The Finish Line, Inc. lowered its guidance for the year as margin pressure led it to miss third-quarter earnings forecasts.

(FINL) today reported results for the thirteen weeks ended November 29, 2014.

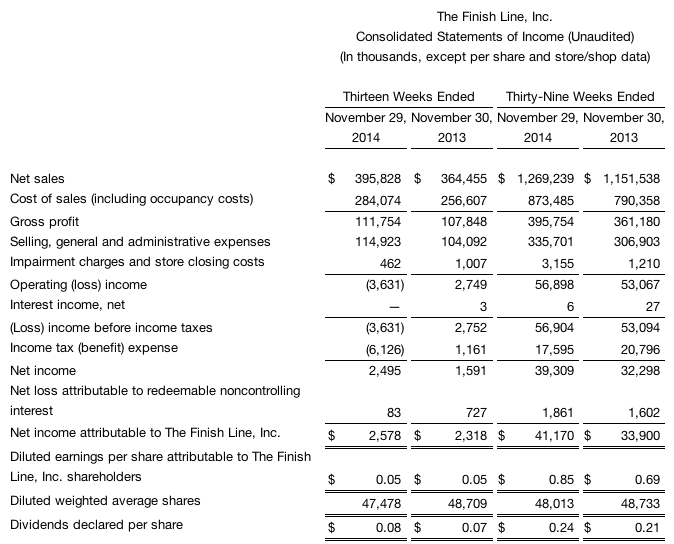

For the thirteen weeks ended November 29, 2014:

- Consolidated net sales were $395.8 million, an increase of 8.6 percent over the prior year period.

- Finish Line comparable store sales increased 4.5 percent.

- On a GAAP basis, diluted earnings per share were 5 cents.

- Non-GAAP diluted earnings per share, which excludes the impact of impairment charges and store closing costs, employee resignation costs and the recognition of a one-time tax benefit were a loss of 2 cents a share. Wall Street’s consensus estimate had been 11 cents a share.

Third quarter comparable sales rebounded from second quarter trends, however merchandise margin pressure kept us from achieving our profitability plan, said Glenn Lyon, Chairman and Chief Executive Officer of Finish Line. We remain confident in the strategic course we have set for the company and well continue to invest in the omnichannel initiatives focused on delivering the long-term financial goals we have previously outlined. That said, we are adjusting our near-term capital spending plans and creating a more flexible expense structure to protect profitability until stronger full price selling trends reemerge.

Balance Sheet

As of November 29, 2014, consolidated merchandise inventories increased 10.6 percent to $398.6 million compared to $360.5 million as of November 30, 2013.

The company repurchased 1.2 million shares of common stock during the thirteen weeks ended November 29, 2014, totaling $29.9 million. The company has 1.9 million shares remaining on its current Board authorized repurchase plan.

As of November 29, 2014, the company had no interest-bearing debt and $85.4 million in cash and cash equivalents, compared to $111.9 million as of November 30, 2013.

Outlook

For the fiscal year ending February 28, 2015, Finish Line now expects non-GAAP diluted earnings per share to be flat to fiscal year 2014 non-GAAP diluted earnings per share of $1.67. The company expects Finish Line comparable store sales to increase low to mid-single digits.

Previously, it expected Finish Line comparable store sales to be up mid single digits and earnings per share to increase in the high single to low double digit range.