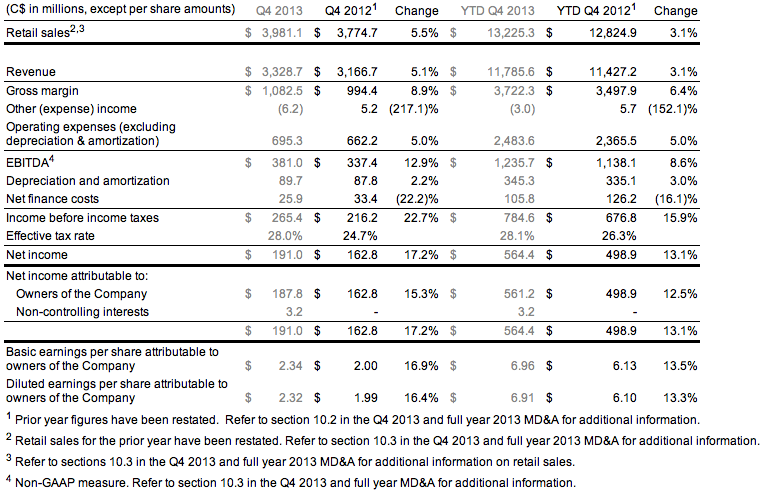

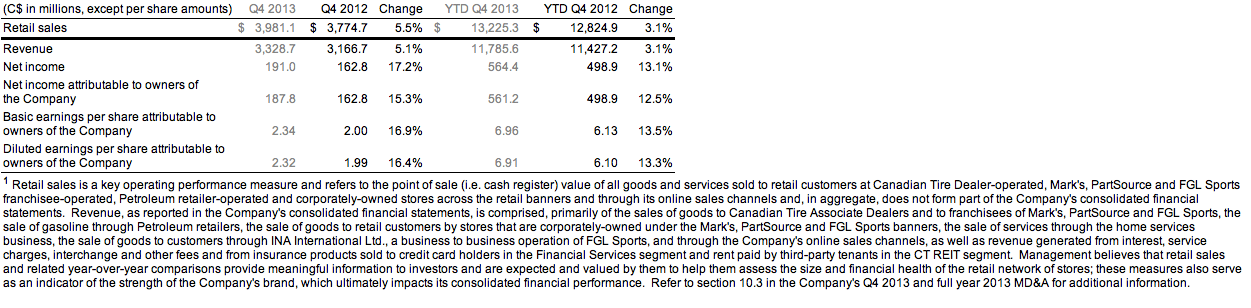

Canadian Tire Corporation, Ltd. reported consolidated retail sales in the fourth quarter increased 5.5 percent to $4.0 billion and consolidated revenue increased 5.1 percent to $3.3 billion over the same period last year.

Diluted earnings per share (EPS) attributable to owners of the company of $2.32 were up 16.4 percent in the fourth quarter compared to the same period the prior year. Normalizing for the one-time costs related to the formation of CT REIT in 2013 and for restructuring, banner rationalization, tax and tax provision adjustments in 2012, diluted EPS attributable to owners of the company were $2.35, an increase of 9.8 percent over the same period last year. The earnings growth largely reflects strong top-line revenue and gross margin contributions from both the Retail and Financial Services segments.

“The ongoing transformation of our company is resulting in significant momentum and record results for our businesses,” said Stephen Wetmore, Chief Executive Officer, Canadian Tire Corporation, Limited. “We have made significant investments to bolster key heritage categories, our team is executing very well and our marketing initiatives are strengthening our brands and having a tremendous impact with our customers. I am proud of our entire team – our corporate employees, dealers and store staff – for delivering the best fourth quarter in our history.”

FULL YEAR

Consolidated retail sales for the full year increased 3.1 percent to $13.2 billion due to sales growth from incremental promotional events and campaigns and a positive customer response to new assortments and merchandising efforts, such as the ProShop concept in Canadian Tire stores. Seasonal winter weather also helped to drive the increase in sales over 2012. Consolidated revenue increased 3.1 percent to $11.8 billion, largely a result of higher shipments to Canadian Tire stores and increased sales across all retail banners. Diluted earnings per share attributable to owners of the company for the year increased 13.3 percent to $6.91. Normalizing for the one-time costs, diluted EPS attributable to owners of the company were $7.02, an increase of 8.8 percent over the prior year's normalized earnings.

