The Finish Line, Inc. reported that average sales price for shoes it sells grew 3.5 percent in the fiscal first quarter ended May 31, despite the growing popularity of more moderately priced sneakers such as Nike’s slip-on Roshe running shoes.

The Finish Line, Inc. reported that average sales price for shoes it sells grew 3.5 percent in the fiscal first quarter ended May 31, despite the growing popularity of more moderately priced sneakers such as Nike’s slip-on Roshe running shoes.

Executives emphasized the ASP number in response to analysts concerns that a shift from higher priced, more technical footwear toward lower priced casual athletic styles would undermine industry profits.

“I don't want you to think that there is a major slowdown in running,” Finish Line Brand President Sam Sato cautioned one analyst. “There is a shift in certain silhouettes that are moving to more casual running from a fashion perspective.

Our key platforms within running — Shox, Air Max, and Free — continue to grow. So this is about a fashion shift which has always been a part of our business since we developed the Finish Line.”

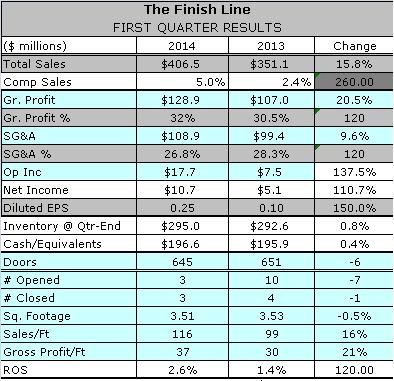

FINL reported net sales grew 15.8 percent to $406.5 million during the quarter. Comp store sales, including e-commerce sales, increased 5.0 percent. The growth reflects a 5.2 percent increase at Finish Line, where sales from a new shop-in-shop venture at Macy's exceeded expectations. Sales reached $17.3 million at Running Specialty Group (RSG), compared with $10 million in the first fiscal quarter of 2013. Excluding e-commerce sales, which grew by more than 20 percent, consolidated comp store sales were up low-single digits. Digital traffic increased in the high double-digits during the quarter, which 30 percent of the visits coming from mobile devices.

Footwear comps increased mid-single-digits with men's up mid-singles and, women's up low-singles and kid’s up low teens. The quarter marked the third consecutive quarter in which all three categories grew. FINL’s kid’s sales have comped up double-digits in each of the last three years and were boosted in the fiscal quarter by high double digit growth of more moderately priced casual athletic styles like Nike Roshe.

“We saw a clear migration from performance silhouettes to casual running styles driven by strong sales of Nikes Roshe Run in both men's and women's,” said Sam Sato, president of the Finish Line brand. “This trend had a measurable effect on our lifestyles business and overall comp performance, although it did negatively impact our running comps which were down just over 1 percent in the first quarter.”

Nike Air Force One as well as retro classics from brands like New Balance and Converse also performed well in the lifestyle footwear category.

Plenty of runway for basketball

FINL executives emphasized that sales of higher-priced performance/running and basketball shoes continued to grow thanks to strong performances from the Nike Air Max and Free, Adidas Springblade and Under Armour Speedform platforms. Basketball comps were up mid-single-digits, are still running nearly 60 percent ahead of their level three years ago and show no signs of slowing.

“We continue to see significant opportunities for expansion of this business,” said Sato.

Nike signature products from both Lebron and KD [Kevin Durant] and performance products, particularly Hyper Rev sold extremely well during the quarter. Within Brand Jordan, strong demand returned for both retro and performance products. Nike and Brand Jordan continued to drive the kid’s business with Adidas also fueling the strong top-line performance. New Balance and Under Armour also posted significant gains over the prior year as new product introductions continue to resonate well with our younger audience.

Apparel sales declined less than 1 percent, marking a big improvement over last quarter, as growth in accessories sales partially offset continued softness in apparel. Sato said sales of newly introduced leggings and tank tops for women and fleece shorts for men provided encouragement that apparel sales would improve in the back half.

Profits and liquidity up, debt and inventory down

On a consolidated basis, first-quarter adjusted net income increased 37.5 percent to $13.6 million and EPS increased 40 percent to 28 cents, compared to 20 cents in the prior year. On a GAAP basis, diluted earnings per share increased to 25 from 10 cents in the prior year.

The company approaches the back-to-school season with clean inventory. As of May 31, 2014, the company’s merchandise inventory was valued at just 0.8 percent more than a year earlier. It also closed the quarter with no interest-bearing debt and cash and cash equivalents of $196.6 million. Cash was essentially flat with a year earlier, even though the company spent $18.7 million to repurchase 700,000 shares of its common stock in the first quarter.

FINL reported consolidated gross margin decreased 40 basis points (bps) from a year earlier to 31.7 percent largely due to a 70 bps decline in merchandise margins. Consolidated SG&A expense was 26.8 percent of sales, down 80 bps from last year thanks to leverage from the comp increase, expense management and a shift of approximately $2.5 million of technology-related spending into furture quarters.

FINL reported consolidated gross margin decreased 40 basis points (bps) from a year earlier to 31.7 percent largely due to a 70 bps decline in merchandise margins. Consolidated SG&A expense was 26.8 percent of sales, down 80 bps from last year thanks to leverage from the comp increase, expense management and a shift of approximately $2.5 million of technology-related spending into furture quarters.

Macy's shop-in-shops exceeding expetations

CEO Glenn Lyon said FINL sales through Macy’s reached $43.8 million, compared with $13 million a year ago. That puts FINL’s Macy’s venture in position to generate sales at the high end of the $175-195 million range it forecast in announcing the venture more than a year ago. FINL is on pace to open and staff 400 branded footwear shops in 262 Macy’s stores by the end of October. Lyon said branded footwear sales have risen in the triple digits at Macy's stores that have been converted to the concept and that Macy's Herald Square will be the number one Finish Line in the country this year.

FINL executives think they can accelerate the growth by selling more kid’s footwear and providing macys.com customers access to FINL’s inventory in Macy’s stores. That will also improve margins by increasing turns and tempering mark downs.

“We feel we have the right staffing model in place and we have made great inroads getting the merchandise mix where the Macy's customer wants it to be, both in the stores and online,” Lyons said.

RSG's clearance activity hurt product margins

FINL attributed lower product margins primarily to RSG, which took higher markdowns to clear excess and aged inventory at an eight-store Michigan retailer it acquired during the quarter. FINL installed its own executive to run RSG in April after acquiring control of the venture from Gart Capital Partners of Denver, CO. The two companies launched the venture in 2010 to roll up independent specialty running stores. The new executive has focused on reducing SKU counts at RSG by about 25 percent to improve inventory turns. RSG comps declined in the high-single-digits during the quarter and FINL now expect its fiscal 2014 sales to come in toward the low end of its forecast.

“As you acquire these specialty guys, their inventory management is not their greatest skill,” noted Lyons. “Their connectivity to the customer is their greatest skill. So we are going to flow inventory better, turn inventory better, have deeper assortments.”

FINL affirmed its guidance for the fiscal year ending Feb. 28, 2015. It still expects Finish Line comparable store sales to be up mid single digits and earnings per share to increase in the high single to low double digit range over fiscal year 2014 non-GAAP diluted earnings per share of $1.66. Sato said he expects new versions of the Under Armour’s Speedform featuring a “very exciting visible technology platform,” to spur back-to-school sales. New colorways and materials from Nike’s Air Max and Max Knit, Adidas Springblade and Roshe will stimulate demand in the back half.