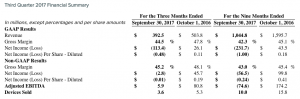

Third Quarter 2017 Financial Highlights

- U.S. revenue grew 23 percent to $244 million, EMEA revenue contracted (18 percent) to $89 million, APAC revenue grew 63 percent to $34 million, and Americas excluding U.S. revenue grew 4 percent to $25 million, all sequentially from the second quarter of 2017.

- New products introduced in the last 12 months, Fitbit Alta HR, and Fitbit Ionic represented 32 percent of revenue.Average selling price increased 4 percent sequentially from the second quarter of 2017 and 12 percent year-over-year from the third quarter of 2016 to $104.72 per device.

- Accessory and other revenue, including sales of our Fitbit Flyer headphones, added the equivalent of $3.60 per device.

- Gross margin was 44.5 percent, and non-GAAP gross margin was 45.2 percent, down 330 and 290 basis points year-over-year from the third quarter of 2016, respectively. Gross margin was impacted by two discrete items: change in warranty in some countries and change in replacement policy for legacy device.

- GAAP operating expenses declined 5 percent to $202 million and non-GAAP operating expenses declined 6 percent to $180 million, both sequentially from the second quarter of 2017.

- Tax Provision of $86 million, inclusive of a non-cash valuation allowance change. Other Current Assets increased to $96 million to reflect anticipated cash refunds related to taxes paid in prior years.

Third Quarter 2017 Business Highlights

- Sold 3.6 million devices, up 7 percent sequentially from the second quarter of 2017.

- 42 percent of the activations in the quarter came from customers who made repeat purchases. Of the repeat purchasers, 39 percent came from customers who were inactive for 90 days or greater.

- The Fitbit app was the No. 1 downloaded health and fitness application, based on U.S. downloads, on both the iOS and Android platforms.

- The Community section in the Fitbit app, which includes a Feed feature designed to increase engagement and offer users a supportive environment continued to grow. Since launching the feature in March 2017, more than 15 million users have utilized the Feed, with over 1.1 billion views of shared posts and more than 3.7 million Group joins.

- Largest distributor in the U.S. filed bankruptcy, resulting in $8 million less revenue and an increase of $8 million in bad debt expense.

Fourth Quarter 2017 Guidance

- Revenue in the range of $570 million to $600 million.

- Non-GAAP net income (loss) per share in the range of (3 cents) to 1 cent. Adjusted EBITDA in the range of ($1 million) to $18 million.

- Effective non-GAAP tax rate of approximately 44 percent.

- Stock-based compensation expense estimated in the range of $23 million to $25 million and basic share count of approximately 238 million. On a fully diluted basis, shares outstanding approximately 14 million higher.

Full Year 2017 Guidance

- Revenue guidance of $1.615 billion to $1.645 billion.

- Non-GAAP gross margin of 42.5 percent to 44 percent.

- Tightening non-GAAP net loss per share to the range of (27 cents) to (23 cents).

- Tightening non-GAAP free cash flow loss to a range of ($50) million to ($30) million.

- Effective non-GAAP tax rate of approximately 44 percent.

- Stock-based compensation expense in the range of $90 million to $100 million and basic share count of approximately 238 million.

Photo courtesy Fitbit