RETAIL SEGMENT

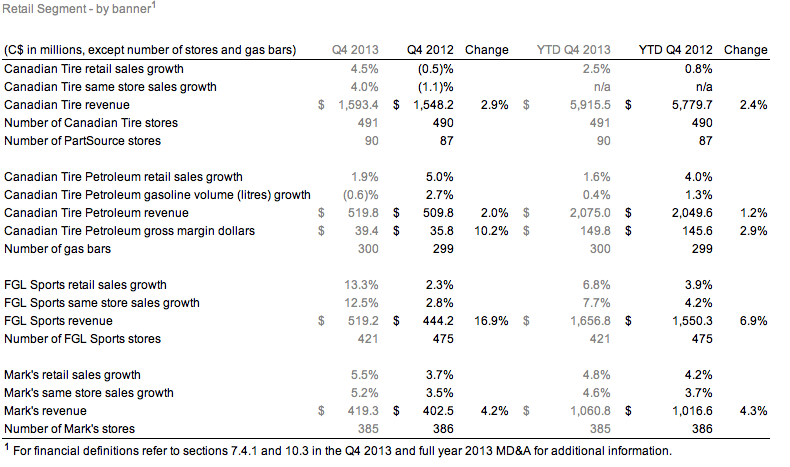

Canadian Tire retail sales increased 4.5 percent and same store sales improved 4.0 percent in the fourth quarter compared to the same period in 2012. Results for the quarter were driven by strong sales of outdoor tools, Automotive and outdoor recreation products as well as positive customer response to new promotional events and marketing initiatives. Canadian Tire saw record sales results and solid margin growth in the quarter. Seasonal weather contributed to the already strong quarter.

For the full year, Canadian Tire stores delivered retail sales growth of 2.5 percent compared to 2012 due to improvements in Automotive service performance, promotional campaigns, seasonal winter weather and enhanced Automotive, outdoor recreation and outdoor tools assortments. In 2013, Canadian Tire introduced new marketing and digital initiatives, including the 'Tested for Life in Canada' platform that solicits feedback from customers to determine the best and most innovative products, and 'We All Play for Canada,' which rallies Canadians to be more active. Digital kiosks were rolled out across the country that enable customers to look up product availability and view the digital catalogue and flyer while in-store.

FGL Sports saw retail sales increase 13.3 percent for the quarter and same-store sales increase 12.5 percent over the fourth quarter of 2012, with its core Sport Chek banner same store sales up 15.6 percent for the same period. For the full year, FGL Sports retail sales increased 6.8 percent with same-store sales growth of 7.7 percent. Sport Chek same store sales for the full year were up 10.3 percent. The positive retail sales performance in the quarter and for the full year also included the results of Pro Hockey Life, which was acquired in August 2013.

Growth at FGL Sports for the quarter was led by higher sales of new brands and strengthened assortments in casual clothing and athletic footwear, the addition of Olympic performance apparel products and reflected the continued emphasis on the Sport Chek brand and in-store execution.

At Mark's, retail sales grew 5.5 percent in the quarter with same-store sales growth of 5.2 percent over the fourth quarter of 2012. Strong sales in industrial apparel, men's and women's accessories and footwear categories drove much of the growth. New marketing programs and promotional events, improved execution in stores and seasonal winter weather also contributed to the strength in sales in the quarter. For the full year, Mark's retail sales increased 4.8 percent over 2012.

Petroleum retail sales increased 1.9 percent for the quarter over the same period last year, primarily due to higher gasoline prices and increased non-gasoline sales. For the full year, sales increased 1.6 percent over 2012.

Retail segment revenue increased 5.1 percent or $147.4 million in the quarter over the fourth quarter of 2012 as a result of higher shipments in key Automotive and Seasonal and Gardening categories at Canadian Tire, higher retail sales at FGL Sports, Mark's and Petroleum, and the addition of Pro Hockey Life results.

Retail segment fourth quarter income before income taxes of $192.8 million was up 24.5 percent compared to 2012. The earnings increase was reflective of strong revenue and gross margin contributions, partially offset by higher operating expenses in the quarter.

FINANCIAL SERVICES SEGMENT

Financial Services finished another strong quarter with a revenue increase of 4.7 percent over the same period last year. The revenue growth was due, in part, to deeper integration with the retail banners and a focus on account acquisitions. These initiatives led to an increase in the number of active accounts and higher average account balances, resulting in higher credit card charges. Income before income taxes increased 16.6 percent to $71.6 million, due primarily to the growth of credit card receivables and interest expense savings. For the full year, income before income taxes increased 15.6 percent over 2012.

CAPITAL EXPENDITURES

Capital expenditures for 2013 were $544.5 million, including $102.2 million for land purchased for future distribution capacity. The company accelerated the expansion of the FGL Sports store network and investments in technology that will help enable future digital capabilities across the retail network.

CT REAL ESTATE INVESTMENT TRUST

On October 23, 2013, CT REIT completed its initial public offering. Canadian Tire Corporation, CT REIT's majority shareholder, owned an approximate 83.1 percent effective interest in CT REIT as at December 28, 2013. In December, CT REIT started to execute on its planned growth strategy and purchased two development sites for the future development of Canadian Tire stores from third-party vendors for a total of approximately $9.0 million, including acquisition costs, which were funded by cash on hand.

THE YEAR AHEAD

Current momentum is expected to be carried through 2014 as the company continues its journey to be a brand-led organization, investing in and growing its existing retail network through the completion of new store concepts, store refurbishments and the opening of new flagship locations for Sport Chek. CTC aims to be a world leader in digitizing retail and exploring new and innovative ways to connect with its customers through continued investment in digital initiatives and the evolution of its collection and use of customer data and insights. Underpinning this work is the company's continued focus on optimizing organizational performance and execution. This includes, in part, implementing terms of the new Dealer contract and identifying opportunities to improve productivity to generate additional earnings growth.