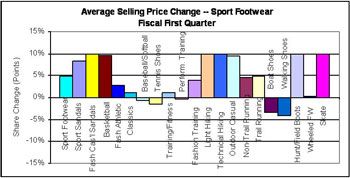

After a down period in the 2008 fourth fiscal quarter through January, Sport Footwear sales rebounded in the retail fiscal first quarter ended May 3, posting a low- to mid-single-digit increase in sales for the period. Based on retail point-of-sale data compiled by SportScanINFO, the increase came from a mid-single-digit increase in average retail selling prices for Sport Footwear, which offset a low-single-digit decline in unit sales.

It is very apparent now that the strong comps in February were an aberration and not the trend for the year. The big jump in early sales was likely a function of a confluence of events such as pent-up demand, early tax checks, and a surge in fresh products refreshing the lean inventories. March was about as expected and April came in with a low-single-digit increase. One note of concern was that there was barely a lift around the Easter/Spring Break shopping period this year.

All major retail channels of distribution tracked by SportScanINFO posted increases for the fiscal first quarter, with the exception of Sport Specialty and Mid-Tier Department Stores. The trend was best in full-line sporting goods, driven by running and team sports, while the mall and the family channels both had moderate increases.

All major retail channels of distribution tracked by SportScanINFO posted increases for the fiscal first quarter, with the exception of Sport Specialty and Mid-Tier Department Stores. The trend was best in full-line sporting goods, driven by running and team sports, while the mall and the family channels both had moderate increases.

Average selling prices were up in all channels with the exception of the Internet/Catalog channel, which posted a mid-single-digit decline in average selling prices.

“The increase in average selling prices was due in part to a shift in gender sales and a shift in product mix,” said James Hartford, chief market analyst for The SportsOneSource Group, which manages the SportScanINFO system. “Sales of womens Sport Footwear declined for the first quarter, while mens and kids both showed increases. Basketball, Running and Hunting/Field Boots all showed significant increases for the period, which helped push average selling prices higher.”

Hartford also noted that the Skate category-the fastest-growing category over the last year-also posted strong double-digit growth that was fueled in part by a low double-digit improvement in average selling prices.

Performance Footwear, which represented 24% of total Sport Footwear sales, declined in the low-single-digits while Non-Performance Footwear grew in the mid-singles-digits.

Running continued its strong trend with sales improving in the high singles. Nike running grew in the high-single-digits, as did Mizuno. Asics and Brooks both posted increases in the high teens, while Saucony was up more than 20% for the quarter. The running brands are telling Sports Executive Weekly that a key driver is the move to more fill-in business by many retailers – and not just the specialty guys. SEW is getting reports of fill-in increases of 20% to as high as 35% in the running business. Under Armour also helped boost the Running category with its entry into the business in the first quarter. UA had a low-single-digit share of the overall Running category, giving them 7th position. New Balance and Adidas running both declined for the period.

Fashion Running (65% of running sales) improved in the high-single-digits, while Performance Running grew in the low-singles.

Basketball continues to go in a number of directions. Overall Basketball sales improved in the mid-teens, but when we look deeper, some interesting patterns emerge. Fashion basketball grew more than 25%, with brand Jordan taking share from the Nike brand. Performance Basketball declined more than 20% for the quarter and sales of product over $80 improved in the low-single-digits, indicating there is still some health to the team basketball business.

Lifestyle fashion Athletic declined again in the mid-single-digits and Classics sales declined in the high-singles. Without Chuck Taylor (+50%), it would have been much worse. The only other major brand to have an increase was Nike, up in the low-single-digits

Skate remained the hot story with sales up more than a third.

Sandals posted a high-single-digit decline. Cleated footwear had a small increase, as Nike and Under Armour both took share from Adidas.

April was the first full month for the tracking of Shaping/Toning Footwear and the sales looked very encouraging.

April was the first full month for the tracking of Shaping/Toning Footwear and the sales looked very encouraging.